Don’t miss:

– Israeli Nuclear Expert Accuses Japan Of Downplaying Danger Nuclear Calamity: ‘If there is fallout of plutonium oxide, a most toxic substance that they use in the reactor that exploded, no one will be able to set foot on the site for thousands of years’

Flashback:

– Japan’s Deadly Game of Nuclear Roulette (Must-Read!):

However, many of those reactors have been negligently sited on active faults, particularly in the subduction zone along the Pacific coast, where major earthquakes of magnitude 7-8 or more on the Richter scale occur frequently. The periodicity of major earthquakes in Japan is less than 10 years. There is almost no geologic setting in the world more dangerous for nuclear power than Japan — the third-ranked country in the world for nuclear reactors.

“I think the situation right now is very scary,” says Katsuhiko Ishibashi, a seismologist and professor at Kobe University. “It’s like a kamikaze terrorist wrapped in bombs just waiting to explode.”

When reading the following article keep this fact in mind …

Gamma radiation measurements – on which all those low health risk statements were based – do NOT take into account radiation from alpha-emitting radionuclides such as uranium and plutonium!!!

… and also remember that the fuel rods may have already burned:

– Continuing problems raise fears of greater radiation threat (CNN):

High temperatures inside the building that houses the plant’s No. 4 reactor may have caused fuel rods sitting in a pool to ignite or explode, the plant’s owner said.

CNN has changed the article, but you can still see that this exact phrase has been used in the article here.

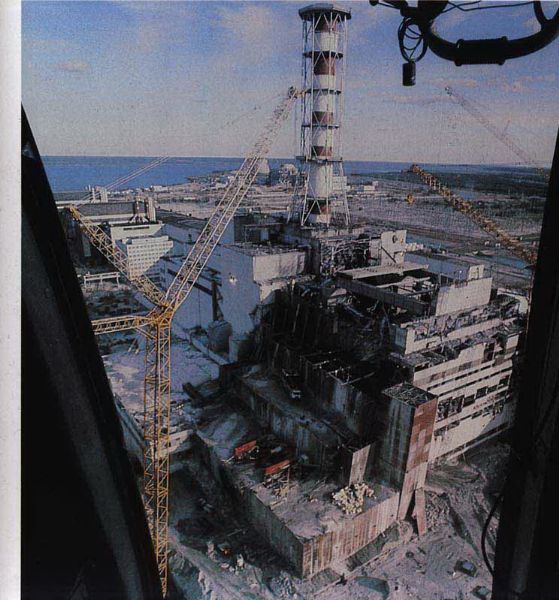

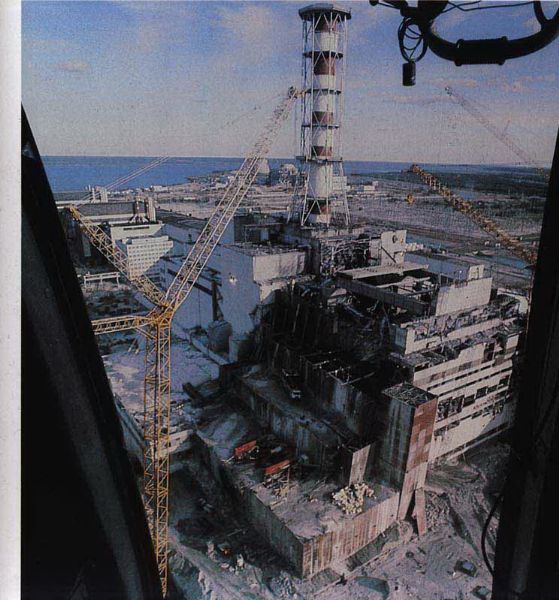

Here is why Japan’s nuclear disaster could get (much) worse than Chernobyl

Chernobyl

GE, the company that boasts that it “brings good things to life,” was the designer of the nuclear plants that are blowing up like hot popcorn kernels at the Fukushima Daiichi generating plant north of Tokyo that was hit by the double-whammy of an 9.1 earthquake and a hugh tsunami.

The company may escape tens or hundreds of billions of dollars in liability from this continuing disaster, which could still result in a catastrophic total meltdown of one or more of the reactors (as of this writing three of the reactors are reported to have suffered explosions and partial meltdowns, and all could potentially become more serious total meltdowns with a rupture of the reactor container), thanks to Japanese law, which makes the operator–in this case Tokyo Electric Power Co. (TEPCO) liable. But if it were found that it was design flaws by GE that caused the problem, presumably TEPCO or the Japanese government could pursue GE for damages.

In fact, the design of these facilities–a design which, it should be noted, was also used in 23 nuclear plants operating in the US in Alabama, Georgia, Illinois, Iowa, Massachusetts, Minnesota, Nebraska, New Jersey, New York, North Carolina, Pennsylvania and Vermont–appear to have included serious flaws, from a safety perspective.

The drawings of the plants in question, called Mark I systems, provide no way for venting hydrogen gas from the containment buildings, despite the fact that one of the first things that happens in the event of a cooling failure is the massive production of hydrogen gas by the exposed fuel rods in the core. This is why three of the nuclear generator buildings at Fukushima Daiichi have exploded with tremendous force blasting off the roof and walls of the structures, and damaging control equipment needed to control the reactors.

One would have thought that design engineers at GE would have thought about that possibility, and provided venting systems for any hydrogen gas being vented in an emergency into the building. But no. They didn’t.

There is a worse problem though. Probably in an effort to keep the problem of nuclear waste hidden from the public, these plants feature huge pools of water up in the higher level of the containment building above the reactors, which hold and store the spent fuel rods from the reactor. These rods are still “hot” but besides the uranium fuel pellets, they also contain the highly radioactive and potentially biologically active decay products of the fission process–particularly radioactive Cesium 137, Iodine 131 and Strontium 90. (Some of GE’s plants in the US feature this same design. The two GE Peach Bottom reactors near me, for example, each have two spent fuel tanks sitting above their reactors.)

As Robert Alvarez, a former nuclear energy adviser to President Bill Clinton, has written, if these waste containers, euphemistically called “ponds,” were to be damaged in an explosion and lose their cooling and radiation-shielding water, they could burst into flame from the resulting burning of the highly flammable zirconium cladding of the fuel rods, blasting perhaps three to nine times as much of these materials into the air as was released by the Chernobyl reactor disaster. (And that’s if just one reactor blows!) Each pool, Alvarez says, generally contains five to ten times as much nuclear material as the reactors themselves. Alvarez cites a 1997 Nuclear Regulatory Commission study that predicted that a waste pool fire could render a 188-square-mile area “uninhabitable” and do $59 billion worth of damage (but that was 13 years ago).

Another nuclear scientist agrees with Alvarez, quoted in an article in the Christian Science Monitor:

“There should be much more attention paid to the spent-fuel pools,” says Arjun Makhijani, a nuclear engineer and president of the anti-nuclear power Institute for Energy and Environmental Research. “If there’s a complete loss of containment [and thus the water inside], it can catch fire. There’s a huge amount of radioactivity inside – far more than is inside the reactors. The damaged reactors are less likely to spread the same vast amounts of radiation that Chernobyl did, but a spent-fuel pool fire could very well produce damage similar to or even greater than Chernobyl.”

Adding to that worry, Alvarez says photos of Reactor 3 seem to show white steam rising from the damaged facility, from a location where the spent fuel pond would likely be.

But it gets worse. According to news reports, the Reactor 3 unit was being fueled with MOX, a controversial mixed oxides fuel rod, which includes, in addition to uranium, a significant amount of plutonium–a far more dangerous element both chemically as a toxin, and in terms of its radioactivity.

You have to ask, what kind of numbskull would put the waste “pond” for spend fuel right above the reactor of a nuclear plant, thus insuring that in the event of a meltdown, not only would the core of the reactor blow up into the environment, but also all of the spent fuel from prior years?

Read moreJapan Nuclear Meltdown: It’s Much, Much Worse Than It Looks (Thanks To The Stupidity of Nuclear Engineers!)