– How We Got Here – The 2008 Financial Crisis For Dummies (ZeroHedge, July 26, 2015):

It could never happen again, right?

The man who trades freedom for security does not deserve nor will he ever receive either. – Benjamin Franklin

– How We Got Here – The 2008 Financial Crisis For Dummies (ZeroHedge, July 26, 2015):

It could never happen again, right?

– Bernanke Finally Reveals, In One Word, Why The Financial System Crashed (ZeroHedge, March 4, 2014):

Now that Ben Bernanke is no longer the head of the Fed, he can finally tell the truth about what caused the financial crash. At least that’s what a packed auditorium of over 1000 people as part of the financial conference staged by National Bank of Abu Dhabi, the UAE’s largest bank, was hoping for earlier today when they paid an exorbitant amount of money to hear the former chairman talk.Bernanke confirmed as much when he said he could now speak more freely about the crisis than he could while at the Fed – “I can say whatever I want.”

So what was the reason, according to the man who was easily the most powerful person in the world for nearly a decade?

Ready?

“Overconfidence.” (no, not “weather”)

Yup. That’s it.

The United States became “overconfident”, he said of the period before the September 2008 collapse of U.S. investment bank Lehman Brothers. That triggered a crash from which parts of the world, including the U.S. economy, have not fully recovered.

“This is going to sound very obvious but the first thing we learned is that the U.S. is not invulnerable to financial crises,” Bernanke said.

Actually what is going to sound even more obvious, is that subprime was not contained.

Read moreBernanke Finally Reveals, In One Word, Why The Financial System Crashed: ‘Overconfidence’

– What’s Starting Now Will Be Much More Terrifying Than 2008 (King World News, Jan 25, 2014)

– Baltic Dry Continues Collapse – Worst Slide Since Financial Crisis (ZeroHedge, Jan 14, 2014):

Despite ‘blaming’ the drop in the cost of dry bulk shipping on Colombian coal restrictions, it seems increasingly clear that the 40% collapse in the Baltic Dry Index since the start of the year is more than just that. While this is the worst start to a year in over 30 years, the scale of this meltdown is only matched by the total devastation that occurred in Q3 2008. Of course, the mainstream media will continue to ignore this dour index until it decides to rise once again, but for now, 9 days in a row of plunging prices is yet another canary in the global trade coalmine and suggests what inventory stacking that occurred in Q3/4 2013 is anything but sustained.

Baltic Dry costs are the lowest in 4 months, down 40% for the start of the year, and the worst start to a year in over 30 years…

As we noted yesterday…

Of course, we are sure the ‘lead’ that the Baltic Dry seems to have over global macro will be quickly ignored…

Charts: Bloomberg

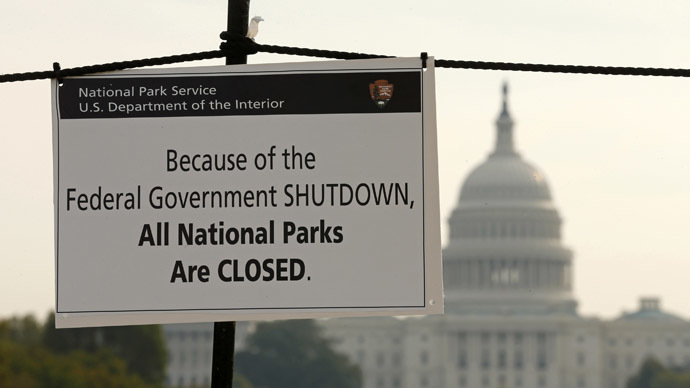

The U.S. Capitol looms in the background of a sign on the National Mall reminding visitors of the closures to all national parks due to the federal government shutdown in Washington October 3, 2013. (Reuters/Kevin Lamarque)

Michel Chossudovsky is an award-winning author, professor of economics, founder and director of the Centre for Research on Globalization, Montreal and editor of the globalresearch.ca website.

– Shutdown of US govt & ‘debt default’: Dress rehearsal for privatization of federal state system? (RT, Oct 15, 2013):

By Michel Chossudovsky

The ‘shutdown’ of the US government and the financial climax associated with a deadline date, leading to a possible ‘debt default’ by the federal government, is a money-making undertaking for Wall Street.

Several overlapping political and economic agendas are unfolding. Is the shutdown – implying the furloughing of tens of thousands of public employees – a dress rehearsal for the eventual privatization of important components of the federal state system?

A staged default, bankruptcy and privatization is occurring in Detroit (with the active support of the Obama administration), whereby large corporations become the owners of municipal assets and infrastructure.

The important question: could a process of ‘state bankruptcy’, which is currently afflicting local level governments across the land, realistically occur in the case of the central government of the United States of America?

This is not a hypothetical question. A large number of developing countries under the brunt of IMF ‘economic medicine’ were ordered by their external creditors to dismantle the state apparatus, fire millions of public sector workers as well as privatize state assets. The IMF’s Structural Adjustment Program (SAP) has also been applied in several European countries.

– Red Cross Launches Emergency Food Aid Plan in the UK – First Time Since World War II (Liberty Blitzkrieg, Oct 12, 2013):

Welcome to the global recovery folks. A recovery that is so strong in the UK, the Red Cross has been called in to provide food aid for the first time since World War II. Nothing spells happy days are here again like that sort of news.

Oh, didn’t participate in the global recovery? No worries, oligarchs have got you covered and will happily offer you a piece of bread in between flat purchases in the City of London so that you remain quietly and apathetically planted squarely in front of the television . The “recovery” was and is a gigantic heist. Nothing more, nothing less.

From the Independent:

The Red Cross will this winter start collecting and distributing food aid to the needy in Britain for the first time since the Second World War, as welfare cuts and the economic downturn send soaring numbers of people to soup kitchens and food banks across Europe.

In what could be the start of an increased role in Britain for the Geneva-based charity best known for its work in disaster zones, its volunteers will be mobilised to go into supermarkets across the country at the end of November and ask shoppers to donate dry goods. The British Red Cross will then help FareShare, a charity working with the Trussell Trust and Tesco, distribute the packets and tins to food banks nationwide.

Britain is just one of many countries where families are struggling to put food on the table. In a report released today into the devastating humanitarian impact of Europe’s financial crisis, the Red Cross recorded a 75 per cent increase in the number of people relying on their food aid over the last three years. At least 43 million people across the Continent are not getting enough to eat each day and 120 million are at risk of poverty.

Read moreRed Cross Launches Emergency Food Aid Plan In The UK … First Time Since World War II

– It Is Happening Again: 18 Similarities Between The Last Financial Crisis And Today (Economic Collapse, July 25, 2013):

If our leaders could have recognized the signs ahead of time, do you think that they could have prevented the financial crisis of 2008? That is a very timely question, because so many of the warning signs that we saw just before and during the last financial crisis are popping up again. Many of the things that are happening right now in the stock market, the bond market, the real estate market and in the overall economic data are eerily similar to what we witnessed back in 2008 and 2009. It is almost as if we are being forced to watch some kind of a perverse replay of previous events, only this time our economy and our financial system are much weaker than they were the last time around. So will we be able to handle a financial crash as bad as we experienced back in 2008? What if it is even worse this time? Considering the fact that we have been through this kind of thing before, you would think that our leaders would be feverishly trying to keep it from happening again and the American people would be rapidly preparing to weather the coming storm. Sadly, none of that is happening. It is almost as if they cannot even see the disaster that is staring them right in the face. But without a doubt, disaster is coming.

The following are 18 similarities between the last financial crisis and today…

Read moreIt Is Happening Again: 18 Similarities Between The Last Financial Crisis And Today

– H/t reader M.G.:

“Adding to this mess, here is a story from Cyprus. They are jailing people for debt. Didn’t the 19th century teach these clowns anything? How can people pay if they are in jail?

Here is the link. Insane.”

You can’t make this stuff up!

– Rise in debtors adds to prison overcrowding (Cyprus Mail, July 23, 2013):

THE ALREADY over-full Nicosia Central Prisons is becoming even more crowded as the financial crisis worsens and more people are being jailed for non-payment of fines and other debts.

Prison Governor Giorgos Tryfonides told the Cyprus News Agency (CNA) that efforts were being made to help such convicts pay off their debts in instalments.

“We are trying our best to make plans for payment of debt so an arrangement can be made with the attorney-general to postpone any punishment as long as the instalment is accepted by the plaintiff,” he said.

Due to the crisis, the number of people facing jail for financial reasons is on the rise compared to other years, Tryfonides said, adding on certain days up to five people might be imprisoned for similar offences.

Google translation:

– Financial Crisis: Now burns Slovenia (Ria Novosti, April 2, 2013):

Slovenia wants to get its financial crisis without external aids under control, writes the newspaper “Novye Izvestia” on Tuesday.

According to the Slovenian Uros Cufer finance minister wants his country is not the example of Cyprus follow and do not ask the EU and the IMF for help.

– Will The Banking Meltdown In Cyprus Be A “Lehman Brothers Moment” For All Of Europe? (Economic Collapsde, March 19, 2013):

Cyprus lawmakers may have rejected the bank account tax, but the truth is that the financial crisis in Cyprus is just getting started. Right now, the two largest banks in Cyprus are dangerously close to a meltdown. If they fail, depositors could end up losing virtually all of their money. You see, the banking system of Cyprus absolutely dwarfs the GDP of that small island nation. Cyprus is known all over the world as a major offshore tax haven, and wealthy Russians and wealthy Europeans have been pouring massive amounts of money into the banking system over the last several decades. Yes, those bank deposits are supposed to be insured, but the truth is that there is no way that the government of Cyprus could ever come up with enough money to cover the massive losses that we are potentially looking at. This is a case where the banking system of a nation has gotten so large that the national government is absolutely powerless to stop a collapse from happening. If those banks fail, depositors may end up getting 50 percent of their money or they may end up getting nothing. We just don’t know how bad the damage is yet. And considering the fact that many of the largest corporations and many of the wealthiest individuals in Europe have huge mountains of cash stashed in Cyprus, the fallout from a banking collapse could potentially be absolutely catastrophic.

So Cyprus needs to come up with some money from somewhere in order to keep that from happening.

Basically, there are three options at this point…

Read moreWill The Banking Meltdown In Cyprus Be A ‘Lehman Brothers Moment’ For All Of Europe?

– Secrets and Lies of the Bailout (Rolling Stone, Jan 4, 2013):

It has been four long winters since the federal government, in the hulking, shaven-skulled, Alien Nation-esque form of then-Treasury Secretary Hank Paulson, committed $700 billion in taxpayer money to rescue Wall Street from its own chicanery and greed. To listen to the bankers and their allies in Washington tell it, you’d think the bailout was the best thing to hit the American economy since the invention of the assembly line. Not only did it prevent another Great Depression, we’ve been told, but the money has all been paid back, and the government even made a profit. No harm, no foul – right?

Wrong.

It was all a lie – one of the biggest and most elaborate falsehoods ever sold to the American people. We were told that the taxpayer was stepping in – only temporarily, mind you – to prop up the economy and save the world from financial catastrophe. What we actually ended up doing was the exact opposite: committing American taxpayers to permanent, blind support of an ungovernable, unregulatable, hyperconcentrated new financial system that exacerbates the greed and inequality that caused the crash, and forces Wall Street banks like Goldman Sachs and Citigroup to increase risk rather than reduce it. The result is one of those deals where one wrong decision early on blossoms into a lush nightmare of unintended consequences. We thought we were just letting a friend crash at the house for a few days; we ended up with a family of hillbillies who moved in forever, sleeping nine to a bed and building a meth lab on the front lawn.

Read moreMatt Taibbi: Secrets And Lies Of The Bailout (Rolling Stone)

– An Hour In The Company Of Kyle Bass (ZeroHedge, Dec 19, 2012):

Last year’s AmeriCatalyst interview with Kyle Bass provided much more color than the normal 30-second soundbites that we are subjected to when serious hedge fund managers are exposed to mainstream media. This year, Bass was the keynote speaker and in the following speech (followed by Q&A), the fund manager provides 60 minutes of eloquence on the end of the grand experiment and its consequences. From Money Printing and Central Bank Balance sheets to Japan and the psychology of the current situation – which in many cases trumps the quantitative data – the question remains, “when will this unravel” as opposed to “if?”; Bass provides his fact-based heresy against the orthodoxy of economic thought “On The Financial Nature Of Things” extending well beyond his recent note. Must watch (there’s no football or X-Factor on tonight).

Make sure to stay tuned to the last 2 minutes when Kyle succinctly sums up our society…

A MUST-SEE!!!

“My goals in 1976 were the same as they are today: Promote peace and prosperity by a strict adherence to the principles of individual liberty.”

…”economic ignorance is common place, as the failed policies of Keynesianism are continually promoted”…

… “psychopathic totalitarians endorse government initiatives to change our world” …

Forward to 2:08:40:

By Mike Stathis

Mike Stathis holds a Master’s of Science in biological chemistry and biophysics from the University of Pennsylvania and was formerly a National Science Foundation research fellow at U.C. Berkeley. Mike serves as the Chief Investment Strategist of AVA Investment Analytics. As the only expert who predicted the financial apocalypse in detail, Mike has been a valuable source of guidance for investors, helping them to navigate the real estate and banking crisis, as well as the resulting global economic collapse. The accuracy of his predictions has positioned him as one of America’s most insightful and creative financial experts. He is the author of America’s Healthcare Solution, The Wall Street Investment Bible, America’s Financial Apocalypse, Cashing in on the Real Estate Bubble, America’s Financial Apocalypse, and The Startup Company Bible for Entrepreneurs.

From the article:

“Washington does not want Americans to understand the real economic problems facing their nation because it’s all about maximizing corporate profits at any expense, as one would expect from a fascist government. This is specifically why profits have remained near record-highs throughout the current recession, now entering its 59th month.”

– The truth about America’s jobless rate (PressTV, Oct 30, 2012):

In many respects, much if not all of the economic gains made in the United States from the past decade have been wiped out due to Wall Street malfeasance. Looking forward, I expect America to lose at least another decade.While some of the economic turmoil is certainly due to the biggest real estate collapse in US history, a much larger portion is the result of the weak job market which is likely to persist for a number of years.

Although the real estate market appears to have bottomed, you should not expect anything other than a very gradual rise from here. In the absence of bubble conditions, the rate of real estate appreciation generally tracks that of inflation.The biggest lift to the real estate market would come from lasting improvements in the job market. Thus, it is important to identify the real reasons for the persistently high unemployment rate so that adequate solutions can be designed. If the factors accounting for the continued weakness in the labor market are not addressed, America stands a good chance to lose much more than a decade.

YouTube Added: 13.06.2012

– The Financial Crisis Was Foreseeable … Thousands of Years Ago (ZeroHedge, July 20, 2012):

We’ve known for 4,000 years that debts need to be periodically written down, or the entire economy will collapse. And see this.

We’ve known for 2,500 years that prolonged war bankrupts an economy.

Read moreThe Financial Crisis Was Foreseeable … Thousands Of Years Ago!

Theresa May says “work is ongoing” to restrict European immigration in the event of a financial collapse

– Theresa May: we’ll stop migrants if euro collapses (Telegraph, May 25, 2012):

In an interview in The Daily Telegraph, Theresa May says “work is ongoing” to restrict European immigration in the event of a financial collapse.

People from throughout the EU, with the exception of new member countries such as Romania and Bulgaria, are able to work anywhere in the single market.

Inside Job, Narrated by Matt Damon (Full Length HD) from jwrock on Vimeo.

Description:

‘Inside Job’ provides a comprehensive analysis of the global financial crisis of 2008, which at a cost over $20 trillion, caused millions of people to lose their jobs and homes in the worst recession since the Great Depression, and nearly resulted in a global financial collapse. Through exhaustive research and extensive interviews with key financial insiders, politicians, journalists, and academics, the film traces the rise of a rogue industry which has corrupted politics, regulation, and academia. It was made on location in the United States, Iceland, England, France, Singapore, and China.

Flashback:

– The Coming Derivatives Crisis That Could Destroy The Entire Global Financial System (The Economic Collapse, Oct. 19th, 2011):

Most people have no idea that Wall Street has become a gigantic financial casino. The big Wall Street banks are making tens of billions of dollars a year in the derivatives market, and nobody in the financial community wants the party to end. The word “derivatives” sounds complicated and technical, but understanding them is really not that hard. A derivative is essentially a fancy way of saying that a bet has been made. Originally, these bets were designed to hedge risk, but today the derivatives market has mushroomed into a mountain of speculation unlike anything the world has ever seen before. Estimates of the notional value of the worldwide derivatives market go from $600 trillion all the way up to $1.5 quadrillion. Keep in mind that the GDP of the entire world is only somewhere in the neighborhood of $65 trillion. The danger to the global financial system posed by derivatives is so great that Warren Buffet once called them “financial weapons of mass destruction”. For now, the financial powers that be are trying to keep the casino rolling, but it is inevitable that at some point this entire mess is going to come crashing down. When it does, we are going to be facing a derivatives crisis that really could destroy the entire global financial system.

Most people don’t talk much about derivatives because they simply do not understand them.

Perhaps a couple of definitions would be helpful.