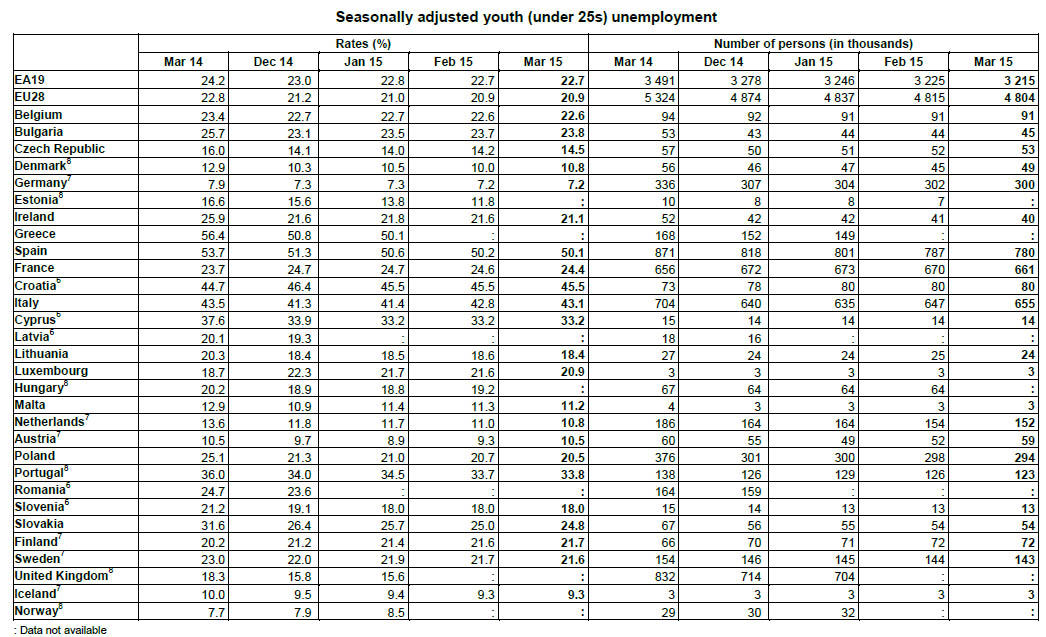

– Greece “Scrambles”To Make Full Monthly Pension Payments: “Still Missing Several Hundred Million Euros” (ZeroHedge, April 30, 2015):

To be sure, Greece has been “running out of money” for quite some time. Given the incessant media coverage surrounding the country’s cash shortage and the fact that Athens somehow seems to scrape together the funds to make payments both to lenders and to public sector employees against impossible odds, it’s tempting to think that as dire as the situation most certainly is, the country might still be able to ride out the storm without suffering a major “accident.” Having said that, some rather alarming events have unfolded over the past week or so, including a government decree mandating the transfer of excess cash reserves from municipalities to the central bank. As it turns out, that didn’t go over well with local officials and as we reported on Tuesday, the government finally hit the brick wall, coming up some €400 million short on payments to pensioners.

Here’s what we said then:

According to Bloomberg, the Greek government is €400 million short of the amount needed for payment of pensions and salaries this month, citing a Kathimerini report.

Surprisingly, this takes place even as Greece’s IKA, OGA pension funds have been informed by the government that amount needed for payment of pensions will be deposited today, while the Greece’s OAEE pension fund has said payment of pensions won’t be a problem.

In other words, someone is not telling the truth: either there is enough money or there isn’t. And if the latter case is valid, then either the government or the pensions are now openly lying to the population.

Fast forward to Thursday and we learn that sure enough, the government ran out of money earlier this week. Here’s FT: