A milder earthquake hit Japan:

– Japan Earthquake: Tsunami Warnings Downgraded After 7.0 Quake Off Japan Coast (Huffington Post)

Rescuers searched for victims and survivors after an apartment complex collapsed in Concepcion.

A woman sat in front a quake-damaged house in Talca, Chile. Residents were also jolted by at least 20 aftershocks measuring over 5.0 on the magnitude scale, with one topping 6.9.

A photo of Santiago, Chile after the quake. Uploaded by Twitter user @Gonzalezcarcey.

UPDATE: 8:25 a.m. — 1,000 times more powerful than the Haiti earthquake– From the New York Times:

Phone lines were down in Concepcion as of 7:30 a.m. and no reports were coming out of that area. The quake in Chile was 1,000 times more powerful than the magnitude 7.0 earthquake that caused widespread damage in Haiti on Jan 12, killing at least 230,000, earthquake experts reported on CNN International.

UPDATE: 8:00 a.m. — 78 and rising — AP now reports that the death toll is at 78 and rising. Officials have no information yet on number of injured.

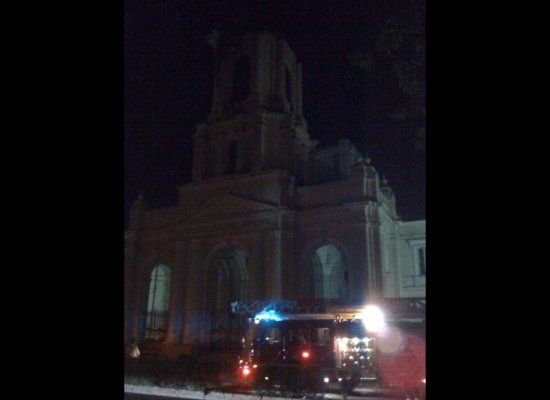

“Calm after #terremoto. Impressive to see Divine Church Providence without cupola.” Photo uploaded to Twitpic by Twitter user @HMartinez.

UPDATE: 6:43 a.m. — 47 dead — Reuters now reports that 47 people have died in the quake.

President Michele Bachelet has declared a “state of catastrophe,” according to the Associated Press:

SANTIAGO, Chile – A massive 8.8-magnitude earthquake struck Chile early Saturday, collapsing buildings, killing at least 16 people and downing phone lines. President Michele Bachelet declared a “state of catastrophe” in central Chile and said the death toll was rising.Tsunami warnings were issued over a wide area, including South America, Hawaii, Australia and New Zealand, Japan, the Philippines, Russia and many Pacific islands.

“We have had a huge earthquake, with some aftershocks,” Bachelet said, appealing from an emergency response center for Chileans to remain calm. “Despite this, the system is

functioning. People should remain calm. We’re doing everything we can with all the forces we have. Any information we will share immediately.”

Bachelet said early reports were that 16 people had been killed, and “without a doubt, with an earthquake of this magnitude, there will be more deaths.”

In the 2 1/2 hours following the 90-second quake, the U.S. Geological Survey reported 11 aftershocks, of which five measured 6.0 or above.

She urged people to avoid traveling in the dark, since traffic lights are down, to avoid causing more fatalities.

The quake hit 200 miles (325 kilometers) southwest of the capital, Santiago, at a depth of 22 miles (35 kilometers) at 3:34 a.m. (0634 GMT; 1:34 a.m. EST), the U.S. Geological Survey reported.

The epicenter was just 70 miles (115 kilometers) from Concepcion, Chile’s second-largest city, where more than 200,000 people live along the Bio Bio river, and 60 miles from the ski town of Chillan, a gateway to Andean ski resorts that was destroyed in a 1939 earthquake.

In Santiago, the capital, modern buildings are built to withstand earthquakes, but many older ones were heavily damaged, including the Nuestra Senora de la Providencia church, whose bell tower collapsed. An apartment building’s two-level parking lot also flattened onto the ground floor, smashing about 50 cars whose alarms and horns rang incessantly. A bridge just outside the capital also collapsed, and at least one car flipped upside down.

In the coastal city of Vina del Mar, the earthquake struck just as people were leaving a disco, Julio Alvarez told Radio Cooperativa in Santiago. “It was very bad, people were screaming, some people were running, others appeared paralyzed. I was one of them.”

Bachelet said she was declaring a “state of catastrophe” in 3 central regions of the country, and that while emergency responders were waiting for first light to get details, it was evident that damage was extensive.

UPDATE: 5:56 a.m. — 17 dead — At least 17 people have died in Chile’s earthquake, according to radio reports from Santiago. Reuters:

Local radio said 17 people were killed and President Michelle Bachelet confirmed six deaths, saying more were possible. Telephone and power lines were down, making a quick damage assessment difficult in the early morning darkness.”Never in my life have I experienced a quake like this, it’s like the end of the world,” one man told local television from the city of Temuco, where the quake damaged buildings and forced staff to evacuate the regional hospital.

UPDATE: 4:49 a.m. — Live broadcast — A USTREAM webcast of CNN’s live coverage of the Chile earthquake:

Read moreCHILE EARTHQUAKE: 8.8 Magnitude Quake Hits Chile, 1,000 Times More Powerful Than The Haiti Earthquake