Gold is down 6% and silver 12% since the start of 2011. This is the sharpest decline in precious metals since June of last year and with technical support broken at the 50-day moving averages, many are concerned of a deeper correction ahead.

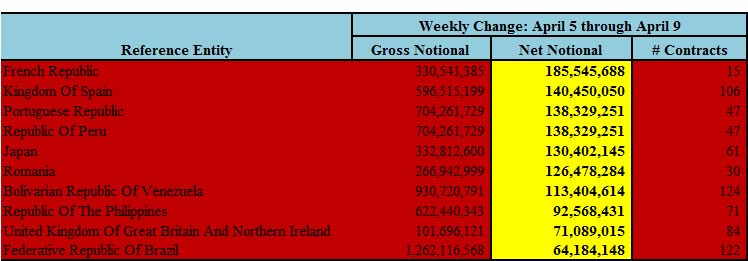

While there are a myriad of factors driving the prices, two of the major opposing forces are Chinese demand for physical gold on the long side and JPMorgan paper schemes on the short side. Which force prevails in the short term remains to be seen, but in the long run the paper shorts will eventually be squeezed, pushing the price for both gold and silver much higher.

Corrections are a healthy and normal part of any secular bull market, allowing the bull to rest its legs, shake out weak hands and prepare for the next phase up. Every correction in precious metals over the past decade has brought so-called “experts” out of the woodwork to proclaim an end to the gold bull market. They were wrong when gold hit $500, $800, $1,000 and will be wrong many times again before gold finally does peak somewhere above $5,000 per ounce.

But the recent slide in gold and silver prices seems like more than the usual correction and profit taking. Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act during July of 2010 and many metals analysts believed it would lead to the CFTC implementing sensible position limits. In addition, the passing of the Volker rule and closing of prop trading desks seemed to jump start precious metals into an impressive and steady advance.

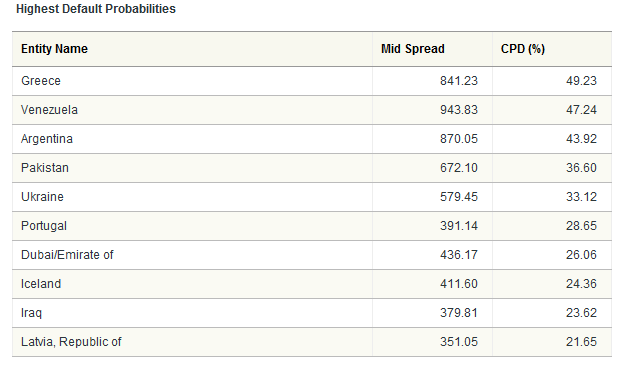

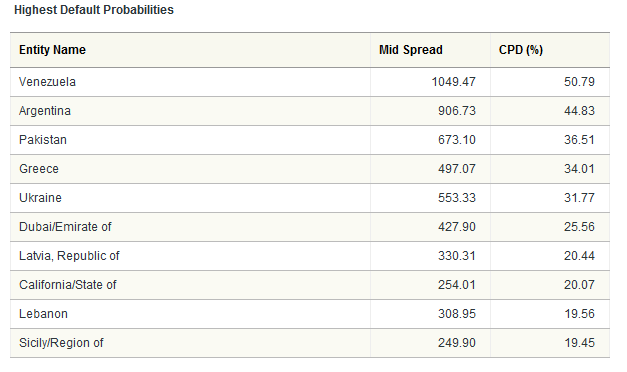

Many gold bugs believed they were witnessing the end of the fraudulent gold and silver manipulation that has been occurring so blatantly over the past several years. This manipulation has been painstakingly exposed by GATA over the years, was detailed in an earlier article that I published and has led to a series of lawsuits against JPMorgan and others.

Gold and silver posted impressive gains in 2010, with gold up 30%, while silver rocketed more than 80% higher! But these advances came to an abrupt halt at the start of 2011 and the decline worsened a few weeks later when the CFTC announced the details of it proposed position limits. First off, the proposed limits were way too high to curb manipulation and more importantly, JPMorgan, HSBC and other large investment banks were granted an exemption to the new position limit rules by being “grandfathered.” The CFTC absolutely caved to the interests of JPMorgan and the price of gold and silver both proceeded to tank and drop through key levels of support.

To what degree the CFTC decision is driving the decline in precious metals is unclear. Gene Arensberg recently pointed out that the large commercial banks have actually been covering their short positions lately and that the swap dealers are the ones that have been uncharacteristically piling on the paper shorts. Regardless, big money has certainly been helping to push prices lower, even as the dollar has weakened significantly in the past few weeks.

While the paper market has been driving the spot price lower, the physical market appears to be as robust as ever. Sales of silver eagle coins for the month of January have already set a new all-time record, with ten days still left in the month. Furthermore, silver demand in China has quadrupled versus last year, as the emerging Chinese middle class looks for a hedge against inflation and the Chinese government encourages its citizens to buy gold and silver.

This is a relatively new phenomenon in Chinese culture, as ownership of precious metals was illegal just a few short years back. But this has all changed as China has become the largest producer of gold in the world and is expected to surpass India as the largest consumer of gold as well.

Demand from China is not only coming from the citizens though, as the Chinese government has been accumulating massive amounts of gold and silver for their reserves. After not reporting gold reserves for six years, the Chinese government in 2009 made a surprise announcement that they had nearly doubled their gold reserves to over 1,000 tons. They have been doing this quietly via buying up the production from Chinese mining companies, as well as making purchases in the open market via intermediaries.

China announced annual gold production of 314 tons in 2010 and this number is expected to be around 320 tons in 2011. If the suspicion that China is buying up most of the country’s gold production is true, there could well be another 600 tons or more moved into ‘unofficial’ reserves before the next announcement. Add in purchases in the international market, and it is conceivable that China’s reserves could effectively be doubled again by the end of 2011 to some 2,000 tons.

Read moreChina vs. JP Morgan: The Battle Over Gold And Silver