Goldman Sachs and other big banks aren’t just pocketing the trillions we gave them to rescue the economy – they’re re-creating the conditions for another crash

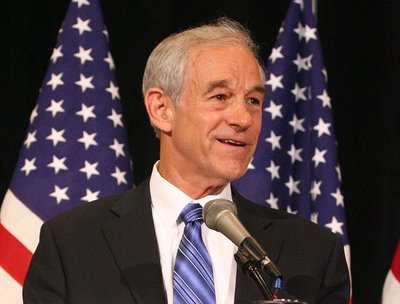

On January 21st, Lloyd Blankfein left a peculiar voicemail message on the work phones of his employees at Goldman Sachs. Fast becoming America’s pre-eminent Marvel Comics supervillain, the CEO used the call to deploy his secret weapon: a pair of giant, nuclear-powered testicles. In his message, Blankfein addressed his plan to pay out gigantic year-end bonuses amid widespread controversy over Goldman’s role in precipitating the global financial crisis.

The bank had already set aside a tidy $16.2 billion for salaries and bonuses – meaning that Goldman employees were each set to take home an average of $498,246, a number roughly commensurate with what they received during the bubble years. Still, the troops were worried: There were rumors that Dr. Ballsachs, bowing to political pressure, might be forced to scale the number back. After all, the country was broke, 14.8 million Americans were stranded on the unemployment line, and Barack Obama and the Democrats were trying to recover the populist high ground after their bitch-whipping in Massachusetts by calling for a “bailout tax” on banks. Maybe this wasn’t the right time for Goldman to be throwing its annual Roman bonus orgy.

Not to worry, Blankfein reassured employees. “In a year that proved to have no shortage of story lines,” he said, “I believe very strongly that performance is the ultimate narrative.”

Translation: We made a shitload of money last year because we’re so amazing at our jobs, so fuck all those people who want us to reduce our bonuses.

Goldman wasn’t alone. The nation’s six largest banks – all committed to this balls-out, I drink your milkshake! strategy of flagrantly gorging themselves as America goes hungry – set aside a whopping $140 billion for executive compensation last year, a sum only slightly less than the $164 billion they paid themselves in the pre-crash year of 2007. In a gesture of self-sacrifice, Blankfein himself took a humiliatingly low bonus of $9 million, less than the 2009 pay of elephantine New York Knicks washout Eddy Curry. But in reality, not much had changed. “What is the state of our moral being when Lloyd Blankfein taking a $9 million bonus is viewed as this great act of contrition, when every penny of it was a direct transfer from the taxpayer?” asks Eliot Spitzer, who tried to hold Wall Street accountable during his own ill-fated stint as governor of New York.

Beyond a few such bleats of outrage, however, the huge payout was met, by and large, with a collective sigh of resignation. Because beneath America’s populist veneer, on a more subtle strata of the national psyche, there remains a strong temptation to not really give a shit. The rich, after all, have always made way too much money; what’s the difference if some fat cat in New York pockets $20 million instead of $10 million?

The only reason such apathy exists, however, is because there’s still a widespread misunderstanding of how exactly Wall Street “earns” its money, with emphasis on the quotation marks around “earns.” The question everyone should be asking, as one bailout recipient after another posts massive profits – Goldman reported $13.4 billion in profits last year, after paying out that $16.2 billion in bonuses and compensation – is this: In an economy as horrible as ours, with every factory town between New York and Los Angeles looking like those hollowed-out ghost ships we see on History Channel documentaries like Shipwrecks of the Great Lakes, where in the hell did Wall Street’s eye-popping profits come from, exactly? Did Goldman go from bailout city to $13.4 billion in the black because, as Blankfein suggests, its “performance” was just that awesome? A year and a half after they were minutes away from bankruptcy, how are these assholes not only back on their feet again, but hauling in bonuses at the same rate they were during the bubble?

The answer to that question is basically twofold: They raped the taxpayer, and they raped their clients.

Read moreMatt Taibbi: Wall Street’s Bailout Hustle