Billionaire Wilbur Ross made his money working for Rothschild and has an apartment in the same building as Evelyn de Rothschild & Henry Kissinger.

Wilbur Ross

– What Does He Know? Ross Dumps Stocks, Buys Treasuries After “Ethics Warning”:

Commerce Secretary Wilbur Ross has been reprimanded by federal ethics officials for failing to sell individual stocks that he had agreed to divest within three months of his confirmation (he was confirmed in February 2017), creating “the potential for a serious criminal violation.” Claiming that he had forgotten about the remainder of his stake, Ross earned himself an additional 15% return when he finally cashed out of his remaining Invesco shares as equity prices continued to rise after his confirmation. As part of his ethics agreement, Ross pledged to divest his Invesco holdings and other equities within 90 days of his confirmation, and more complex assets within 180 days, according to Bloomberg.

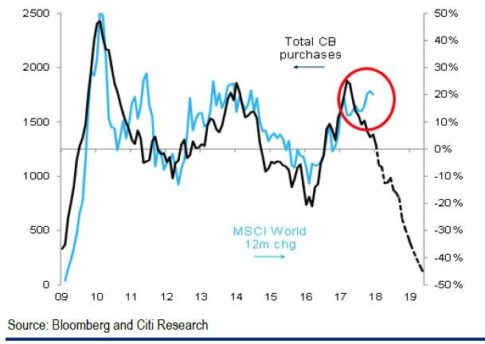

Then again, perhaps investors should interpret Ross’s decision to finally sell as a warning, given that one of the men in charge of the US economy has sold the rest of his stocks and is buying Treasury bonds – hardly an encouraging indicator for the economy.

In fact, Ross hasn’t just sold stocks – in some cases, he’s gone short, saying that he’s shorted shares of holdings to which he doesn’t have access. Ross has reportedly taken short positions in five stocks.