By Chris Powell

CHRIS POWELL IS MANAGING EDITOR OF THE JOURNAL INQUIRER IN MANCHESTER.

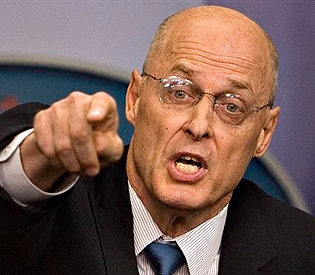

Even leading Republicans in Congress, including presidential nominee Sen. John McCain, recoiled from Treasury Secretary Henry M. Paulson’s proposal to take absolute power over $700 billion to be borrowed by the federal government and used to purchase every sort of bad debt without ever having to answer for it – not to the courts, not to regulatory agencies, and only occasionally and incidentally to Congress itself.

The bad-debt bailout would be the biggest government patronage program in history and would amount to declaring martial law over the U.S. financial system and economy. Even if such martial law is necessary, its implementation should be put in democratic hands – a non-partisan agency with full transparency, statutory standards for its purchases, and close accountability to Congress.

All the same, even if it can work – that is, prop up insolvent financial institutions – the Treasury’s proposal is still a proclamation of the collapse of the whole U.S. financial system. Even if some financial institutions are saved, the collapse will manifest itself in other ways, probably ways more damaging to the public. For who cares if Goldman Sachs and Morgan Stanley endure if the issuance of $700 billion more in government bonds drives interest rates way up, diverts credit from the private economy, devalues the already sinking dollar, and sends commodity prices soaring again?

In that case the financial class will have won another battle in its long war against the producing class. It will be again as was said about the maneuvers of the Second Bank of the United States two centuries ago: “The bank was saved; only the people were ruined.”

Injecting throughout the world financial system their bogus and unregulated financial instruments, like collateralized debt obligations and credit-default swaps, the big New York financial houses have taken the world economy hostage. The president and Congress should strive to save the hostages, not the kidnappers.

But the president and Congress have participated eagerly with the kidnappers in the total corruption of the financial system.

They have staffed the regulatory agencies largely from Wall Street and then diminished financial regulation.

They have let the financial houses finance presidential and congressional campaigns.

They have watched haplessly as accounting firms and credit-rating agencies engaged in conflict of interest and failed to do their jobs over and over again even as corporate scandal followed corporate scandal.

They have waged mistaken imperial war not with taxes but with huge amounts borrowed from abroad, making the country hostage to foreign nations, including some with hostile interests.

They have approved the government’s falsification of inflation data and its surreptitious suppression of the price of gold so that interest rates could be set below the inflation rate, the government and everyone else could borrow more at lower interest, and the public would not become alarmed by monetary debasement.

Now the U.S. government is conjuring into existence via a few computer keystrokes fantastic, virtually inconceivable amounts of money. Unreal as these amounts are, they will be claims on the real goods and services of the country, and, if the rest of the world wants to keep playing along, which is doubtful, claims on the real goods and services of the rest of the world as well.

The purpose of all this will be to save the people who happen to be in charge of the payments system and to save the propertied class generally. But people without many assets, people who don’t earn enough to own housing, people who could gain from lower housing prices and lower prices of everything else, are not even in the government’s equation.

The country is simply busted. Its financial obligations are unpayable, its asset prices are illusions, and the great undertaking in Washington and New York is to preserve those illusions rather than face reality. If the price of preserving those illusions is $700 billion – and of course it is more likely to run into the trillions – could it really be more expensive to dispense with the illusions now? After all, instead of rescuing financial institutions that disregarded risk, the government just as easily could keep the country going by sending checks to everyone every month – as it already sends Social Security checks to retirees.

But as long as the government keeps paying ransom, the financial class will keep taking the country hostage.

Published on 9/26/2008

Source: The Day