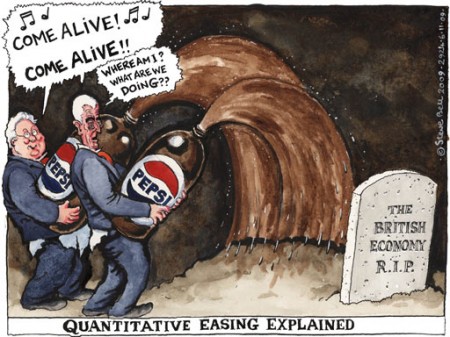

Britain cannot afford to borrow more without jeopardising the country’s financial stability, a senior Bank of England official has warned.

Richard Sharp said the Government had already borrowed an extra £1 trillion since the 2008 financial crisis.

Borrowing more could put the country at risk of suffering from a collapse similar to that experienced by Venezuela, he suggested. Mr Sharp, a member of the Bank’s Financial Stability Committee, spoke just days after Philip Hammond announced a £25?billion spending spree in the Budget and at a time when the Labour Party is advocating borrowing an extra £250?billion.

His comments, which will be seen as a warning to the Chancellor not to loosen the purse strings too far, mark a departure for the Bank, which usually steers clear of commenting on Government finances.

…

H/t reader squodgy:

“Well, if that isn’t a warning, nothing is.

Obviously the MSM have just been given the nod to start to gently herd us into a pre-collapse pen of propaganda, letting us know incrementally that we are at the precipice.

Other newspapers here are letting us know the range of medicines & treatments available from the once beautiful NHS, is being curtailed and rationed, and care for the elderly is being cut.

Can’t beat selfish, hard skinned Conservatives to show no empathy, nor incompetent Labour/Liberals to waste money faster than a man with ten arms.

No hope!”

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP