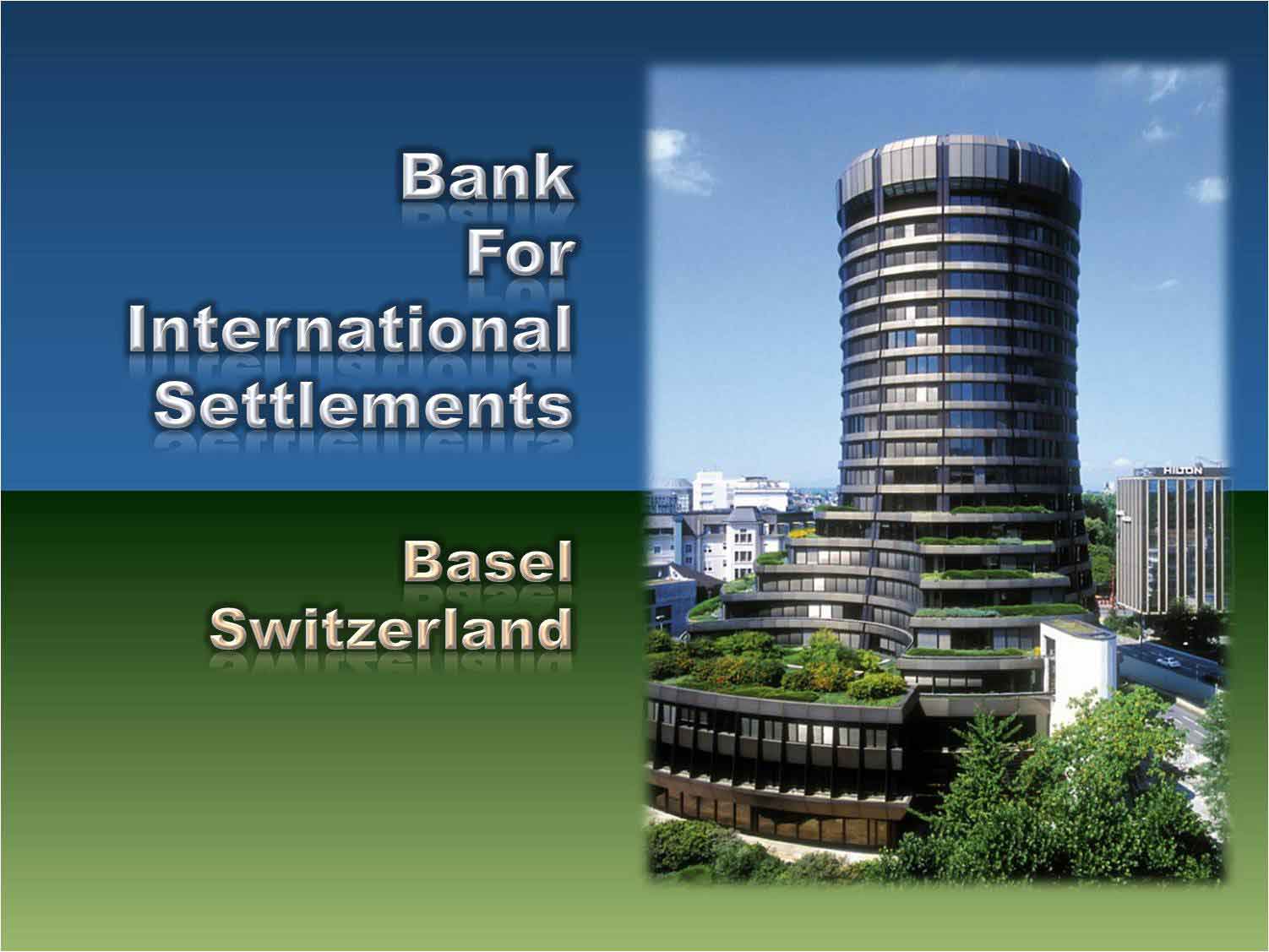

The BIS is the central banks of central banks…

– Head of Bank for International Settlements Calls For Clampdown On Cryptocurrencies:

Central banks must clamp down on Bitcoin and other cryptocurrencies to stop them “piggybacking” on mainstream institutions and becoming a “threat to financial stability,” Agustín Carstens the head of the Bank for International Settlements stated, FT reported.

Carstens, condemned Bitcoin as “a combination of a bubble, a Ponzi scheme and an environmental disaster.”

His comments come after weeks of backlash against cryptocurrencies by mainstream financial institutions contributed to a steep fall in the price of Bitcoin.

Read moreHead of Bank for International Settlements Calls For Clampdown On Cryptocurrencies