– “The Dark Side of the QE Circus” (Silver Bear Cafe, June 25, 2013):

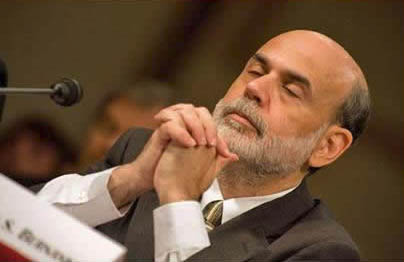

There may come a day soon where the markets sell off if one of the whiskers in Big Ben’s beard is out of place. Or perhaps if his tie is a bit crooked. Or maybe we end up with Janet Yellen as the next puppet in charge over at the local banking cabal and we fret about her hairdo. I don’t know, but one thing that is for certain is that this central bank so wants to be loved and we are so under psychological attack with all of this QE nonsense that it isn’t even funny.

QE is the endgame. ZIRP was only the beginning. QE, or monetization (which they’ll never call it because of the negative connotations), is the heroic measure applied to an already dead system. Our system, for all intent and purposes, died in 2008. It ceased to exist. The investing, economic, and business paradigm that has existed since is drastically different than its predecessor despite all the efforts being made to convince everyone, including Humpty Dumpty, that it is in fact 2005 all over again.

Quantitative Conditioning

Now we get to the fun part of the game. This is the part where the not-so-USFed wants to give the idea that it is tapering (buzzword of the month) without actually doing so. There will be no tapering. There will be no end to QE. The goose (Americans and their willingness to continue to pile up debt) is still laying the golden eggs. And even if they make paper contracts on those golden eggs gyrate wildly in price, they still want them. The quislings on television who are gleefully bashing precious metals this morning? They want them. They want your physical metal. These folks will swim through any sewer to get that which they desire. If you don’t understand the Machiavellian nature of your enemy, then you’re in for an extremely rough ride. This is no playground. This is a battlefield (credit to Chuck Baldwin). They’re playing chess and we’re still playing Tiddly Winks.

Read more‘The Dark Side of the QE Circus’