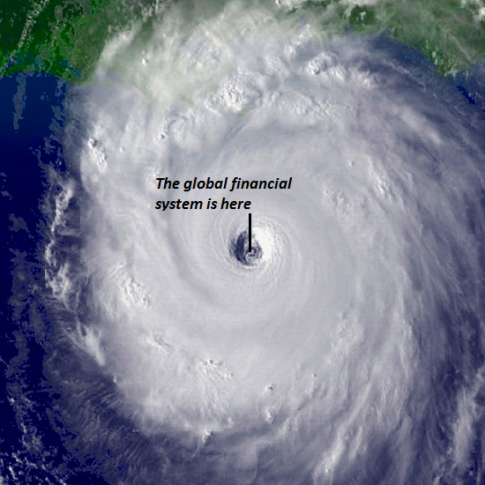

“The future is unknown and we are not dealing with markets that are free markets anymore…now we have government interventions everywhere. [But] in the last say twelve months, I have observed an increasing number of academics who are questioning monetary policies. That’s why I think they will take the gold away and go back to some gold standard by revaluing the gold say from now $1000/oz to say $10,000 dollars. An individual should definitely own some physical gold. The bigger question is where should he store it? because… the failure of monetary policies will not be admitted by the professors that are at central banks, they will then go and blame someone else for it and then an easy target would be to blame it on people that own physical gold because – they can argue – well these are the ones that do take money out of circulation and then the velocity of money goes down – we have to take it away from them… That has happened in 1933 in the US.”

Related info:

– What Gold Nationalization Really Means

– Roosevelt Gold Confiscation In 1933: ‘No American Could Visit A Safe Deposit Box For Some Time Without A Government Agent Accompanying Him’

– On This Day In 1933

– The Day The Government Seized Americans’ Gold – April 5th 1933

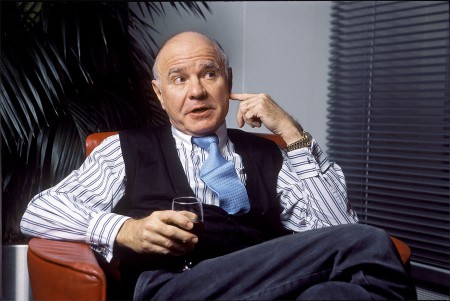

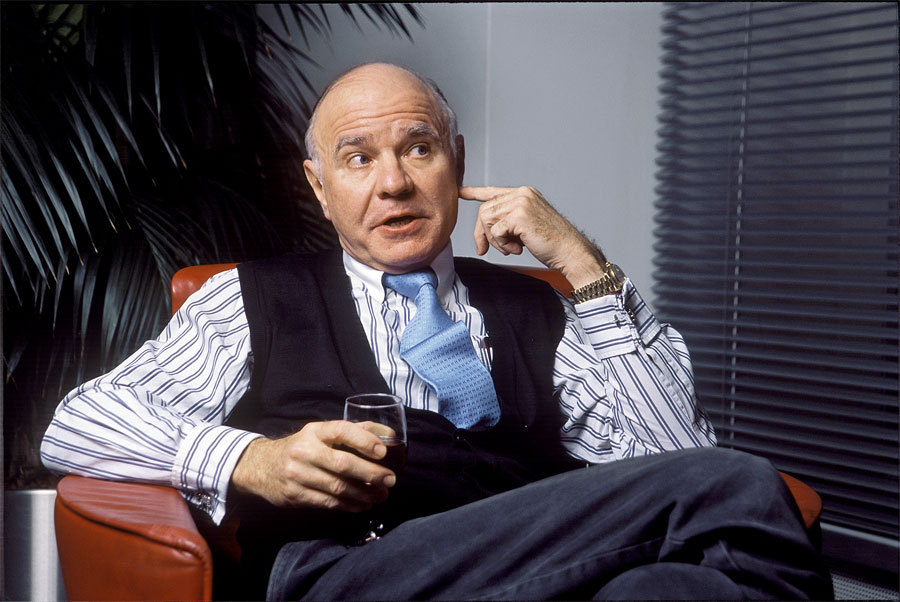

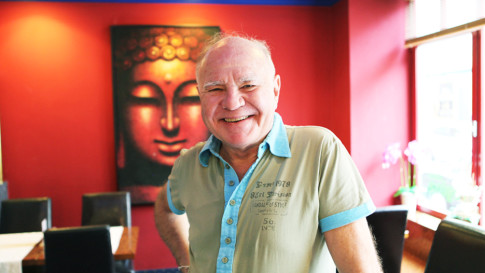

Dr Marc Faber was born in Zurich, Switzerland. He studied Economics at the University of Zurich and, at the age of 24, obtained a PhD in Economics magna cum laude. Dr Faber publishes a widely read monthly investment newsletter “The Gloom Boom & Doom Report” report which highlights unusual investment opportunities, and is the author of several books including “ TOMORROW’S GOLD – Asia’s Age of Discovery”.

– “They’ll Blame Physical Gold Holders For The Failure Of Monetary Policies” Marc Faber Explains Everything (Marcopolis, Aug 7, 2015):

Interview with Marc Faber, Editor and Publisher of “The Gloom, Boom & Doom Report’”

In this exclusive interview with Marcopolis.net Marc Faber covers it all: from commodities and China to the outlook on inflation, the Euro and gold. According to him the global economy is not healing. To the contrary, we might find ourselves back into recession within six months or a year. In that case he expects more money printing by central banks, which eventually could lead to high inflation rates and renewed strength in commodity prices.

On the bright side, he sees great economic potential in Vietnam. Also, the Iraqi stock market has good potential now that a deal with Iran has been reached. While mining stocks are extremely depressed we might see defaults before any meaningful recovery.

* * *

In your 2002 book “Tomorrow’s gold” you identified two major investment themes: emerging markets along with commodities. That was a great call. As for commodities, they had a great run up until 2008. Then they crashed sharply along with everything else just to recover strongly into 2011. Since then they have acted weakly, and recently commodities even reached a 13-years low. Is this the end of the commodities-super-cycle, as some have claimed, or is it more like a correction?

Read more“They’ll Blame Physical Gold Holders For The Failure Of Monetary Policies” Marc Faber Explains Everything