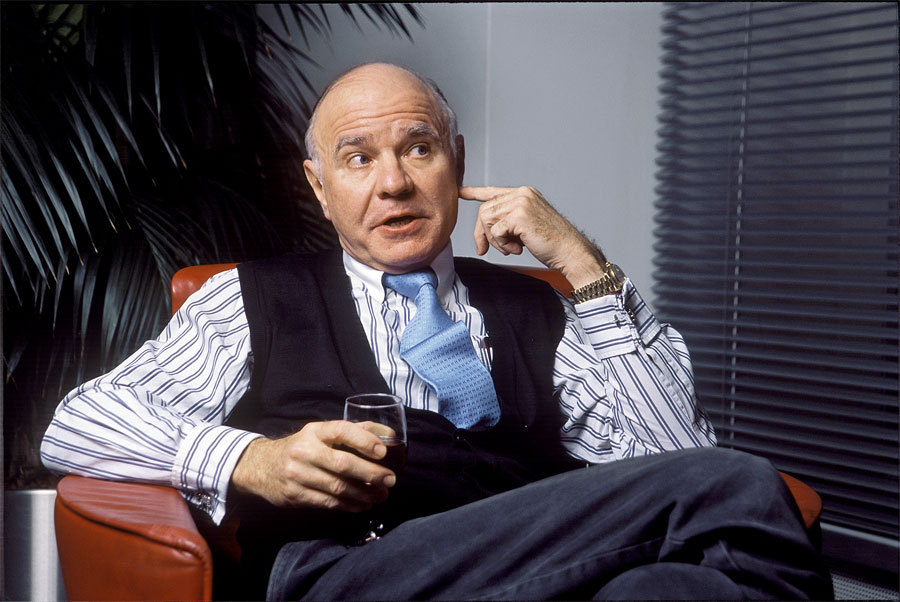

– Marc Faber Responds To CNBC Mockery, Asks “How Has CNBC’s Portfolio Done Since 1999?” (ZeroHedge, July 28, 2014):

Having provided his clarifying perspective on why the markets are extremely fragile and due for a 20-30% correction, Marc Faber was assaulted by CNBC’s Scott Wapner reading off a litany of recent calls that have not worked out as planned. His response was notable: “I started to work in 1970, and over that career, somehow, somewhere, I must have made some right calls; otherwise I wouldn’t be in business.” What CNBC then edited out of the transcript was Faber pointing out his 22% annualized return in his publicly-viewable funds since then and asking – sounding somewhat frustrated at the anchor’s mockery (and background snickers) – “I wonder what the CNBC portfolio would look like since 1999?”The response: silence.

Here are some recent thought summing up his view of the Fed:

It’s pointless to talk to Fed members about economics because they are academics who believe in money printing. Some of them believe they didn’t print enough, and so with these kinds of people, it is like running to the pope.

What do you want to tell them? It’s pointless to spend time with these people trying to convince them that their monetary policies have been very destructive.

They bailed out Mexico in 1994, and there was an EM bubble until 1997. They then bailed out LTCM (Long-Term Capital Management), which gave a signal to leverage up…then they had the Nasdaq bubble, then they printed again and had the housing bubble.

David Hume and Irving Fisher said bubbles are very destructive to the majority of market participants. They lose money, the minority makes money. The Fed doesn’t see it that way so it is pointless to talk to these people.

Faber on the health of the market, money-printing, and his recommendations…

At around 1:00, the tension rises… (before the hit phrase that incriminates CNBC in the bubble blowing falls to the cutting room floor as CNBC apparently decided the section about their own performance was not required).

* * *

It doesn’t take long to remember various CNBC calls from the past that have not worked out too well … or the treatment of Peter Schiff before the last crash to feel a sense of permabullish support for whatever cheerleader is advertising next.