The world’s most entertaining, Tourette syndrome-plagued president, Philippines Rodrigo Duterte has just sparked another scandal.

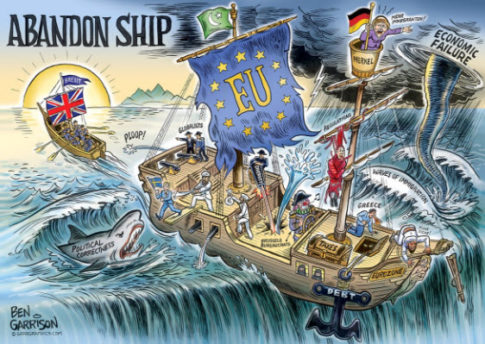

As a reminder, one week ago, in his latest outburst, Duterte stunned reporters and officials when he responded to Europe’s condemnation of his government’s brutal anti-crime crackdown, when after an EU statement urged Duterte to put an end to the “extrajudicial killings” and launch an alternative campaign in line with international human rights laws, the president did not hold back in his response to Brussels and during a speech said: “I read the condemnation of the EU against me. I will tell them: ‘Fuck you.’ “You’re doing it in atonement for your sins.”

He accused the bloc of hypocrisy, saying a rudimental check of the history books showed European countries had killed thousands of people in the past. “He added: And then the EU has the gall to condemn me. I repeat: “Fuck you.”

Fast forward one week, when Duterte compared himself to Adolf Hitler on Friday, and said he would “be happy” to exterminate three million drug users and peddlers in the country.

In yet another rambling, disjointed speech on his arrival in Davao City after a visit to Vietnam, Duterte told reporters that he had been “portrayed to be a cousin of Hitler” by critics. Explaining that Hitler had murdered millions of Jews, Duterte said: “There are three million drug addicts (in the Philippines). I’d be happy to slaughter them.

“If Germany had Hitler, the Philippines would have…,” he said, pausing and pointing to himself. “You know my victims. I would like (them) to be all criminals to finish the problem of my country and save the next generation from perdition.”

Read morePhilippines President Compares Himself To Hitler, One Week After Telling Brussels “F**k You”