– “There’s No Silver Lining”: Deutsche Bank Tumbles On Abysmal Earnings:

It is safe to say that after years of disappointment, investor expectations were low ahead of today’s Deutsche Bank earnings report. Yet somehow, the biggest German lender failed to beat even the most pessimistic one.

Deutsche Bank, which had already guided for a slump, shocked markets when revenue that missed the lowest estimate and fell to the lowest in seven years amid declines at businesses from transaction banking to equity derivatives, and pretty much everything else. Even cost control – supposedly a key feature of CEO John Cryan’s tenure – was worse than expected. The company also reported a €1.3 billion loss for Q4, which while better than the company’s disastrous report last year, was €100mm worse than the lowest forecast and far worse than the consensus loss of €478mm.

“The results are disappointing again and we don’t see anything encouraging in them, reinforcing our doubts in the bank’s strategy and management,” said Michael Huenseler at Assenagon. “There’s no silver lining.”

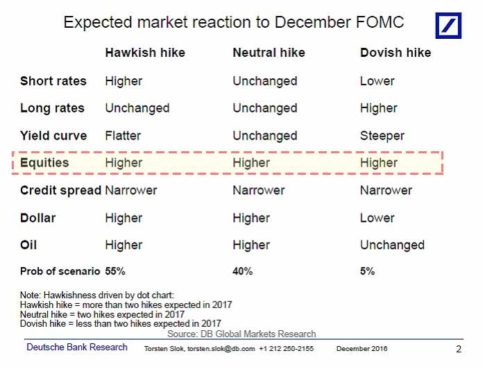

In line with its US peers, revenues in the all important fixed income and currencies trading group fell 29% year-on-year, and combined FIC and FIC-related financing were 20% lower. Echoing JPM and Goldman, Deutsche said the division suffered from “low volatility, low institutional client activity and difficult trading conditions in certain areas“, Deutsche said in a statement.

Overall trading revenue at the investment bank, excluding financing, declined 27 percent, Deutsche Bank said.

Read more“There’s No Silver Lining”: Deutsche Bank Tumbles On Abysmal Earnings