– Britain admits rendition of terror suspects (Times Online):

Gordon Brown was under growing pressure to hold an independent inquiry into Britain’s complicity in torture last night after ministers admitted that terror suspects detained by British soldiers in Iraq were secretly flown by the US to Afghanistan.

– 60000 face axe in banks bloodbath: Bailed-out RBS and Lloyds in cost-cutting spree (Daily Mail)

– President Barack Obama unveils $4 trillion budget (Times Online):

(Yes we can … burst the bond bubble, destroy the dollar and default on our debt!)

– Dear Mr. President, With All Due Respect …. (Mike Shedlock):

With all due respect Mr. President, The United States spends more on its military budget than the next 45 highest spending countries in the world combined; The United States accounts for 48 percent of the world’s total military spending; The United States spends on its military 5.8 times more than China, 10.2 times more than Russia, and 98.6 times more than Iran. Isn’t that enough Mr. President?

With all due respect Mr. President, the downfall of every great nation in history has been unsustainable military expansion. Mr. President, the US can no longer afford to be the world’s policeman. You act as if we can. Mr. President, can you please tell us how we can afford this spending?

– Citi Gets Third Rescue as US Plans to Raise Stake (Bloomberg):

Feb. 27 (Bloomberg) — The U.S. government ratcheted up its effort to save Citigroup Inc., agreeing to a third rescue attempt that will cut existing shareholders’ stake in the company by 74 percent. The stock fell as much as 37 percent.

– US economy suffers sharp nosedive (BBC News):

The US economy shrank by 6.2% in the last three months of 2008, official figures have shown, a far sharper fall than had previously been reported. Plunging exports and the biggest fall in consumer spending in 28 years dragged the figure down from the 3.8% estimate the government gave earlier. The decline was much worse than analysts had expected.

– Crisis in the US newspaper industry (BBC News):

If the economic crisis goes on much longer, will there be any newspapers left in the US to write about it?

– Bangladesh sends in tanks to quell mutiny (Telegraph):

The Bangladeshi government has sent in tanks to tackle a mutiny by the Bangladesh Rifles border security guards which has left more than 50 dead, including senior army officers.

– Information Commissioner Richard Thomas warns of surveillance culture (Times):

Richard Thomas told The Times that “creeping surveillance” in the public and private sectors had gone “too far, too fast” and risked undermining democracy.

– Protesters clash with Pakistan troops after court bars Nawaz Sharif (Times):

Paramilitary troops were called out to keep order in Pakistan yesterday after thousands of people took to the streets to protest at the imposition of direct central control over the key province of Punjab.

– China hits back at US criticism on human rights (Telegraph):

China has retaliated to condemnation of its human rights record with its own report on human rights in the United States.

– Obama Faces Prospect of Japan-Like Stagnation, Kamco’s Lee Says (Bloomberg):

“The U.S. seems to be lost, not knowing where to go,” Lee Chol Hwi, chief executive officer of Korea Asset Management Corp., said yesterday in an interview in Seoul. “The U.S. is inexperienced in dealing with this kind of crisis.”

– Rocky Mountain News to close, publish final edition Friday (Rocky Mountain News):

The Rocky Mountain News has chronicled the storied, and at times tumultuous, history of Colorado for nearly 150 years.

– Housing Bailout Déjà Vu (National Review Online):

Congress is poised to hand the Obama administration a housing-bailout bill that looks eerily like the ineffective one passed last year. Before that happens, we might want to ask Fannie and Freddie what happened to the first $200 billion we gave them.

– In Geithner We Trust Eludes Treasury as Market Fails to Recover (Bloomberg):

(Geithner is a member of the Trilateral Comission and the CFR. Trust him? Not for a millisecond.)

– Future is ‘bleak’ warns Joschka Fischer (Telegraph):

Joschka Fischer, the former German vice-chancellor, has issued a bleak assessment of Europe’s prospects for surviving the financial crisis, warning that leaders of a “self-weakening” continent are failing to come to grips with its decline.

– Banks Vacate Towers Pushing Empty NYC Space to Record (Bloomberg)

– East Europe banks set for €24.5bn loan (Financial Times)

– Now Sarkozy gets the chance to redraw the map of France (Independent):

The political map of France may be radically redrawn under ambitious, intriguing – and explosive – proposals which will be presented to President Nicolas Sarkozy next week.

– FDIC raising fees on banks, adds emergency fee (AP)

– Global crisis hits Swedish economy hard (Financial Times):

Sweden is in the middle of a much more serious recession than previously thought, according to official figures for the fourth quarter of last year that revealed the economy contracted by nearly 10 per cent on an annualised basis.

– Zimbabwe: British minister’s bank propped up Robert Mugabe, says Foreign Office (Telegraph):

Standard Chartered, a British bank that was run by Lord Davies, the trade minister, has been accused by the Foreign Office of ‘propping up’ President Robert Mugabe’s government in Zimbabwe.

– Lloyds confirms £10.8bn HBOS loss (Financial Times)

Lloyds, which rescued HBOS last year, had been expected to reveal that the government was insuring up to £250bn of the bank’s assets.Meanwhile, the Financial Times has learnt that Barclays has also sounded out the government about potentially participating in the asset protection scheme.

– Mexico is in free fall (Guardian)

– It is time to resist (Guardian):

David Omand’s national security strategy report shows us we have a very short time to save society from tyranny.

“Once an individual has been assigned a unique index number, it is possible to accurately retrieve data across numerous databases and build a picture of that individual’s life that was not authorised in the original consent for data collection,” says Sir David Omand in a report for the Institute for Public Policy research. This is not some wild fantasy. It is the world that we are about to move into and which Jack Straw’s coroners and justice bill, the ID Cards Act, RIPA laws and the EBorders scheme have patiently constructed while we have been living in an idiots’ paradise of easy money.

– We’re on the brink of disaster (Salon):

Violent protests and riots are breaking out everywhere as economies collapse and governments fail. War is bound to follow.

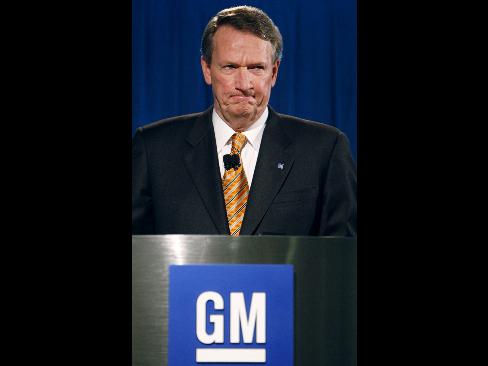

– Thousands of Opel Workers Demonstrate against GM (Spiegel Online)

– Indigenous people in legal challenge against oil firms over tar sand project (Guardian):

British oil firms are facing a legal battle over exploitation of the huge Canadian tar sand fields with indigenous people who claim the industry is ruining their traditional lands.

– Rapid HIV evolution avoids attack (BBC News):

HIV is evolving rapidly to escape the human immune system, an international study has shown.

– Greenland’s Ice Armageddon Comes To An End (The Resilient Earth):

One of the catastrophic results of global warming always cited by climate change alarmists is the melting of the ice sheets covering Greenland. Some even speculated that global warming had pushed Greenland past a “tipping point” into a scary new regime of wildly heightened ice loss and rapidly rising in sea levels. Now, from the fall meeting of the American Geophysical Union, comes word that Greenland’s Ice Armageddon has been called off.

– Arsonists Torch Berlin Porsches, BMWs on Economic Woe (Bloomberg):

At least 29 vehicles were destroyed in arson attacks this year, most of them luxury cars, according to police. The number is already about 30 percent of the total for 2008.

– French professor sacked over 9/11 conspiracy theory (Russia Today):

An academic in France has been sacked by the Ministry of Defence after questioning the official version of events surrounding the 9/11 attacks. He now reportedly plans to sue the government.

– UK rules out charges against Pentagon hacker (Reuters):

A British court ruled in 2006 that he should be extradited to the United States to face trial. If convicted by a U.S. court, he could face up to 70 years in prison. McKinnon has been battling the British court decision ever since.

– Fluoridation scheme could go England-wide (Guardian):

City of Southampton to get first water fluoridation project in 25 years despite 78% opposition in consultation

(The combination of chlorination and fluoridation causes heavy damage to the DNA.)

– New Study Finds GM Genes in Wild Mexican Maize (Soyatech):

New Scientist — February 21, 2009 — Now it’s official: genes from genetically modified corn have escaped into wild varieties in rural Mexico. A new study resolves a long-running controversy over the spread of GM genes and suggests that detecting such escapes may be tougher than previously thought.

Presidential powers in Iran are often circumscribed by the clerics

Presidential powers in Iran are often circumscribed by the clerics