– FSA moves HQ from Turkey to Syria to prepare offensive against Assad (RT, Sep 22, 2012)

FSA

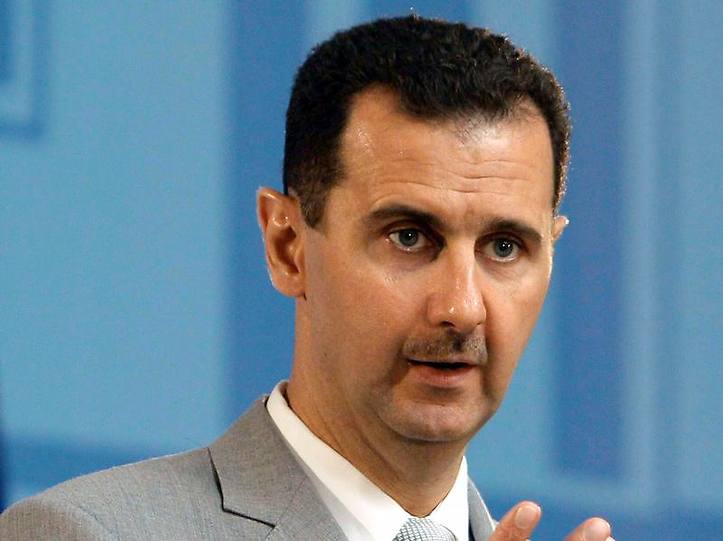

‘Dead Or Alive’: Syria Rebel Commander Offers $25 Million Bounty For Bashar Al-Assad

– 25 million USD for Bashar al-Assad: dead or alive (Times.am):

The rebel Free Syrian Army (FSA) has offered a $25 million reward for the capture, dead or alive, of Syrian President Bashar al-Assad. Turkishweekly.net informs about this referring to Anadolu news agency.

FSA commander Ahmed Hijazi said the money will be paid out by supporters as well as by “Syrian businessmen working both at home and abroad.”

The United States said last month it had set aside $25 million for non-lethal aid to Syrian rebels.

– Syria rebel commander offers $25 million bounty on Assad, ‘dead or alive’ (Haaretz):

A commander with the rebel Free Syrian Army (FSA) has offered a 25-million-dollar bounty for anyone who captures Syrian President Bashar Assad “alive or dead,” reported the Turkish news agency Anatolia on Tuesday.

The announcement by an unnamed commander with the FSA said the money for the bounty had been set up with donations from anti-Assad business people.

The reported bounty offer came as Western officials said Tuesday there was little doubt a growing number of foreign jihadi fighters are entering the fray in Syria, although it is far from clear whether any have direct links to Al Qaeda. But it is just one worry amongst many.

Cereal Box Cancer Warning After Recycled Cardboard Study

Breakfast cereal manufacturers are to stop using recycled cardboard in packaging after a study indicated that current boxes could pose a cancer risk.

Jordans – whose brands include Country Crisp and Crunchy Oats – has already stopped using recycled cardboard, while Kellogg’s and Weetabix say they are taking steps to reduce the risk to human health.

The alert was sparked when researchers in Switzerland found that mineral oils in printing ink from recycled newspapers used in cardboard can get into foods – even passing through protective inner plastic bags.

Brands of pasta and rice which are packaged in recycled cardboard could also pose a risk.

Dr Koni Grob, of the Food Safety Laboratory in Zurich, said toxicologists had linked the oils to inflammation of internal organs and even cancer, though he stressed that individual meals would contain only a tiny dose of the chemicals.

The BBC reported that cereal firm Jordans has stopped using recycled cardboard while other manufacturers are reducing levels of mineral oils in packaging.

The Swiss researchers analysed a total of 119 products bought from German supermarkets last year and found that a large majority contained traces of mineral oils higher than the agreed level. Only those with thicker and more expensive inner lining bags appeared to escape contamination, which increased the longer products were on the shelves.

”Roughly 30 products from 119 were free of mineral oils, nearly all because of an inner barrier,” said Dr Grob. ”For the others, they all exceeded the limits and most exceeded it by 10 times.

”We calculated that before the end of their shelf life, they would probably exceed the limit 50 times on average and many would exceed it by several hundred times.”

Studies on rats have highlighted the dangers to health of mineral oils, said Dr Grob, adding: ”Toxicologists talk about two effects. One is the chronic inflammation of various internal organs and the other one is cancer.”

Read moreCereal Box Cancer Warning After Recycled Cardboard Study

Europe: Meat From Cloned Animals to Enter The Food Chain ‘Through An Open Door’

Cloned meat: Britain and Europe set for another clash

Europe is allowing meat from cloned animals to enter the food chain “through an open door”, according to MEPs.

Demonstrators wearing masks depicting Britain’s Prime Minister David Cameron, protest against cloning animals for food, in London Photo: REUTERS

They have called for an immediate measures to stop the importing of meat from America, South America or Japan without some safeguards or a new labelling regime put in place.

Their comments came after the European Commission reconfirmed this week that it believed meat, milk, cheese or any other product from the offspring of a cloned animal was perfectly legitimate and needed no special licence to be sold.This position puts Europe at direct loggerheads with the Food Standards Agency, whose board is meeting next week to discuss cloned animals.

The FSA has always stated that any products from the offspring of a cloned animal, even three generations down the line, had to have a licence before they can be sold.

The row between Europe and the FSA has been simmering after the FSA discovered last month that meat from the offspring of a cloned cow had been unwittingly sold in butcher’s shops in Britain, without a licence being obtained.

The discovery that such meat, for the first time had been eaten by consumers, triggered an often ill-tempered debate into the ethics of cloning animals.

Read moreEurope: Meat From Cloned Animals to Enter The Food Chain ‘Through An Open Door’

UK Food Watchdog Battling The Food Industry To Be Abolished By Health Secretary

Victory for food manufacturers as health groups accuse Andrew Lansley of caving in to big business

Andrew Lansley, the health secretary, will ask Defra and the health department to take over the FSA’s responsibilities.

The Food Standards Agency is to be abolished by Andrew Lansley, the health secretary, it emerged last night, after the watchdog fought a running battle with industry over the introduction of colour-coded “traffic light” warnings for groceries, TV dinners and snacks.

The move has sparked accusations that the government has “caved in to big business”.

As part of the changes Lansley will reassign the FSA’s regulatory aspects – including safety and hygiene – to the Department for Environment, Food and Rural Affairs (Defra).

Its responsibilities for nutrition, diet and public health will be incorporated into the Department of Health.

“The functions of the FSA will be subsumed into the Department of Health and Defra,” a source told Reuters.

Andrew Burnham, Labour’s health spokesman, said: “Getting rid of the FSA is the latest in a number of worrying steps that show Andrew Lansley caving in to the food industry. It does raise the question whether the health secretary wants to protect the public health or promote food companies.”

Read moreUK Food Watchdog Battling The Food Industry To Be Abolished By Health Secretary

UK Academics Quit Rigged FSA Frankenfood Propaganda

Quit: Professor Brian Wynne and Dr Helen Wallace stepped down from leading roles at the Food Standards Agency, saying it is biased towards GM technology

An official public consultation into genetically modified food has been thrown into chaos following protests that it has been rigged.

The exercise by the Food Standards Agency could now be axed following the resignation of two leading advisers working on it.

The two academics said they were not prepared to support a proposal that would spend £500,000 of public money on a spin exercise to promote so-called ‘Frankenstein Food’.

They argued the money would be better spent on schools and hospitals rather than boosting the interests of GM companies such as Monsanto and Syngenta.

Ministers in the coalition Government are believed to be ready to kill off the idea in a move against Whitehall waste.

The GM consultation plan was ordered by the old Labour government in what critics believe was a last ditch effort to overturn consumer opposition to the technology.

Ministers even appointed Lord Rooker, the former Labour minister Jeff Rooker and a self-avowed advocate of GM farming, to the post of FSA chairman to oversee the process.

The FSA, which has a history of supporting GM technology, made great play of claims that the consultation would be independent. However, two advisers who sit on the steering group overseeing the proposal have stepped down claiming it is biased in favour of GM.

They include the vice chairman, Professor Brian Wynne, a sociologist at Lancaster University.

He is the country’s leading expert on public engagement with science and has also advised House of Lords and EU committees.

Dr Helen Wallace, who is the director of Genewatch UK and a long time critic of GM, has also stepped down.

Dr Wallace said: ‘This is a worst case example of dirty politics where vested interests are paid to dupe the public using public money.

‘Taxpayers will be shocked to learn that a former minister still has his fingers in their pockets long after the New Labour government is dead.

‘This money should be spent on schools or hospitals, not reputation management for Monsanto and other GM companies.’

Professor Wynne added that it appeared the FSA had been ordered to conduct the GM exercise after the biotech industry lobbied the last government-In a letter of resignation-he complained that the planned consultation had turned out to be little more than propaganda.

He accused the FSA of having adopted a ‘dogmatically entrenched’ pro-GM position.

Read moreUK Academics Quit Rigged FSA Frankenfood Propaganda

A cancerous conspiracy to poison your faith in organic food

Debate: Despite its obvious benefits organic food continues to be denigrated by the political and corporate establishment in Britain

Despite its obvious benefits for our health and for the environment, organic food continues to be denigrated by the political and corporate establishment in Britain.

The food industry, in alliance with pharmaceutical and big biotechnology companies, has waged a long, often cynical campaign to convince the public that mass-produced, chemically-assisted and intensively-farmed products are just as good as organic foods, despite mounting evidence to the contrary.

The latest assault in this propaganda exercise comes from the Food Standards Agency, the government’s so-called independent watchdog, which has just published a report claiming that there is no nutritional benefit to be gained from eating organic produce.

Those forces bent on promoting GM crops and industrialised production, would have been delighted by the widespread media coverage of the Agency’s report, portraying enthusiasm for organic foods as little more than a fad among neurotic consumers that would pass once the public is given the correct information.

But what is truly misguided is not the increasing popularity of organic goods, but the Food Standards Agency’s determination to halt this trend and instead promote genetic modification.

The new report from the FSA highlights this. For all the publicity it has attracted, the document does not contain any new material.

In fact, it is just an analysis of existing research carried out by other bodies. Moreover, the organisation that conducted this second-hand study, the London School of Hygiene and Tropical Medicine, is not renowned as a leading centre in this field.

Indeed, there is far more significant work currently being done on organic foods by several other bodies, some of it funded by the European Union, though the FSA has chosen to ignore it.

It is difficult to avoid the conclusion that the FSA has decided to give such loud backing to this report because it can bend the findings to suit its political, pro-GM, anti-organic agenda.

What is truly misguided is not the increasing popularity of organic goods, but the Food Standards Agency’s determination to instead promote genetic modification

Ever since its creation in 2000, the Food Standards Agency has been biased against organic farming. The first chairman, Sir John Krebs (“Krebs” by the way is the German word for “Cancer”. – Infinite Unknown) , was supportive of the biotechnology lobby and only too keen to promote GM as the future of farming.

Read moreA cancerous conspiracy to poison your faith in organic food

The 1.3 trillion pound bank job

The furore over Sir Fred Goodwin’s massive pension worked as an effective smokescreen for far worse financial news that the Government was happy to keep out of the public eye.

Lord Mandelson, asked Sir Fred Goodwin (pictured), to give back some of his pension

As scapegoats go, Sir Fred Goodwin is straight out of Central Casting. He’s a banker; he’s mucked up big time, cost the taxpayer sums still too large to calculate properly, and he’s walked away from the mess with riches beyond the avarice of a Premiership footballer. All he lacks, as a media villain, is a pair of staring eyes and record of cruelty to animals.

If Alastair Campbell were still around, Sir Fred might have been saddled with even that. But this week, as loomed the handing to banks of further barrels of public cash on what the furniture stores used to call easy terms, the Government had no need for nudge-nudge rumours of scuttlebutt to create a diversion. It had information even more incriminating and instantly unpopular: the size of Sir Fred’s pension pot.

It was huge; it was blood-pressure raisingly indefensible; and, above all, it seemed politically useful. Ministers had known the scale of it for months; something pretty close to its size had been reported on City pages as far back as 14 October last year. But it had never become An Issue. Now the time for it to do so had arrived. And so, on Wednesday evening, the exact magnitude of it was leaked to Robert Peston of the BBC. He went on air and could barely get the numbers out for hyperventilating: Sir Fred’s pot of gold was worth £16.9m; the man – so the story went – whose megalomaniac regime of compulsive acquisitions had brought down the Royal Bank of Scotland was now retired, at the age of 50, with a pension worth £13,000 a week for the rest of his life.

The ploy worked. By the following day, Fred’s Pension was dominating the news and provoking all the anti-banker indignation that a government spin-doctor hoped it might: “These fat cats must have their fortunes neutered” (Daily Mail), “Obscene: I won’t give up a penny” (Daily Express), and “No shred of shame; RBS boss Fred” (Daily Mirror). Yet all the while, behind this smokescreen, hundreds of billions of taxpayers’ cash was being committed to the banks on terms that seemed bewildering. This – the biggest leap in the dark in British economic history – is what the row over Fred’s pension concealed. It is a story that should now be told.

For a long time, it has been known that the big scheduled domestic event of last week would be RBS’s results. Their gargantuan size was widely expected, and the final figures didn’t disappoint: £24.1bn in the red – bigger than any American bank could manage, vastly outscoring some of the week’s other losses (such as housebuilder Barratt’s £592m), and relegating to barely visible footnotes the other depressing statistics of the week, such as household spending declining at its fastest rate since 1991; house prices down 15 per cent in a year; and service sector job losses at a 10-year high.

RBS’s losses, and those of Lloyds HBOS the following day, meant a further extension to the Government’s bailout, and taxpayers’ exposure. The size of the potential commitment to the banks is estimated at £1.3 trillion, equivalent to the value of the British economy for a whole year, and a burden equal to possibly as much as £36,000 for every man, woman and child in the country. And there could yet be more unpleasant discoveries. Looming rather less large in the public consciousness than Sir Fred’s pot was the appearance before the Treasury Select Committee of Mervyn King, Governor of the Bank of England. Fully five months after the present crisis began with the collapse of Lehman Brothers in September, he told MPs that it is still not known just how big the liabilities of British banks are. In his evidence to the Treasury Select Committee last week, he said it would take “many months” to establish the scale of toxic assets held by banks, requiring a detailed assessment contract by contract.

Also overshadowed by Sir Fred’s pot was the size of the latest government support for the banks. For a fee of £6.5bn, RBS will place £325bn worth of toxic assets in the Government’s newly created Asset Protection Scheme. The bank will then be liable for only the first £19.5bn of these dodgy assets, with the taxpayer accepting the risk of the rest. The shadow chancellor, George Osborne, said: “The British taxpayer is insuring the car after it has crashed.” Lloyds Banking Group’s participation is not yet finalised, but is expected to involve about £250bn worth of toxic assets.

Gordon Brown helped fuel banking crisis – FSA head

Gordon Brown helped fuel Britain’s banking crisis by pressuring the City regulator not to intervene and stop reckless lending, Lord Turner, the head of the Financial Services Authority, said.

Chairman of the FSA Lord Turner Photo: JULIAN SIMMONDS

The authority’s chairman claimed the regulator was under political “pressure” not to be “heavy and intrusive” with banks such as HBOS and Northern Rock.

Instead, it was told to operate a “light touch” approach, which had now been proved to be “mistaken”, he told a Commons committee.

The failure of the regulator to intervene earlier has been blamed for the banking crisis, which has led to the near-collapse of several of the country’s biggest banks.

Lord Turner’s remarks, made to MPs, are deeply embarrassing for the Prime Minister, who oversaw the FSA while he was Chancellor.

Queen’s stockbroker raided, biggest ever crackdown on insider trading

The Queen’s stockbroker Cazenove has been caught up in Britain’s biggest ever crackdown on insider trading.

Eight people were arrested in dawn raids yesterday by the City watchdog the Financial Services Authority.

Cazenove admitted that one of the arrested worked at its London offices as a sub-contractor.

A 40-strong team from the FSA swooped on addresses in London and the South East with back-up from City of London police.

Cazenove, the Queen’s stockbroker, has been at the centre of police raids into insider trading

They are believed to have seized computers and paperwork.

Read moreQueen’s stockbroker raided, biggest ever crackdown on insider trading

Banks: Plans to Seek Secret Emergency Funding

So in a free market it is justifiable to keep some “potentially situations” secret!?!? Hmmhh.

Secret from whom?

“The main case for an exception would be if disclosure could panic investors and lead to fears for a bank’s solvency, the regulator said.” Investors in the U.K. have all the right to panic.

“Under certain circumstances, immediate disclosure would still be required.”

These “certain circumstances” will occur when it is too late to panic!

_______________________________________________________________________________________

The City watchdog has laid out plans to allow banks to tap the Bank of England for emergency funding without informing the market, in a move which might avoid a repeat of the run on the bank which led to the collapse of Northern Rock.

Under the European Union’s market abuse directive, regulated firms have to disclose price sensitive information. However, the Financial Services Authority yesterday said there were potentially situations where banks would be allowed to keep it secret if they had applied to the Bank.

The main case for an exception would be if disclosure could panic investors and lead to fears for a bank’s solvency, the regulator said. The FSA laid out a series of proposals in a consultation document. It invited industry groups to respond by September 30.

Food additives ‘could be as damaging as lead in petrol’

Artificial food colours are set to be removed from hundreds of products after a team of university researchers warned they were doing as much damage to children’s brains as lead in petrol.

Academics at Southampton University, who carried out an official study into seven additives for the Food Standards Agency (FSA), said children’s intelligence was being significantly damaged by E-numbers. After receiving the advice last month, officials at the FSA have advised their directors to call for the food industry to remove six additives named in the study by the end of next year.

Read moreFood additives ‘could be as damaging as lead in petrol’

Federal Reserve staff move into offices of investment banks to monitor activities

The US Federal Reserve has sent staff into some of Wall Street’s biggest firms and its New York branch is gathering evidence on key traders’ activities as America’s central bank raises its scrutiny of risk to an unprecedented level.

Fed staff have set up shop in Goldman Sachs, Morgan Stanley, Lehman Brothers, Merrill Lynch, and Bear Stearns to monitor their financial condition just days after Henry Paulson, the US Treasury Secretary, proposed that the Fed become the financial industry’s “risk czar”.

This is the first time in more than a decade that the Fed has put staff in securities firms and is a response, in part, to its decision to extend to investment banks the “discount window” of cheap loans traditionally offered only to the commercial banks. The Fed argues that if it is to act as lender of last resort to the securities firms, it should keep a closer eye on their activities.

The move comes as the central bank’s New York branch separately compiles a list of names and numbers of key traders in specific, esoteric securities such as auction rate preferred securities. These obscure instruments can be traded only at auctions and demand for them has virtually evaporated in recent weeks.

A senior US mutual fund executive, whom the Fed has approached, said: “They are looking in every corner to understand every esoteric financial product – who its traders are, who holds the most, whether its market is liquid and how great the losses could be. They are approaching people like me to find the key players in particular securities and then contacting them to find out the details. I have never heard of that being done before.”

Read moreFederal Reserve staff move into offices of investment banks to monitor activities