Add that to Climategate! Global warming is a scam.

Most experts believe that the Himalayan glaciers will take centuries to melt

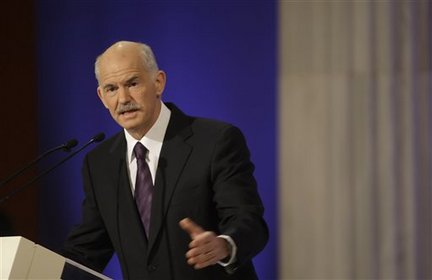

The chairman of the leading climate change watchdog was informed that claims about melting Himalayan glaciers were false before the Copenhagen summit, The Times has learnt.

Rajendra Pachauri was told that the Intergovernmental Panel on Climate Change assessment that the glaciers would disappear by 2035 was wrong, but he waited two months to correct it. He failed to act despite learning that the claim had been refuted by several leading glaciologists.

The IPCC’s report underpinned the proposals at Copenhagen for drastic cuts in global emissions.

Dr Pachauri, who played a leading role at the summit, corrected the error last week after coming under media pressure. He told The Times on January 22 that he had only known about the error for a few days. He said: “I became aware of this when it was reported in the media about ten days ago. Before that, it was really not made known. Nobody brought it to my attention. There were statements, but we never looked at this 2035 number.”

Asked whether he had deliberately kept silent about the error to avoid embarrassment at Copenhagen, he said: “That’s ridiculous. It never came to my attention before the Copenhagen summit. It wasn’t in the public sphere.”

However, a prominent science journalist said that he had asked Dr Pachauri about the 2035 error last November. Pallava Bagla, who writes for Science journal, said he had asked Dr Pachauri about the error. He said that Dr Pachauri had replied: “I don’t have anything to add on glaciers.”

The Himalayan glaciers are so thick and at such high altitude that most glaciologists believe they would take several hundred years to melt at the present rate. Some are growing and many show little sign of change.

Dr Pachauri had previously dismissed a report by the Indian Government which said that glaciers might not be melting as much as had been feared. He described the report, which did not mention the 2035 error, as “voodoo science”.