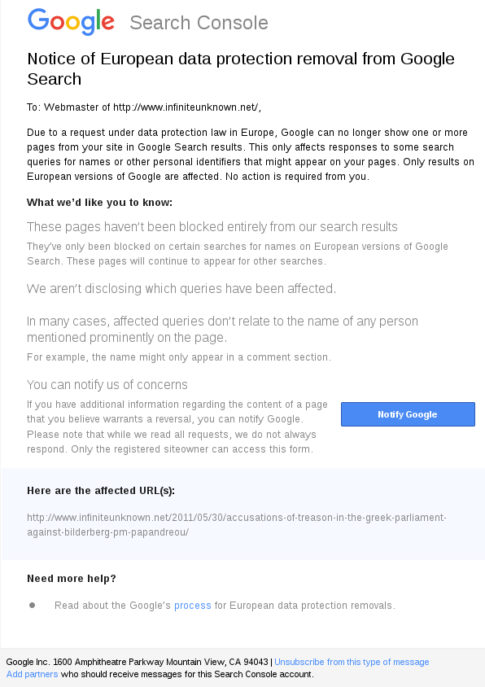

(Screenshot – Click on image to enlarge.)

Here is the censored article:

– Accusations Of Treason In The Greek Parliament Against Bilderberg PM Papandreou

In my commentary to the above article I wrote:

Flashback:

– Greek Central Bank Accused of Encouraging Naked Short Selling of Greek Bonds (Financial Times)

And remember that the biggest Greek CDS speculator has been the state-controlled Hellenic Post Bank with help from (Yes, you’ve guessed it!) Goldman Sachs:– State-controlled Hellenic Post Bank (TT) bet against Greece (Kathimerini)

– Fragwürdige Finanzgeschäfte Griechen wetten auf eigene Pleite (Sueddeutsche Zeitung)

The state-controlled Hellenic Post Bank was betting on Greece going bankrupt!

What will happen if Greece defaults:

– Here Is What Happens After Greece Defaults

Solution:

So who could possibly ‘dislike’ such an article?

On a side note:

Alexa Rank:

Infinite Unknown had a global Alexa Rank of just above 100,000 (for a while) and even below that (quite a while ago).

A webmaster told me (when it became apparent that the numbers were dropping fast) that Alexa had changed its rating methods, which in his opinion clearly disfavors websites like I.U.

You can look up I.U.’s global ranking here:

http://www.alexa.com/siteinfo/infiniteunknown.net

The only way we can make up for all this censorship coming our way is if readers would start hitting that social media buttons like crazy.

Maybe that would also bring more attention to the website, which could possibly result in more financial support for my work, which is much, much needed.

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP