See also:

– Banksters Bet Greece Defaults on Debt They Helped Hide

– Greek Debt Crisis: How Goldman Sachs Helped Greece to Mask its True Debt

– Greece: 2009 Budget Deficit Was Just Revised From 12.2% To 16% Of GDP!

– The CDS Puppetmaster Behind It All And The Ever Increasing Parallels Between AIG And Greece

The people will have to pay the bill …

… and the elite that controls the banksters, the governments, the media and the central banks always gains more money, power and control.

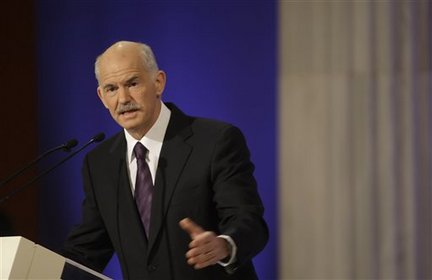

George Papandreou, Greece’s prime minister, gestures during a press briefing at the European Union Parliament headquarters in Brussels, on March 18, 2010. Photographer: Jock Fistick/Bloomberg

March 18 (Bloomberg) — Greek Prime Minister George Papandreou set a one-week deadline for the European Union to craft a financial aid mechanism for Greece, challenging Germany to give up its doubts about a rescue package.

Papandreou said he may turn to the International Monetary Fund to overcome Greece’s debt crisis unless leaders agree to set up a lending facility at a summit March 25-26. The IMF option has already been dismissed by European Central Bank President Jean-Claude Trichet and French President Nicolas Sarkozy, who say it would show the EU can’t solve its own crises.

“It’s an opportunity to make a decision next week at the summit,’’ Papandreou told reporters in Brussels today. “This is an opportunity we should not miss. When you have that instrument in place, that could be enough to tell the markets hands off, no speculation, let this country do what it’s doing.”

Read morePapandreou Gives EU One Week to Seal Aid Plan as Germany Pushes IMF Option