The fall of 2008 was a hectic time, when in the aftermath of the Lehman failure, the entire financial system was on the verge of collapse and only the biggest Fed/taxpayer-backed bailout in history avoided an all out depression. Today, as a result of the latest, 12th Podesta leak, we find that then president-elect Barack Obama was also being intimately briefed with unfolding events.In a previously never before seen confidential memo, sent on November 9, 2008 from current Fed governor Dan Tarullo addressed to Barack Obama, Tarullo send John Podesta an email in which Tarullo, who at the time was not employed by the Fed and was Professor of Law at Georgetown University Law Center, reveals what Hank Paulson and Ben Bernanke in which Tarullo was told on a “confidential basis that, before the markets open tomorrow morning, they will be announcing a significant restructuring of the AIG bailout package. They are taking this step in order to avoid what they asserted would be a systemic crisis.“

AIG

NY Fed Head Of Banking Supervision, And Person Who Handed Over Billions In AIG Profits To Goldman, Resigns

From the article:

Just three questions here about Sarah Dahlgren’s “resignation”:

1. Why is she resigning now: is there a crackdown on just how corrupt the Goldman Sachs branch office at Liberty 33 truly is? Acutally, just kidding. Ignore this for obvious reasons.

2. What will her salary at Goldman Sachs be once she joins the 200 West firm?

3. Which Goldman partner will replace her?

– NY Fed Head Of Banking Supervision, And Person Who Handed Over Billions In AIG Profits To Goldman, Resigns (ZeroHedge, April 30, 2015):

The name Sarah Dalgren is well-known to long-term Zero Hedge readers: back in January 2010 we revealed that, just before the Great US banking system backdoor bailout by way of getting a par return on AIG CDS, back in August 2008 Goldman was willing to tear up AIG Derivative Contracts, and had in fact offered to take a haircut. It was the Fed who turned Goldman’s offer down! And the person who made the decision would become the Fed’s head of Special Investments [AIG] Management Group: Sarah Dahlgren.

We said that Dahlgren “not only did not save US taxpayers’ money, but in fact ended up costing money, when they funded the marginal difference between par (the make whole price given to all AIG counterparties after AIG was told to back off in its negotiations) and whatever discount would have been applicable to the contract tear down that had been proposed by Goldman a mere month earlier. This, more so than anything presented up to now, is the true scandal behind the New York Fed’s involvement.“

9/11 Conspiracy Solved (Documentary)

Added: Apr 21, 2013

Description:

9/11 Conspiracy Solved: Watch this documentary and look for the evidence and then make up your own mind whether or not 9/11 was an inside job.

Special thanks to Michael C. Ruppert, Mark H. Gaffney, and Kevin Ryan for their amazing research, as they tried to solve the crimes of 9/11. This video is a compilation of evidence they have uncovered.

Hedge Fund Manager Kyle Bass Warns “The ‘AIG’ Of The World Is Back”

– Kyle Bass Warns “The ‘AIG’ Of The World Is Back” (ZeroHedge, March 12, 2013):

Kyle Bass, addressing Chicago Booth’s Initiative on Global Markets last week, clarified his thesis on Japan in great detail, but it was the Q&A that has roused great concern. “The AIG of the world is back – I have 27 year old kids selling me one-year jump risk on Japan for less than 1bp – $5bn at a time… and it is happening in size.” As he explains, the regulatory capital hit for the bank is zero (hence as great a return on capital as one can imagine) and “if the bell tolls at the end of the year, the 27-year-old kid gets a bonus… and if he blows the bank to smithereens, ugh, he got a paycheck all year.” Critically, the bank that he bought the ‘cheap options’ from recently called to ask if he would close the position – “that happened to me before,” he warns, “in 2007 right before mortgages cracked.” His single best investment idea for the next ten years is, “Sell JPY, Buy Gold, and go to sleep,” as he warns of the current situation in markets, “we are right back there! The brevity of financial memory is about two years.”

Click the image below for the full presentation (unembeddable):

The main thrust of the discussion is Bass’ thesis on Japan’s pending collapse – which we wrote in detail on here, here, and here – and while the details of this thesis should prepare most for the worst, it is the Q&A that provides some very clear insights into just what is going on in the world.

Starting at around 50:00…

Bass On Immigration Reform in Japan – hailed as a solution to the demographic problem – Bass says “Ain’t gonna happen. They need wage inflation and this will not encourage that. It’s an untenable situation.” Summing up his whole view on Japan – “I just don’t think it can be fixed.”

Question: When you look today in the capital markets at the tactical asymmetry that exists among the various financial instruments to take advantage of cheap optionality – what is that instrument?

I’ll give you guys a bit of an idea… we don’t talk about exactly what

we do – we tell you how much we love coke but we’re not gonna give you

the formula.The AIG of the world is back – I have 27 year old kids selling me one-year jump risk on Japan for less than 1bp – $5bn at a time.

You know why? Because it’s outside of a 95% VaR, its less than one-year to maturity, so guess what the regulatory capital hit is for the bank… I’ll give you a clue – it rhymes with HERO…

Read moreHedge Fund Manager Kyle Bass Warns “The ‘AIG’ Of The World Is Back”

Matt Taibbi: Secrets And Lies Of The Bailout (Rolling Stone)

– Secrets and Lies of the Bailout (Rolling Stone, Jan 4, 2013):

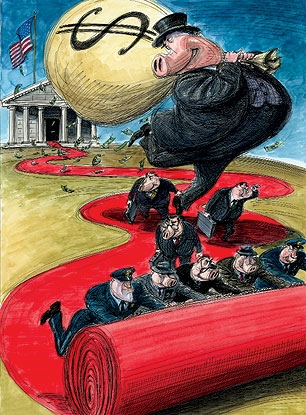

It has been four long winters since the federal government, in the hulking, shaven-skulled, Alien Nation-esque form of then-Treasury Secretary Hank Paulson, committed $700 billion in taxpayer money to rescue Wall Street from its own chicanery and greed. To listen to the bankers and their allies in Washington tell it, you’d think the bailout was the best thing to hit the American economy since the invention of the assembly line. Not only did it prevent another Great Depression, we’ve been told, but the money has all been paid back, and the government even made a profit. No harm, no foul – right?

Wrong.

It was all a lie – one of the biggest and most elaborate falsehoods ever sold to the American people. We were told that the taxpayer was stepping in – only temporarily, mind you – to prop up the economy and save the world from financial catastrophe. What we actually ended up doing was the exact opposite: committing American taxpayers to permanent, blind support of an ungovernable, unregulatable, hyperconcentrated new financial system that exacerbates the greed and inequality that caused the crash, and forces Wall Street banks like Goldman Sachs and Citigroup to increase risk rather than reduce it. The result is one of those deals where one wrong decision early on blossoms into a lush nightmare of unintended consequences. We thought we were just letting a friend crash at the house for a few days; we ended up with a family of hillbillies who moved in forever, sleeping nine to a bed and building a meth lab on the front lawn.

Read moreMatt Taibbi: Secrets And Lies Of The Bailout (Rolling Stone)

Facing Backlash, AIG Won’t Join Lawsuit Against U.S. Over Bailout Of AIG

– Facing backlash, AIG won’t join suit against U.S. (USA Today/AP, Jan 9, 2013):

NEW YORK — Facing a certain backlash from Washington and beyond, American International Group won’t be joining a shareholder lawsuit against the U.S. government.

AIG was legally obligated to consider joining the lawsuit being brought against the government by former AIG Chief Executive Maurice Greenberg, who claims that the terms of the $182 billion bailout weren’t fair to AIG shareholders.

The prospect of AIG joining the lawsuit had already triggered outrage. A congressman from Vermont issued a statement telling AIG: “Don’t even think about it.”

Read moreFacing Backlash, AIG Won’t Join Lawsuit Against U.S. Over Bailout Of AIG

Lawmakers Outraged After AIG Announces Potential Lawsuit Against US Over AIG Bailout

– AIG Considers Suing US Over US Bailout Of AIG (ZeroHedge, Jan 8, 2013):

Sometimes you just have to laugh – or you will cry. In what could well have been Tuesday Humor if it wasn’t so real, the AIG board (fulfilling its shareholder fiduciary duty) is considering joining Hank Greenberg’s suit against the government over the cruel-and-unusual bailout that saved the company. The $25bn lawsuit, as NY Times reports, based not on the basis that help was needed but that the onerous nature “taking what became a 92% stake in the company with high interest rates and funneling billions to the insurer’s Wall Street clients” deprived shareholders of tens of billions of dollars and violated the Fifth Amendment (prohibiting the taking of private property for “public use, without just compensation”). The ‘audacious display of ingratitude’ comes weeks after the firm has repaid the $182 billion bailout funneled to it and its clients by an overly generous Treasury. The firm has asked for 16 million pages of government documentation, this “slap in the face of the government” portends a question of whether the government will sue The Fed for enabling the recovery that strengthened Greenberg’s case that the bailout was so harsh. Happy retirement Tim Geithner.

– Lawmakers outraged after AIG announces potential suit against US over bailout (FOX News, Jan 9, 2013):

As American International Group Inc. weighs whether to join a lawsuit against the government that spent $182 billion to save it from collapse, U.S. lawmakers have a message for the insurance behemoth: “Don’t even think about it.”

In a letter to AIG Chairman Robert Miller, U.S. Reps. Peter Welch, D-Vt., and Michael Capuano, D-Mass., characterized the insurer as the “poster child” for Wall Street greed, fiscal mismanagement and executive bonuses.

“Now, AIG apparently seeks to become the poster company for corporate ingratitude and chutzpah,” the letter read. “Taxpayers are still furious that they rescued a company whose own conduct brought it down. Don’t rub salt in the wounds with yet another reckless decision that is on par with the reckless decision that led to the bailout in the first place.”

Read moreLawmakers Outraged After AIG Announces Potential Lawsuit Against US Over AIG Bailout

Marc Faber’s 50 Minute Lecture On Virtually Everything: ‘Keynesians Like Paul Krugman Should Go And Live In North Korea’ (The Bubble Film Interview)

– Marc Faber: “Paul Krugman Should Go And Live In North Korea” (ZeroHedge, Dec 13, 2012):

If there is one thing better than Marc Faber providing a free, must-watch (and listen) 50 minute lecture on virtually everything that has transpired in the end days of modern capitalism, starting with who caused it, adjustable rate mortgages, leverage, why did the Fed let Lehman fail, why was AIG bailed out, quantitative easing, Operation Twist, where the interest on the debt is going, which bubbles he is most concerned about, a discussion of gold and silver, and culminating with his views on a world reserve currency, is him saying the following: “The views of the Keynesians like Mr. Krugman is that the fiscal deficits are far too small. One of the problems of the crisis is that it was caused by government intervention with fiscal and monetary measures. Now they tells us we didn’t intervene enough. If they really believe that they should go and live in North Korea where you have a communist system. There the government intervenes into every aspect of the economy. And look at the economic performance of North Korea.” Priceless.

50 minutes of Faberian bliss:

And Now … AIG To Offer ‘REPUTATION INSURANCE’

ROFL!

– A.I.G. Is Now Worried About Bad P.R. — for Policyholders (New York Times, Oct. 11, 2011):

Insurance providers are constantly coming up with new products to sell to policyholders. But the American International Group has hit upon one of the more unusual new services we’ve heard of in some time: reputation insurance.

Chartis, A.I.G.’s property and casualty insurance arm, said Tuesday that it would begin selling something called ReputationGuard. Created by Chartis’s executive liability team, it would give policyholders access to “a select panel” of experts at the public relations firms Burson-Marsteller and Porter Novelli to protect against negative publicity.

Full-Blown Civil War Erupts On Wall Street: As Reality Finally Hits The Financial Elite, They Start Turning On Each Other

Recommended ‘extensive roundup’ here:

– Full-Blown Civil War Erupts On Wall Street: As Reality Finally Hits The Financial Elite, They Start Turning On Each Other (AmpedStatus, Sep 3, 2011):

Finally, after trillions in fraudulent activity, trillions in bailouts, trillions in printed money, billions in political bribing and billions in bonuses, the criminal cartel members on Wall Street are beginning to get what they deserve. As the Eurozone is coming apart at the seams and as the US economy grinds to a halt, the financial elite are starting to turn on each other. The lawsuits are piling up fast. Here’s an extensive roundup:

…

How Goldman Sachs Created the Food Crisis

Don’t blame American appetites, rising oil prices, or genetically modified crops for rising food prices. Wall Street’s at fault for the spiraling cost of food.

Demand and supply certainly matter. But there’s another reason why food across the world has become so expensive: Wall Street greed.

It took the brilliant minds of Goldman Sachs to realize the simple truth that nothing is more valuable than our daily bread. And where there’s value, there’s money to be made. In 1991, Goldman bankers, led by their prescient president Gary Cohn, came up with a new kind of investment product, a derivative that tracked 24 raw materials, from precious metals and energy to coffee, cocoa, cattle, corn, hogs, soy, and wheat. They weighted the investment value of each element, blended and commingled the parts into sums, then reduced what had been a complicated collection of real things into a mathematical formula that could be expressed as a single manifestation, to be known henceforth as the Goldman Sachs Commodity Index (GSCI).

US Poverty Levels Equal to the 1930s For Some 16 Percent Of The Population

“When a country embarks on (record) deficit financing (Obamanomics) and inflationism (Quantitative easing) you wipe out the middle class and wealth is transferred from the middle class and the poor to the rich.”

– Ron Paul

The other 93% will be destroyed in the coming greatest financial collapse. (1% will get richer.)

This is the Greatest Depression.

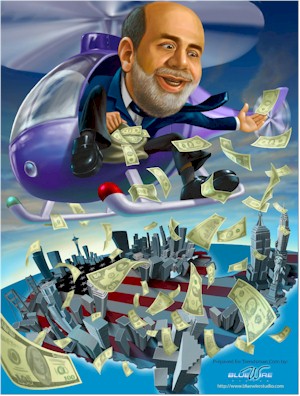

Wall Street at least temporarily relieved of the burden of having to buy Treasuries & Agency bonds, is looking at the jump in oil prices as nothing more than an irritant to their plans for a higher market. Bill Dudley of the NY Fed, a most powerful member, continues to make a vigorous defense of Federal Reserve policies. He, and a few other Fed participants, and Chairman Bernanke believe liquidity is the key for solving problems. That is not only in the realm of debt purchases, but in the relief it brings to Wall Street and banking. It relieves them of the responsibility of having to make those purchases to assist the Fed. Those funds can then be directed toward other investments, such as la liquidity-driven stock market rally. The correlation between the movements in the Fed balance sheet and market can be traced to 85% of market movement for the past 2-1/2 years. An interesting result of Fed manipulative policy is low level of short interest during this period. Most of the professional market players knew the market was headed higher, because they knew such overwhelming liquidity injections would have to take it higher.

They also knew that the Fed had to keep the wealth affect going, because the market was the only generator of wealth left, as the bond market bubble would be broken eventually. The Fed has engineered a market recovery and Wall Street knew what they were up too. QE1 saved the financial community and QE2 saved the government debt structure at least temporarily. The wealth effect has been saved temporarily as well. The public has been left with a pile of crumbs as they struggle for survival. Unemployment has improved ever so slightly and now we have a new problem to increase the suffering and that is much higher oil prices.

Read moreUS Poverty Levels Equal to the 1930s For Some 16 Percent Of The Population

Former Senator And Chairman of the Congressional Oversight Panel Ted Kaufman: ‘TARP Was The Largest Welfare Program For Corporations And Their Investors Ever Created In The History Of Humankind’

Ted Kaufman

On Friday, free and efficient market champion Ted Kaufman, previously known for his stern crusade to rid the world of the HFT scourge, and all other market irregularities which unfortunately will stay with us until the next major market crash (and until the disbanding of the SEC following the terminal realization of its corrupt and utter worthlessness), held a hearing on the impact of the TARP on financial stability, no longer in his former position as a senator, but as Chairman of the Congressional TARP oversight panel. Witness included Simon Johnson, Joseph Stiglitz, Allan Meltzer, William Nelson (Deputy Director of Monetary Affairs, Federal Reserve), Damon Silvers (AFL-CIO Associate General Counsel), and others.

In typical Kaufman fashion, this no-nonsense hearing was one of the most informative and expository of all Wall Street evils to ever take place on the Hill. Which of course is why it received almost no coverage in the media. Below we present a full transcript of the entire hearing, together with select highlights.

The insights proffered by the panelists and the witnesses, while nothing new to those who have carefully followed the generational theft that has been occurring for two and a half years in plain view of everyone and shows no signs of stopping, are truly a MUST READ for virtually every citizen of America and the world: this transcript explains in great detail what absolute crime is, and why it will likely forever go unpunished.

Key highlights from the transcript:

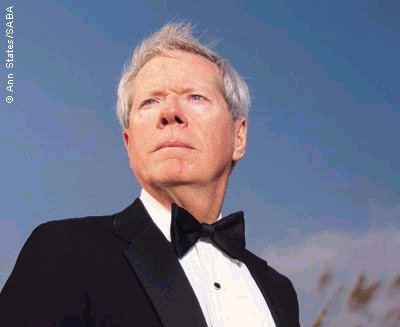

Paul Craig Roberts: The Perfidy Of Government How We Lost Our Economy, The Constitution And Our Civil Liberties

Paul Craig Roberts was Assistant Secretary of the Treasury during President Reagan’s first term. He was Associate Editor of the Wall Street Journal. He has held numerous academic appointments, including the William E. Simon Chair, Center for Strategic and International Studies, Georgetown University, and Senior Research Fellow, Hoover Institution, Stanford University.

This essay is about three recent books that explain how we lost our economy, the Constitution and our civil liberties, and how peace lost out to war.

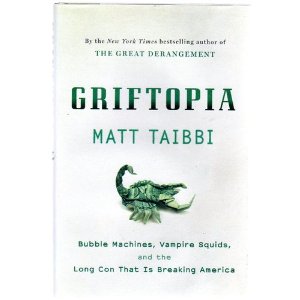

Matt Taibbi is the best–certainly the most entertaining–financial/political reporter in the country. There is no better book than Griftopia (2010) to which to turn to understand how stupidity, greed, and criminality, spread evenly among policymakers and Wall Street, created the financial crisis that has left Americans overburdened with both private and public debt. Taibbi walks the reader through the fraudulent financial instruments that littered the American, British, and European financial communities with toxic waste. He has figured it all out, and what in other hands might be an arcane account for MBAs is in Taibbi’s hands a highly readable and entertaining story.

Amazon.com: Griftopia: Bubble Machines, Vampire Squids, and the Long Con That Is Breaking America

Amazon.de: Griftopia: Bubble Machines, Vampire Squids, and the Long Con That Is Breaking America

For the first 65 pages Taibbi entertains the reader with the inability of the public and politicians to focus on any reality. The financial story begins on page 65 with Fed chairman Alan Greenspan undermining the Glass-Steagall Act leading to its repeal by three political stooges, Gramm-Leach-Bliley. This set the stage for the banksters to leverage debt upon debt until the house of cards collapsed. When Brooksley Born, head of the Commodity Futures Trading Commission, attempted to do her regulatory job and regulate derivatives, the Federal Reserve, Treasury, and Securities and Exchange Commission got her bounced out of office. To make certain that no other regulator could protect the financial system and its participants from what was coming, Congress deregulated the derivatives markets by passing the Commodity Futures Modernization Act.

Will AIG Implosion 2.0 Lead To QE 3.0?

I am sure helicopter Ben can’t wait to nuke the US dollar one last time

There was a time when everyone thought CDOs are perfectly safe. That ended up being a tad incorrect. It resulted in AIG blowing up, recording hundreds of billions in losses and almost taking the rest of the financial world with it, leading ultimately to the first iteration of quantitative easing. A few years thereafter, several blogs and fringe elements suggested that munis are the next major cataclysm and will likely require Fed bail outs (some time before Meredith Whitney came on the public scene with her apocalyptic call). It would be only fitting that the same AIG that blew up the world the first time around, end up being the same company that does so in 2011, and with an instrument that just like back then only an occasional voice warned is a weapon of mass destruction: municipal bonds. AIG dropped over 6% today following some very unpleasasnt disclosures about its muni outlook, and corporate liquidity implications arising therefrom: “American International Group Inc., the bailed-out insurer, said it faces increased risk of losses on its $46.6 billion municipal bond portfolio and that defaults could pressure the company’s liquidity.” So how long before we discover that Goldman has been lifting every AIG CDS for the past quarter? And how much longer after that until someone leaks a document that the company’s muni strategy was orchestrated by one Joe Cassano?

From the Risk Factors section in the company’s just issued 10-K:

Matt Taibbi: Why Isn’t Wall Street in Jail? (Rolling Stone)

Financial crooks brought down the world’s economy — but the feds are doing more to protect them than to prosecute them

Over drinks at a bar on a dreary, snowy night in Washington this past month, a former Senate investigator laughed as he polished off his beer.

“Everything’s fucked up, and nobody goes to jail,” he said. “That’s your whole story right there. Hell, you don’t even have to write the rest of it. Just write that.”

I put down my notebook. “Just that?”

“That’s right,” he said, signaling to the waitress for the check. “Everything’s fucked up, and nobody goes to jail. You can end the piece right there.”

Nobody goes to jail. This is the mantra of the financial-crisis era, one that saw virtually every major bank and financial company on Wall Street embroiled in obscene criminal scandals that impoverished millions and collectively destroyed hundreds of billions, in fact, trillions of dollars of the world’s wealth — and nobody went to jail. Nobody, that is, except Bernie Madoff, a flamboyant and pathological celebrity con artist, whose victims happened to be other rich and famous people.

This article appears in the March 3, 2011 issue of Rolling Stone. The issue is available now on newsstands and will appear in the online archive February 18.

The rest of them, all of them, got off. Not a single executive who ran the companies that cooked up and cashed in on the phony financial boom — an industrywide scam that involved the mass sale of mismarked, fraudulent mortgage-backed securities — has ever been convicted. Their names by now are familiar to even the most casual Middle American news consumer: companies like AIG, Goldman Sachs, Lehman Brothers, JP Morgan Chase, Bank of America and Morgan Stanley. Most of these firms were directly involved in elaborate fraud and theft. Lehman Brothers hid billions in loans from its investors. Bank of America lied about billions in bonuses. Goldman Sachs failed to tell clients how it put together the born-to-lose toxic mortgage deals it was selling. What’s more, many of these companies had corporate chieftains whose actions cost investors billions — from AIG derivatives chief Joe Cassano, who assured investors they would not lose even “one dollar” just months before his unit imploded, to the $263 million in compensation that former Lehman chief Dick “The Gorilla” Fuld conveniently failed to disclose. Yet not one of them has faced time behind bars.

Instead, federal regulators and prosecutors have let the banks and finance companies that tried to burn the world economy to the ground get off with carefully orchestrated settlements — whitewash jobs that involve the firms paying pathetically small fines without even being required to admit wrongdoing. To add insult to injury, the people who actually committed the crimes almost never pay the fines themselves; banks caught defrauding their shareholders often use shareholder money to foot the tab of justice. “If the allegations in these settlements are true,” says Jed Rakoff, a federal judge in the Southern District of New York, “it’s management buying its way off cheap, from the pockets of their victims.”

To understand the significance of this, one has to think carefully about the efficacy of fines as a punishment for a defendant pool that includes the richest people on earth — people who simply get their companies to pay their fines for them. Conversely, one has to consider the powerful deterrent to further wrongdoing that the state is missing by not introducing this particular class of people to the experience of incarceration. “You put Lloyd Blankfein in pound-me-in-the-ass prison for one six-month term, and all this bullshit would stop, all over Wall Street,” says a former congressional aide. “That’s all it would take. Just once.”

But that hasn’t happened. Because the entire system set up to monitor and regulate Wall Street is fucked up.

Just ask the people who tried to do the right thing.

Read moreMatt Taibbi: Why Isn’t Wall Street in Jail? (Rolling Stone)

Quotes From Former Treasury Secretary Henry Paulson’s Memoir of The Financial Crisis, On The Brink

Make no mistake, the financial crisis has only just begun.

This is The Greatest Depression.

Paulson on Paulson

A friend sent me a collage of quotes from former Treasury Secretary Henry Paulson’s memoir of the financial crisis, On the Brink. The quotes are particularly relevant in view of the Financial Crisis Inquiry Commission’s newly issued report which concludes that the 2008 financial crisis was badly mishandled by the government.

The collage paints a stunning picture of a confused and panicked government without a coherent strategy for getting in front of and containing the crisis. Judge for yourself:

“I misread the cause, and the scale, of the coming disaster. Notably absent from my presentation was any mention of problems in housing or mortgages.” (p. 47)

“All of this led me in late April 2007 to say . . . that subprime mortgage problems were ‘largely contained.’ I repeated that line of thinking publicly for another couple of months. . . . We were just plain wrong.” (p. 66)

“Lehman’s UK bankruptcy administrator, PricewaterhouseCoopers, had frozen [Lehman’s] assets in the UK . . . a completely unexpected . . . jolt.” (p. 230)

“General Electric . . . was having problems selling commercial paper. This stunned me.” (p. 172)

“I’d never expected to hear those troubles spreading like this to the corporate world. . . .” (p. 227)

“In a celebratory mood, [Rep.] Pelosi, [Sen.] Reid, [Sen.] Dodd, [Rep.] Frank, [Sen.] Schumer, and I walked together to Statuary Hall to announce the [TARP] deal. . . . Perhaps I should have foreseen the problems ahead . . . .” (p. 314)

“I expected [TARP] to be politically unpopular, but the intensity of the backlash astonished me.” (p. 370)

“I began to seriously doubt that our asset-buying program [TARP] could work. This pained me, as I had sincerely promoted the [toxic asset] purchases to Congress and the public. . . .” (p. 385)

Bank Bailouts Explained (Must-See!!!)

Added: 28. January 2011

Goldman Sachs Banksters Got Billions From AIG For Its Own Account, Crisis Panel Finds

See also:

– Another Windfall for Goldman Secret Partners

More info on the criminal Goldman Sachs banksters at the end of the following article.

That is what Goldman Sachs CEO Blankfein calls ‘doing God’s work‘.

Goldman Sachs collected $2.9 billion from the American International Group as payout on a speculative trade it placed for the benefit of its own account, receiving the bulk of those funds after AIG received an enormous taxpayer rescue, according to the final report of an investigative panel appointed by Congress.

The fact that a significant slice of the proceeds secured by Goldman through the AIG bailout landed in its own account–as opposed to those of its clients or business partners– has not been previously disclosed. These details about the workings of the controversial AIG bailout, which eventually swelled to $182 billion, are among the more eye-catching revelations in the report to be released Thursday by the bipartisan Financial Crisis Inquiry Commission.

The details underscore the degree to which Goldman–the most profitable securities firm in Wall Street history–benefited directly from the massive emergency bailout of the nation’s financial system, a deal crafted on the watch of then-Treasury Secretary Henry Paulson, who had previously headed the bank.

“If these allegations are correct, it appears to have been a direct transfer of wealth from the Treasury to Goldman’s shareholders,” said Joshua Rosner, a bond analyst and managing director at independent research consultancy Graham Fisher & Co., after he was read the relevant section of the report. “The AIG counterparty bailout, which was spun as necessary to protect the public, seems to have protected the institution at the expense of the public.”

Read moreGoldman Sachs Banksters Got Billions From AIG For Its Own Account, Crisis Panel Finds

The Dylan Ratigan Show with Prof. William Black: ‘Fire Holder, Fire Geithner, Fire Bernanke’

Complete administrations should have been fired a long time ago:

– Elite Puppet President Obama Exposed

Even firing complete administrations would not solve the problem, because they are all only puppets of the elitists that OWN governments (all big parties), the Federal Reserve, other central banks, the big corporations and the mass media worldwide.

Added: 25. October 2010

The fraudulent CEOs looted with impunity, were left in power, and were granted their fondest wish when Congress, at the behest of the Chamber of Commerce, Chairman Bernanke, and the bankers’ trade associations, successfully extorted the professional Financial Accounting Standards Board (FASB) to turn the accounting rules into a farce.

The FASB’s new rules allowed the banks (and the Fed, which has taken over a trillion dollars in toxic mortgages as wholly inadequate collateral) to refuse to recognize hundreds of billions of dollars of losses. This accounting scam produces enormous fictional “income” and “capital” at the banks.

The fictional income produces real bonuses to the CEOs that make them even wealthier. The fictional bank capital allows the regulators to evade their statutory duties under the Prompt Corrective Action (PCA) law to close the insolvent and failing banks.

See also:

– Prof. William Black: Timothy Geithner ‘Burned Billions,’ Shafted Taxpayers on CIT Loan

Goldman Sachs Reveals That Bailout Cash Went Overseas

Goldman Sachs received a $12.9 billion payout from the government’s bailout of AIG, which was at one time the world’s largest insurance company.

Goldman Sachs sent $4.3 billion in federal tax money to 32 entities, including many overseas banks, hedge funds and pensions, according to information made public Friday night.

Goldman Sachs disclosed the list of companies to the Senate Finance Committee after a threat of subpoena from Sen. Chuck Grassley, R-Ia.

Asked the significance of the list, Grassley said, “I hope it’s as simple as taxpayers deserve to know what happened to their money.”

He added, “We thought originally we were bailing out AIG. Then later on … we learned that the money flowed through AIG to a few big banks, and now we know that the money went from these few big banks to dozens of financial institutions all around the world.”

Read moreGoldman Sachs Reveals That Bailout Cash Went Overseas

US drops criminal probe of AIG executives

Totally absurd!

The logo of American International Group Inc. (AIG) on the outside of their corporate headquarters in New York (Reuters)

NEW YORK (Reuters) – The U.S. Justice Department has dropped a probe of American International Group Inc executives involving the credit default swaps that sent the insurer to the brink of bankruptcy and forced a huge taxpayer bailout, lawyers for the executives said on Saturday.

The investigation had centered on AIG Financial Products, which nearly brought down the giant insurer after writing tens of billions of dollars on insurance-like contracts on complex securities backed by mortgages that turned out to be toxic.

The U.S. government stepped in with a $182 billion bailout to avert a bankruptcy filing by AIG.

The criminal probe had focused on whether Joseph Cassano, who ran the financial products unit, and Andrew Forster, his deputy, knowingly misled investors about the company’s accounting losses on its credit default swaps portfolio.

“Although a 2-year, intense investigation is tough for anyone, the results are wholly appropriate in light of our client’s factual innocence,” F. Joseph Warin and Jim Walden, Cassano’s lawyers, said in a statement.

Forster’s lawyers also confirmed the probe had been dropped.

TARP Watchdog Barofsky Says Criminal Charges Possible For New York Fed Over AIG Coverup

Neil Barofsky, special inspector general for the Troubled Asset Relief Program (TARP), testifies at a House Oversight and Government Reform Committee hearing on preventing home foreclosures in Washington, D.C. (Bloomberg)

– Barofsky Says Criminal Charges Possible in Alleged AIG Coverup (Boomberg):

Janet Tavakoli, founder of Chicago-based Tavakoli Structured Finance Inc., says Barofsky hasn’t been aggressive enough. She says SIGTARP should be running criminal probes of the bankers who underwrote and managed the collateralized debt obligations that were at the center of the financial meltdown.

CDOs are bundles of mortgage-backed bonds and other debt sold to investors.

Tavakoli says the CDO managers sometimes replaced relatively high-quality securities with new ones that were more likely to default.

‘Phony Labels’

“It is securities fraud if you take securities and package them and knowingly pass them off with phony labels,” she says.

…

TARP Police

Barofsky says investigations related to the underwriting and sale of CDOs are ongoing.

Barofsky says the question of whether the New York Fed engaged in a coverup will result in some sort of action.

“We’re either going to have criminal or civil charges against individuals or we’re going to have a report,” Barofsky says. “This is too important for us not to share our findings.”

He won’t say whether the investigation is targeting Geithner personally.

WHOA: TARP Watchdog Says Criminal Charges May Be On the Table For New York Fed Over AIG Coverup

Neil Barofsky, The Special Inspector General for TARP oversight, better known as SIGTARP, says criminal or civil charges are still on the table in the AIG coverup, according to a long profile at Bloomberg.

In the eye-opening piece, Barofsky talks about how he got a crappy basement office in the Treasury building and likens its foul smell to relations between the Treasury department and himself.

Since Barofsky’s job is to watchover TARP funds and how they’re used. it should come as no surprise that when $700 billion is on the line, funds are bound to be misappropriated.

So what’s the essence of Barofsky’s beef? A few things:

- “Barofsky’s most recent broadside came on April 20, when a SIGTARP report labeled a housing-loan modification program funded with $50 billion of TARP money as ineffectual.”

- He has also criticized Tim Geithner in reports for his handling of the AIG bailout back when he was Chair of the NY Fed.

- Mortgage deals involving CDOs similar to the ABACUS deal.

- How both Obama and Bush handled the financial crisis.

Read moreTARP Watchdog Barofsky Says Criminal Charges Possible For New York Fed Over AIG Coverup