A dozen senior bankers whose influence has shaped the financial world gave themselves pay awards valued at more than £1bn before the credit crunch spectacularly exposed the fragility of the profits they appeared to have secured for shareholders.

Although seemingly profitable during the boom, these same banks have since revealed losses, write-downs and emergency capital injections totalling more than £300bn.

In Britain, they include Barclays executives John Varley and Bob Diamond, who between them took more than £50m of awards in the past four years.

But the biggest winners were on Wall Street where Stan O’Neal – who was pushed out of Merrill Lynch in 2007 after shock losses from sub-prime mortgage investments made him one of the first high-profile casualties of the crisis – received pay, bonuses, stock and options totalling $279m (£196m) for less than nine years’ service. This is the highest amount for any Wall St executive in the Guardian’s study.

The figures are based on annual proxy statement filings in the case of US bank executives. These include a projection by the banks of the likely future value of stock and option awards. If such awards have not been cashed in they will have depreciated in value along with relevant bank share prices. Data for UK bank directors only values share-based awards that have been cashed in and therefore makes comparisons difficult.

The US bankers include Dick Fuld who presided over the collapse of Lehman Brothers – the world’s biggest ever corporate failure, which sent shockwaves throughout the global banking system last September. Fuld received annual awards totalling $191m from 1999 to 2007. The tally includes stock and options valued at the time at $111m.

Jimmy Cayne, the long-serving boss of Bear Stearns, also makes the list. Cayne received pay awards valued at $233m before Bear Stearns became the first big Wall Street investment bank to effectively fail, when it was forced to seek an emergency Federal Reserve loan in March last year.

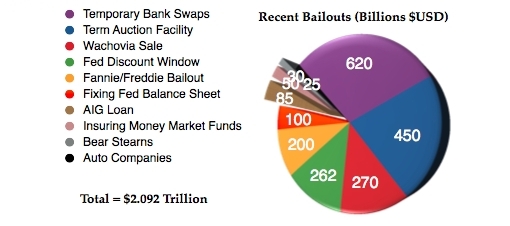

Former US treasury secretary Hank Paulson, charged by George Bush with marshalling the $700bn taxpayer bailout efforts, had been another central Wall St figure – chairman and chief executive of Goldman Sachs – until joining the US government three years ago. Paulson’s taxpayer-funded troubled assets relief programme is in the process of handing out tens of billions of dollars each to firms including Goldmans, Morgan Stanley and Citigroup. Paulson’s pay awards from Goldmans totalled $170m over eight years.

His successor Lloyd Blankfein took home $231m over eight years. Fellow Goldman executive and later Merrill Lynch boss John Thain received $94.9m over six years, while Citigroup boss Sandy Weill and his successor Chuck Prince received $173m and $110m respectively over seven years.

Britain’s top five banks made two-year pre-tax profits of £76bn for 2006 and 2007 after credit and housing boom years combined with ever more exotic financial instruments to push their earning power to unprecedented heights.

Wednesday 28 January 2009

Simon Bowers

Source: The Guardian