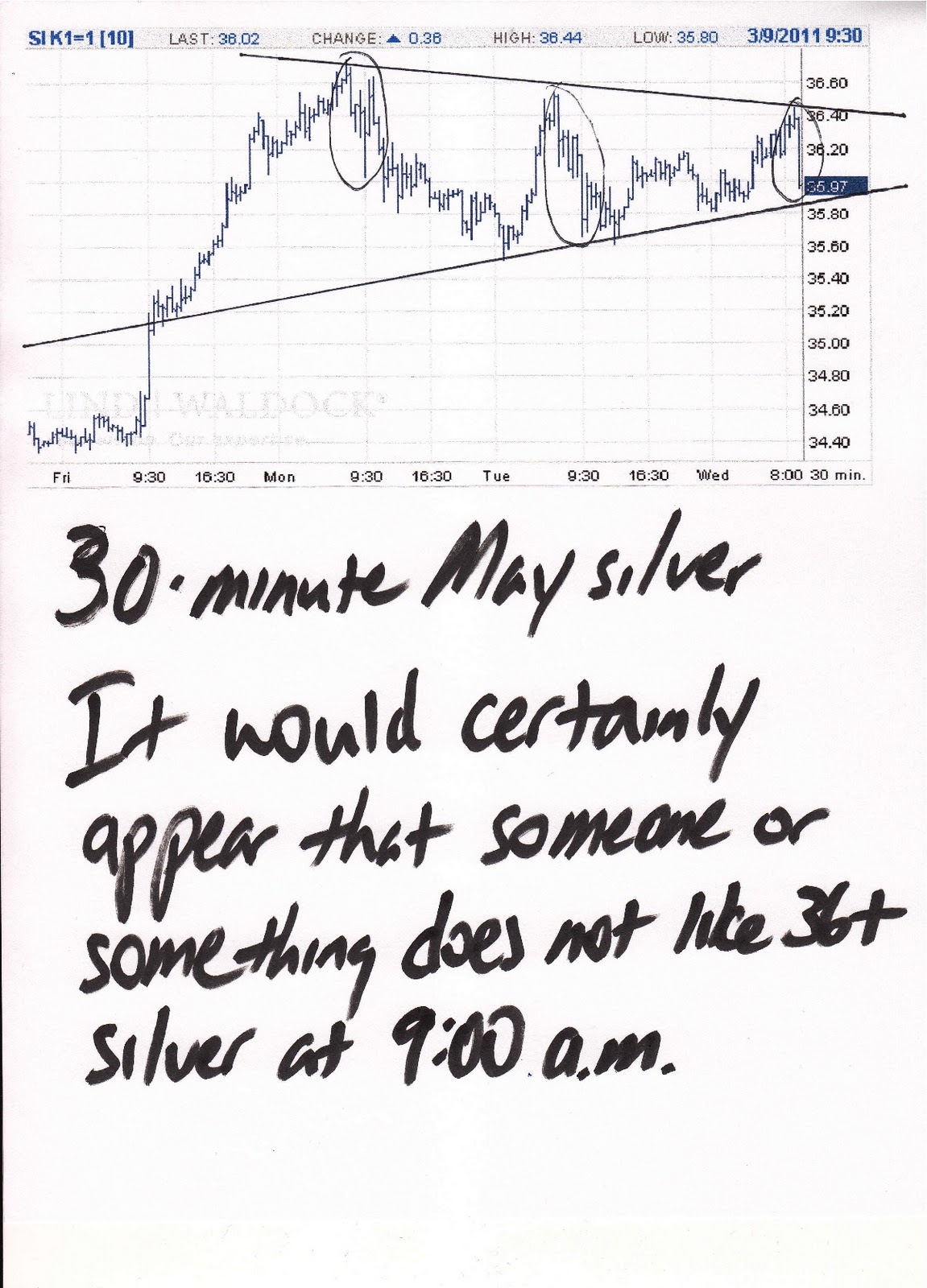

Each day this week, silver has been hammered down at approximately 9:00 am EST. Now, we all know that this isn’t atypical…the EE have been doing this for years and we did see copper sell off at roughly the same time. However, several readers have brought to my attention the little nugget below and I think it requires your serious consideration.

(Click on image to enlarge.)

First things first, here’s a 15-minute May silver chart to peruse. Keep in mind that today’s smackdown was in the face of ongoing strength in gold and crude, so, silver acted somewhat independently.

“WB: JPM is in worse shape then we ever dared to hope 20-Nov-10 07:06 am

Blythe,

This is what I am now hearing from traders on the floor. These traders are not even sure if Blythe knows the full extent of JPM’s silver exposure.

When I first started to realize that JPM has shorted far more silver than they could ever hope to cover, my first question was “why would they do that?” Not only that, why do it with a commodity where you must report your positions through the COT and Bank Participation Report? After all,the whole world can see what you are doing. [my added comment: Ted Butler included!]

Now I know the answer. According to Max Keiser and now a couple of other independent sources, it seems the reasons why first Bear Stearns and now JPM are so desperate to manipulate the price of silver down is due to the fact that BS and JPM shorted billions (yes billions not millions) in ounces of silver through their derivatives.

Just like Joe Conason at AIG, silver shorting through derivatives have caused literally billions in losses not the millions that we know about publicly. That is why JPM has been so desperate to manipulate the price of silver downward so blatantly. If I am right about this, then JPM will be dead when silver hits $60 or so. Based upon the COT and BPR, if silver hits $60, JPM will lose around an additional $6 billion dollars, a large number but not nearly large enough to bring down mighty JPM.

But what is not known is that due to the way that its derivatives are written, JPM’s losses are exponentional once silver breaks $36 or so. Rumors has it that JPM could be losing as much as $40 billion once silver is above $50. It has something to do with how the derivatives are written with payment tied to the price of silver.

Since JPM was a price manipulator with respectt to the price of silver, JPM assumed that any derivative payments tied to silver would be less than they would be tied to some other index like the CPI or TIPS implied inflation index. JPM’s inability to hold down the price of silver relative to other measures of inflation will cause unbelievable losses due to a mismatch in their derivative structures.

In essence,JPM has bet (a huge amount)through derivatives that silver will never outperform inflation. And why not,since JPM assumed that it will always be able to manipulate the price of silver. We have now come to understand that JPM’s loss exposure to silver is much greater than we have ever dared to hope.

WB: In an effort to clear up some recent confusion regarding my latest posting, I will try to explain what I have recently uncovered.JPM’s current short silver position is estimated to be approximately 150 million ounces down from the recent 180 million ounces in August. The losses from these positions are easy to figure out. For every $10 rise in the price of silver, JPM will lose $1.5 billion. But what I have recently discovered is that through its derivative positions, JPM will lose about 5 times that amount ounce the price of silver is above $36. And ounce silver is above $45 dollars, JPM’s losses will increase to 8 times the amount of losses in their short positions. The reason is that as the price of silver increases, certain provisions get activated which multiplies the losses.

One reader asks the question why isnt the price of JPM going down to reflect the lossesd in silver. My answer is that the price of silver is not high enough to begin to trigger losses in their derivative positions. But once silver approaches this critical level say around $36, then you should begin to see the price of JPM stock begin to reflect these losses.

In fact, traders are saying that once the price of silver surpasses the stock price of JPM, then for every dollar the price of silver go up, JPM should lose around 70 cents or so. This means that if silver hits $60, JPM will be a single digit stock.

JPM market cap is around $170 billion. If silver losses are as great as $40 billion in cash , then JPM will be insolvent. Period.

From your former traders (whom you dismissed so callously)”

Look, I still have absolutely no idea if this whole “WB Group” thing is real or imagined. There are, though, a lot of coincidences and in a rigged and manipulated “market” such as silver, the old phrase about “there are no coincidences” certainly rings true.

Wednesday, March 9, 2011

Full article here: Along The Watchtower

Only physical gold and silver are real, everything else is an illusion.

– Exposed: The iShares Silver Trust (SLV) Scam

More on gold and silver:

Silver:

– Chinese Silver Investors Bring Suitcases of Cash and Leave in Moving Vans

– The Constraints on Silver Supply: Bob Quartermain

– Physical Silver (PSLV) Premium To NAV Surges To Record High

– JP Morgan And HSBC Silver Manipulation Explained In The New York Times!

– Louise Yamada: $80 Silver, $2,000 Gold and $140 Oil

– John Hathaway: $50 to $60 Silver, US Dollar in Danger

– Why Silver Is Headed To $500 Per Oz – Backwardation Explained

– CNBC: Total Silver Demand At 127% ! – The Case For $130 Silver

– Dollar Ready to Collapse, Silver Squeeze to Continue

– Even The Royal Canadian Mint Now Says It’s Difficult To Secure Silver

– Unprecedented: Silver Backwardation Surges To Over $1.00

– Eric Sprott on Silver: ‘THERE IS NOTHING LEFT’

– Fractal Analysis Suggests Silver to Reach $52 – $56 by May – June 2011

– Short Squeeze in Silver, Manipulators Getting Overrun

– Silver Takes Out Hunt Brothers High … When Priced In Euros

– Silver Backwardation Now ‘Unprecedented 73 Cents’

– Short Squeeze Takes Silver To Fresh 31 Year High

– Silver: Short Squeeze Could Be the Big One – Reaches New Multi-Decade High – Still In Backwardation

– Massive Short Squeeze in Silver, Gold to Hit New Highs

– London Source: Asians Buying SLV to Take Delivery of Silver

– COMEX Silver Inventories Drop To 4 Year Low. COMEX Default Or Hunt Brothers Redux?

– This Past Week in Gold and Silver

– ‘US Silver Term Structure Inverts As Supply Tightens’ – Reuters Article On Silver Backwardation

– JP Morgan Silver Manipulation Explained (Part 1-4)

– Silver Bullion Backwardation Suggests Supply Stress

– Silver Lease Rates Rise Sharply – Bond Yields in Portugal Rise to Record

– Perth Mint Has Run Out of 100 Ounce SILVER Bars for at least 6 Weeks!!!

– Silver Breaks Its Golden Shackles And More Signs of Silver Shortages

– $6,000 Silver and the ONE BANK

– Canada’s Biggest Bullion Bank Scotia Mocatta: ALL SILVER BARS SOLD OUT

– Eric Sprott: Expect $50 Silver, Gold Possibly $2,150 by Spring

– US Mint Reports Unprecedented Buying Spree Of Physical Silver

– BullionVault.com Runs Out Of Silver In Germany

– Silver: Shortage This Decade, Will Be Worth More Than Gold (!!!)

– Silver Derivatives – China and JP Morgan

– Max Keiser: Want JP Morgan to Crash? Buy Silver!

– Max Keiser: Crash JP Morgan – Buy Silver!

– JPMorgan Silver Manipulation Explained (Must-See!)

Gold:

Gold:

– The Driver For Gold (Almost) Nobody Is Watching

– Forget $8,000, Gold Headed Much Higher, Dow To Lose 90% Vs Gold

– Pay Taxes In Gold? Obama Golf, We Buy Gold!

– Chief Investment Strategist John Embry: Gold to $1,650, Shorts to Get Crushed

– Gold Buying in China Jumps as Inflation Flares, Boosting Demand: UBS

– Probable Black Swan Event Equals Gold Explosion

– Richard Russell: Possibility of Gold Breaking to New Highs

– Brazilian Billionaire Eike Batista Reaffirms $1 Billion Bid for Ventana Gold

– Americans Will Flock Into $5,000 Gold and $500 Silver

– ‘GoldNomics’: Cash or Gold Bullion?

– George Soros’ and John Paulson’s Biggest Holding Is GOLD

– China, Russia, Iran are Dumping the Dollar, Buy Gold And Silver

– Gold and Gold Mining Shares As a Percentage of Global Assets or ‘The Once In a Lifetime Ride’

And don’t forget to do this (!!!)…

– James G. Rickards of Omnis Inc.: Get Your Gold Out Of The Banking System

… or …

Related information:

– The Dollar Collapse Will Shock the World

– Marc Faber: ‘I Think We Are All Doomed’

– The Market Is Telling Us That The US Dollar Is Finished

– Tungsten Outperforms Gold, Returns 70 Percent In Last Year (And we all know exactly why!)

– Alert: Get Out of Your Dollar Assets Now!!!

– The Ultimate Cost of 0% Money

– These Central Banks Are Printing Money – Prepare Yourself

– Quantitative Easing Explained

Summary: