Source: deviantArt

Month: December 2009

US military accused of executing 10 Afghan civilians, including children

Still think that such an atrocity – reported by the Times – is impossible?:

The report into the deaths has provoked demonstrations (Reuters)

American-led troops were accused yesterday of dragging innocent children from their beds and shooting them during a night raid that left ten people dead.

Afghan government investigators said that eight schoolchildren were killed, all but one of them from the same family. Locals said that some victims were handcuffed before being killed.

Western military sources said that the dead were all part of an Afghan terrorist cell responsible for manufacturing improvised explosive devices (IEDs), which have claimed the lives of countless soldiers and civilians.

“This was a joint operation that was conducted against an IED cell that Afghan and US officials had been developing information against for some time,” said a senior Nato insider. But he admitted that “the facts about what actually went down are in dispute”.

The allegations of civilian casualties led to protests in Kabul and Jalalabad, with children as young as 10 chanting “Death to America” and demanding that foreign forces should leave Afghanistan at once.

President Karzai sent a team of investigators to Narang district, in eastern Kunar province, after reports of a massacre first surfaced on Monday.

“The delegation concluded that a unit of international forces descended from a plane Sunday night into Ghazi Khan village in Narang district of the eastern province of Kunar and took ten people from three homes, eight of them school students in grades six, nine and ten, one of them a guest, the rest from the same family, and shot them dead,” a statement on President Karzai’s website said.

Assadullah Wafa, who led the investigation, said that US soldiers flew to Kunar from Kabul, suggesting that they were part of a special forces unit.

“At around 1 am, three nights ago, some American troops with helicopters left Kabul and landed around 2km away from the village,” he told The Times. “The troops walked from the helicopters to the houses and, according to my investigation, they gathered all the students from two rooms, into one room, and opened fire.” Mr Wafa, a former governor of Helmand province, met President Karzai to discuss his findings yesterday. “I spoke to the local headmaster,” he said. “It’s impossible they were al-Qaeda. They were children, they were civilians, they were innocent. I condemn this attack.”

In a telephone interview last night, the headmaster said that the victims were asleep in three rooms when the troops arrived. “Seven students were in one room,” said Rahman Jan Ehsas. “A student and one guest were in another room, a guest room, and a farmer was asleep with his wife in a third building.

“First the foreign troops entered the guest room and shot two of them. Then they entered another room and handcuffed the seven students. Then they killed them. Abdul Khaliq [the farmer] heard shooting and came outside. When they saw him they shot him as well. He was outside. That’s why his wife wasn’t killed.”

A local elder, Jan Mohammed, said that three boys were killed in one room and five were handcuffed before they were shot. “I saw their school books covered in blood,” he said.

The investigation found that eight of the victims were aged from 11 to 17. The guest was a shepherd boy, 12, called Samar Gul, the headmaster said. He said that six of the students were at high school and two were at primary school. He said that all the students were his nephews. In Jalalabad, protesters set alight a US flag and an effigy of President Obama after chanting “Death to Obama” and “Death to foreign forces”. In Kabul, protesters held up banners showing photographs of dead children alongside placards demanding “Foreign troops leave Afghanistan” and “Stop killing us”.

Read moreUS military accused of executing 10 Afghan civilians, including children

US government wants farmers to use coal waste on fields

Remember?

– Obama administration refuses to disclose “high hazard” coal dump locations:

A rift has opened between the Obama administration and some of its closest allies – Democratic leaders and environmental organisations – over its refusal to publicly disclose the location of 44 coal ash dumps that have been officially designated as a “high hazard” to local populations.

The administration turned down a request from a powerful Democratic senator to make public the list of 44 dumps, which contain a toxic soup of arsenic and heavy metals from coal-fired electricity plants, citing terrorism fears.

The federal government is encouraging farmers to spread a chalky waste from coal-fired power plants on their fields to loosen and fertilize soil even as it considers regulating coal wastes for the first time.

The material is produced by power plant “scrubbers” that remove acid-rain-causing sulfur dioxide from plant emissions. A synthetic form of the mineral gypsum, it also contains mercury, arsenic, lead and other heavy metals.

The Environmental Protection Agency says those toxic metals occur in only tiny amounts that pose no threat to crops, surface water or people. But some environmentalists say too little is known about how the material affects crops, and ultimately human health, for the government to suggest that farmers use it.

“This is a leap into the unknown,” said Jeff Ruch, executive director of Public Employees for Environmental Responsibility. “This stuff has materials in it that we’re trying to prevent entering the environment from coal-fired power plants, and then to turn around and smear it across ag lands raises some real questions.”

Read moreUS government wants farmers to use coal waste on fields

DHS Threatens Blogger Who Posted New TSA Screening Directive

TSA Special Agent John Enright, left, speaks to Steven Frischling outside the blogger’s home in Niantic, Connecticut, after returning Frischling’s laptop Wednesday.

Photo: Thomas Cain/Wired.com

Special agents from the TSA’s Office of Inspection interrogated two U.S. bloggers, one of them an established travel columnist, and served them each with a civil subpoena demanding information on the anonymous source that provided the TSA document.

The document, which the two bloggers published within minutes of each other Dec. 27, was sent by TSA to airlines and airports around the world and described temporary new requirements for screening passengers through Dec. 30, including conducting “pat-downs” of legs and torsos. The document, which was not classified, was posted by numerous bloggers. Information from it was also published on some airline websites.

“They’re saying it’s a security document but it was sent to every airport and airline,” says Steven Frischling, one of the bloggers. “It was sent to Islamabad, to Riyadh and to Nigeria. So they’re looking for information about a security document sent to 10,000-plus people internationally. You can’t have a right to expect privacy after that.”

Transportation Security Administration spokeswoman Suzanne Trevino said in a statement that security directives “are not for public disclosure.”

“TSA’s Office of Inspections is currently investigating how the recent Security Directives were acquired and published by parties who should not have been privy to this information,” the statement said.

Frischling, a freelance travel writer and photographer in Connecticut who writes a blog for the KLM Royal Dutch Airlines, said the two agents who visited him arrived around 7 p.m. Tuesday, were armed and threatened him with a criminal search warrant if he didn’t provide the name of his source. They also threatened to get him fired from his KLM job and indicated they could get him designated a security risk, which would make it difficult for him to travel and do his job.

“They were indicating there would be significant ramifications if I didn’t cooperate,” said Frischling, who was home alone with his three children when the agents arrived. “It’s not hard to intimidate someone when they’re holding a 3-year-old [child] in their hands. My wife works at night. I go to jail, and my kids are here with nobody.”

Frischling, who described some of the details of the visit on his personal blog, told Threat Level that the two agents drove to his house in Connecticut from DHS offices in Massachusetts and New Jersey and didn’t mention a subpoena until an hour into their visit.

Read moreDHS Threatens Blogger Who Posted New TSA Screening Directive

Goldman Sachs: Investors Could Only Lose in Offshore Deals

NEW YORK — When financial titan Goldman Sachs joined some of its Wall Street rivals in late 2005 in secretly packaging a new breed of offshore securities, it gave prospective investors little hint that many of the deals were so risky that they could end up losing hundreds of millions of dollars on them.

McClatchy has obtained previously undisclosed documents that provide a closer look at the shadowy $1.3 trillion market since 2002 for complex offshore deals, which Chicago financial consultant and frequent Goldman critic Janet Tavakoli said at times met “every definition of a Ponzi scheme.”

The documents include the offering circulars for 40 of Goldman’s estimated 148 deals in the Cayman Islands over a seven-year period, including a dozen of its more exotic transactions tied to mortgages and consumer loans that it marketed in 2006 and 2007, at the crest of the booming market for subprime mortgages to marginally qualified borrowers.

In some of these transactions, investors not only bought shaky securities backed by residential mortgages, but also took on the role of insurers by agreeing to pay Goldman and others massive sums if risky home loans nose-dived in value — as Goldman was effectively betting they would.

Some of the investors, including foreign banks and even Wall Street giant Merrill Lynch, may have been comforted by the high grades Wall Street ratings agencies had assigned to many of the securities. However, some of the buyers apparently agreed to insure Goldman well after the performance of many offshore deals weakened significantly beginning in June 2006.

Goldman said those investors were fully informed of the risks they were taking.

These Cayman Islands deals, which Goldman assembled through the British territory in the Caribbean, a haven from U.S. taxes and regulation, became key links in a chain of exotic insurance-like bets called credit-default swaps that worsened the global economic collapse by enabling major financial institutions to take bigger and bigger risks without counting them on their balance sheets.

The full cost of the deals, some of which could still blow up on investors, may never be known.

Before the subprime crisis, the U.S. financial system had used securities for 40 years to generate $12 trillion to help Americans finance their houses, cars and college educations, said Gary Kopff, a financial services consultant and the president of Everest Management Inc. in Washington. The offshore deals, he lamented, “became the biggest contributors to the trillions of dollars of losses” in 2008’s global meltdown.

Read moreGoldman Sachs: Investors Could Only Lose in Offshore Deals

Responding to Goldman Sachs Banksters

The New York Times published a Christmas Eve expose of Goldman Sachs’s so-called “Abacus” synthetic collateralized debt obligations (CDOs). They were created with credit derivatives instead of cash securities. Goldman used credit derivatives to create short bets that gain in value when CDOs lose value. Goldman did this for both protection and profit and marketed the idea to hedge funds.

Goldman responded to the New York Times saying many of these deals were the result of demand from investing clients seeking long exposure. In an earlier Huffington Post article, I wrote about Goldman’s key role in the AIG crisis; it traded or originated $33 billion of AIG’s $80 billion CDOs. AIG was long the majority of six of Goldman’s Abacus deals. These value-destroying CDOs were stuffed with BBB-rated (the lowest “investment grade” rating) portions of other deals. These BBB-rated portions were overrated from the start. Many of them eventually exploded like firecrackers.

Goldman said it suffered losses due to the deterioration of the housing market and disclosed $1.7 billion in residential mortgage exposure write-downs in 2008. These losses would have been substantially higher had it not hedged. Goldman describes its activities as prudent risk management. Many Wall Street firms wound up taking losses. The question is, however, how did they manage to get through a couple of bonus cycles without taking accounting losses while showing “profits?”

The answer is that they sold a lot of “hot air” disguised as valuable securities. Goldman claims this was prudent risk management. In reality, Goldman created products that it knew or should have known were overrated and overpriced.

If Wall Street had not manufactured value-destroying securities and related credit derivatives, the money supply for bad loans would have been choked off years earlier. Instead, Wall Street was chiefly responsible for the “financial innovation” that did massive damage to the U.S. economy.

Afghanistan: Suicide bomber ‘kills four CIA agents’ after attacking CIA base, at least 8 Americans killed

– Suicide bomber attacks CIA base in Afghanistan, killing at least 8 Americans (Washington Post):

A suicide bomber infiltrated a CIA base in eastern Afghanistan on Wednesday, killing at least eight Americans in what is believed to be the deadliest single attack on U.S. intelligence personnel in the eight-year-long war and one of the deadliest in the agency’s history, U.S. officials said.

– CIA Officers Are Killed in Afghan Attack (Wall Street Journal)

– CIA workers killed by ‘Afghan soldier’ (BBC News):

Eight Americans working for the CIA have died in a bomb attack in Afghanistan, the worst against US intelligence officials since 1983.

Taleban spokesman Zabiullah Mujahid

A suicide bomber disguised as a Afghan soldier killed eight US civilians inside base used by the CIA and wounded at least six others, officials said, in an audacious attack that marked a bloody end to 2009.

Reports in the Washington Post suggested that at least four of the dead were agents, but the CIA refused to confirm that any of its staff were involved.

Locals said they heard a massive explosion just before dusk yesterday and saw a huge plume of smoke rising from inside the heavily guarded compound, close to the capital of Khost province, in southeastern Afghanistan.

“We heard firing, but that’s normal,” said shopkeeper Mir Wali, 28, who lives around 200 metres from the camp perimeter. “We thought they were practising on the range.

“But then we heard a loud, loud, really loud explosion. I though a rocket had landed on my house. When I came outside to see what had happened there were helicopters flying over the base, patrolling very close to the ground.”

Eyewitnesses said they saw at least three air ambulances – Black Hawk helicopters marked with distinctive red crosses – landing and taking off from inside the compound moments after the attack.

US embassy officials confirmed eight American civilians were killed in the explosion, but the CIA has neither confirmed nor denied whether its staff were involved.

US Congress: Banksters Get $4 Trillion Gift From Barney Frank

Change you can believe in!

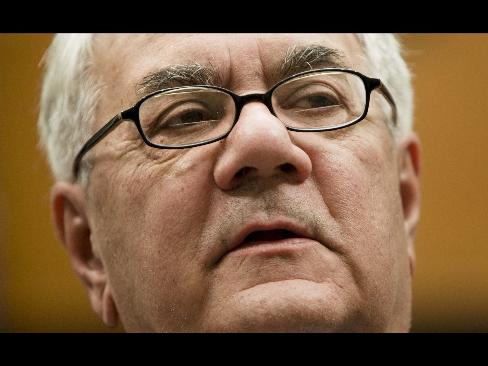

Representative Barney Frank, a Democrat from Massachusetts, speaks during a news conference on Capitol Hill in Washington (Getty Images)

Dec. 30 (Bloomberg) — To close out 2009, I decided to do something I bet no member of Congress has done — actually read from cover to cover one of the pieces of sweeping legislation bouncing around Capitol Hill.

Hunkering down by the fire, I snuggled up with H.R. 4173, the financial-reform legislation passed earlier this month by the House of Representatives. The Senate has yet to pass its own reform plan. The baby of Financial Services Committee Chairman Barney Frank, the House bill is meant to address everything from too-big-to-fail banks to asleep-at-the-switch credit-ratings companies to the protection of consumers from greedy lenders.

I quickly discovered why members of Congress rarely read legislation like this. At 1,279 pages, the “Wall Street Reform and Consumer Protection Act” is a real slog. And yes, I plowed through all those pages. (Memo to Chairman Frank: “ystem” at line 14, page 258 is missing the first “s”.)

The reading was especially painful since this reform sausage is stuffed with more gristle than meat. At least, that is, if you are a taxpayer hoping the bailout train is coming to a halt.

If you’re a banker, the bill is tastier. While banks opposed the legislation, they should cheer for its passage by the full Congress in the New Year: There are huge giveaways insuring the government will again rescue banks and Wall Street if the need arises.

Nuggets Gleaned

Here are some of the nuggets I gleaned from days spent reading Frank’s handiwork:

— For all its heft, the bill doesn’t once mention the words “too-big-to-fail,” the main issue confronting the financial system. Admitting you have a problem, as any 12- stepper knows, is the crucial first step toward recovery.

— Instead, it supports the biggest banks. It authorizes Federal Reserve banks to provide as much as $4 trillion in emergency funding the next time Wall Street crashes. So much for “no-more-bailouts” talk. That is more than twice what the Fed pumped into markets this time around. The size of the fund makes the bribes in the Senate’s health-care bill look minuscule.

— Oh, hold on, the Federal Reserve and Treasury Secretary can’t authorize these funds unless “there is at least a 99 percent likelihood that all funds and interest will be paid back.” Too bad the same models used to foresee the housing meltdown probably will be used to predict this likelihood as well.

More Bailouts

Read moreUS Congress: Banksters Get $4 Trillion Gift From Barney Frank

Goldman Sachs: Betting Against All of Us

“To be thorough, investigations of these and other questions would have to reach into the Obama Treasury Department. One of the most aggressive creators of the questionable investments was a firm called Tricadia, whose parent firm was overseen by Lewis Sachs, now a senior adviser to Treasury Secretary Timothy Geithner.”

See also: Chinese firm says won’t pay Goldman Sachs on options losses!

Doing ‘God’s work‘!

Update: Goldman Sachs denies betting against its clients on CDOs

During the bubble, Goldman Sachs and other financial firms created complicated mortgage-related investments, sold them to clients and then placed bets that those investments would decline in value. The practice, detailed in The Times by Gretchen Morgenson and Louise Story, allowed Wall Street to profit handsomely as its clients tanked. It also amplified the financial meltdown, spreading the losses to pretty much everyone.

These deals are now the targets of various government and industry-led investigations. It may turn out that some or all of the products and practices were not illegal, in part because the derivatives at the heart of the transactions have been largely deregulated since 2000.

There are several outrages here. Despite pledges to rein in the excesses, financial reform legislation is months away from passage. The House-passed bill would impose some controls over derivatives, although it is unclear whether it would stop this particular practice. The Senate has not yet produced a bill. And neither the White House nor Capitol Hill has adequately addressed the bigger question of how to curb the high-risk proprietary trading by banks that has created conflicts with clients and endangered the economy at large.

Meanwhile, Wall Street continues to defend what looks to us as rank financial speculation. The way the wizards explain it, betting against one’s clients is one of many techniques to prudently guard against loss.

Chinese firm says won’t pay Goldman Sachs on options losses!

A small Chinese power generator possesses the impudence to challenge Goldman, who is doing ‘God’s work‘!

Message from China to Goldman Sachs:

BEIJING, Dec 29 (Reuters) – A small Chinese power generator on Tuesday rejected demands from a Goldman Sachs unit to pay for nearly $80 million lost on two oil hedging contracts, part of a long-running dispute over how China deals with derivatives losses.

Goldman Sachs (GS.N) was one of the foreign banks, along with Citigroup (C.N), Merrill Lynch and Morgan Stanley (MS.N), blamed by the state assets watchdog for providing “extremely complicated” and difficult to understand derivatives products. [ID:nPEK242617]

Shenzhen Nanshan Power (000037.SZ) (200037.SZ) said in a statement that it received several notices from J. Aron & Company, a trading subsidiary of Goldman Sachs (GS.N), for at least $79.96 million as compensation for terminating oil option contracts.

“We will not accept the demand by J. Aron for all the losses and related interests,” said Nanshan, in line with the stance it took last December.

“We will try our best to negotiate with J. Aron and resolve the dispute peacefully…but the possibility of using a lawsuit can not be ruled out when talks fail,” it added.

“J. Aron told us in one notice that if we do not pay the money, they will reserve the right to launch a lawsuit and will not send us any further notice.”

The State Assets Supervision and Administration Commission said in September that it would back state-owned companies in any legal action against the foreign banks that sold them oil derivatives, which resulted in losses when oil prices dived late last year. [ID:nPEK14474]

Read moreChinese firm says won’t pay Goldman Sachs on options losses!

Stanford University: Ethanol burns dirtier than gasoline

(NaturalNews) A recent study conducted by researchers at Stanford University has revealed that ethanol fuel produces more ozone that regular gasoline. When ethanol is burned through combustion, it produces emissions that are substantially higher than gasoline in aldehydes, the carcinogenic precursors to ozone.

Much of the fuel dispensed at pumps in America today is a blend of both ethanol and gasoline. E85, a typical gasoline blend that is 85 percent ethanol, was found to emit more ozone pollutants than gasoline, especially during warm, sunny days. Diana Ginnebaugh, a doctoral candidate who worked on the study, explained that even on cold days when ozone is typically not a problem, E85 could result in problematic levels of ozone.

When a car is first started on a cold day, it takes the catalytic converter a few minutes to warm up in order to reach maximum efficiency. During the warmup period, the highest proportion of pollutants escape the car’s tailpipe, resulting in increased pollution. According to Ginnebaugh, even a slight increase in pollutants could cause places like Los Angeles and Denver, cities that already have smog problems, to have significantly more days when ozone limits are exceeded and public health is at risk.

E85 emissions contain several other different pollutants including ones that cause throat and eye irritation and lung problems. Crop damage may also occur from the aldehydes emitted from the burning of ethanol. In the worst-case scenario, E85 was found to potentially add 39 parts per billion more ozone into the air a day than normal gasoline.

Read moreStanford University: Ethanol burns dirtier than gasoline

NCDC: 250 Snowfall Records So Far In 2009; This December Shapes Up to be the Coldest on Record

Total Number of Records for December 25, 2009

(out of 11,209 stations with at least 30 years of data)

New: 250 + Tied: 13 = Total: 263

More here: National Climatic Data Center

December shaping up to be one of the coldest on record in the US

Blizzard hits Christmas travelers in Nebraska and Oklahoma. (AP Photo/Nati Harnik)

It has often been said that “Weather is not climate”, but ultimately it provides the only meaningful way to verify climate models. Did the climate models predict the cold, snowy weather which has been seen across much of the US?

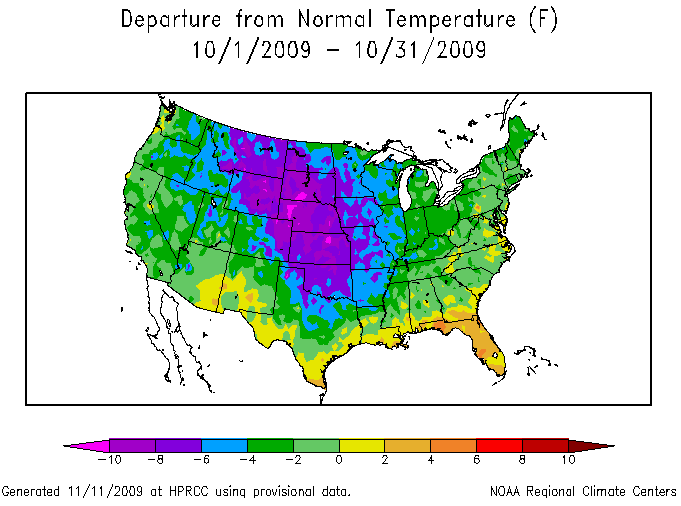

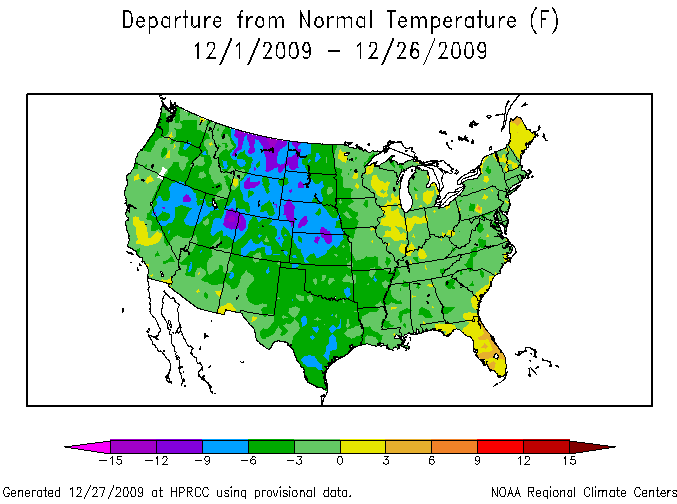

According to NOAA, October was the third coldest on record in the US, with almost every state showing temperatures from one to ten degrees below normal. Some Parts of Colorado received record snowfall during October, starting the first week of the month.

Image from HPRCC – University of Nebraska at Lincoln

With a few days left, it appears that December is headed for a repeat, with temperatures ranging from one to fifteen degrees below normal. (Note that the color scale is different from October, now the greens show more negative departure, even South Texas is at -6F)

Image from HPRCC – University of Nebraska at Lincoln

Temperatures for the rest of the month are forecast by NCEP to be below normal for almost the entire country, so it is unlikely that the map will change much before New Years Day.

The Food Crisis of 2010: USDA vs Reality

Loooong article!

See also:

– The No.1 Trend Forecaster Gerald Celente: The Terror And The Crash of 2010

If you read any economic, financial, or political analysis for 2010 that doesn’t mention the food shortage looming next year, throw it in the trash, as it is worthless. There is overwhelming, undeniable evidence that the world will run out of food next year. When this happens, the resulting triple digit food inflation will lead panicking central banks around the world to dump their foreign reserves to appreciate their currencies and lower the cost of food imports, causing the collapse of the dollar, the treasury market, derivative markets, and the global financial system. The US will experience economic disintegration.

The 2010 Food Crisis Means Financial Armageddon

Over the last two years, the world has faced a series of unprecedented financial crises: the collapse of the housing market, the freezing of the credit markets, the failure of Wall Street brokerage firms (Bear Stearns/Lehman Brothers), the failure of Freddie Mac and Fannie Mae, the failure of AIG, Iceland’s economic collapse, the bankruptcy of the major auto manufacturers (General Motors, Ford, and Chrysler), etc… In the face of all these challenges, the demise of the dollar, derivative markets, and the modern international system of credit has been repeatedly forecasted and feared. However, all these doomsday scenarios have so far been proved false, and, despite tremendous chaos and losses, the global financial system has held together.

The 2010 Food Crisis is different. It is THE CRISIS. The one that makes all doomsday scenarios come true. The government bailouts and central bank interventions, which have held the financial world together during the last two years, will be powerless to prevent the 2010 Food Crisis from bringing the global financial system to its knees.

Financial crisis will kick into high gear

So far the crisis has been driven by the slow and steady increase in defaults on mortgages and other loans. This is about to change. What will drive the financial crisis in 2010 will be panic about food supplies and the dollar’s plunging value. Things will start moving fast.

Dynamics Behind 2010 Food Crisis

Early in 2009, the supply and demand in agricultural markets went badly out of balance. The world experienced a catastrophic fall in food production as a result of the financial crisis (low commodity prices and lack of credit) and adverse weather on a global scale. Meanwhile, China and other Asian exporters, in an effort to preserve their economic growth, were unleashing domestic consumption long constrained by inflation fears, and demand for raw materials, especially food staples, exploded as Chinese consumers worked their way towards American-style overconsumption, prodded on by a flood of cheap credit and easy loans from the government.

Normally food prices should have already shot higher months ago, leading to lower food consumption and bringing the global food supply/demand situation back into balance. This never happened because the United States Department of Agriculture (USDA), instead of adjusting production estimates down to reflect decreased production, adjusted estimates upwards to match increasing demand from china. In this way, the USDA has brought supply and demand back into balance (on paper) and temporarily delayed a rise in food prices by ensuring a catastrophe in 2010.

National Irish Bank moves to cashless banking in all its branches

LOL!

IT MIGHT sound like a contradiction in terms, but for the first time one of the main Irish consumer banks is moving to cashless banking in all its branches.

National Irish Bank has written to thousands of its customers this month informing them of a “new style of banking” in which branches will not handle over-the-counter cash transactions.

The letter says branches will no longer handle cash withdrawals and lodgements, night safe lodgements and foreign currency cash. Branches will continue to lodge cheques, drafts and postal orders and issue drafts.

Customers are advised to obtain cash from “ATMs nationwide” or to seek “cash-back” on their debit cards.

A spokesman confirmed that cashless banking was being introduced across the entire NIB branch network over the next 18 months, and had already been introduced successfully in a number of branches. He said the feedback from customers was positive with few complaints.

“These branches provide better security for staff and allow us to spend more time, in a better setting, with our customers . . . Customers like them, as our staff have more time to discuss customers’ overall needs.”

However, NIB customer Frank Barry from Malahide described the change as hilarious and ridiculous: “A bank refusing to accept cash . . . I thought that’s what they are for?”

Mr Barry contacted The Irish Times after his wife Catherine Gralton received two letters informing her that the local branch would stop handling cash from next February.

“If I did have a cash lodgement, I would have to go to another bank, buy a bank draft and then go to NIB to lodge it,” he said.

Read moreNational Irish Bank moves to cashless banking in all its branches

Vatican declares unique copyright on Papal figure

Hilarious!

Vatican City, Dec 19, 2009 / 12:23 pm (CNA).- The Vatican made a declaration on the protection of the figure of the Pope on Saturday morning. The statement seeks to establish and safeguard the name, image and any symbols of the Pope as being expressly for official use of the Holy See unless otherwise authorized.

The statement cited a “great increase of affection and esteem for the person of the Holy Father” in recent years as contributing to a desire to use the Pontiff’s name for all manner of educational and cultural institutions, civic groups and foundations.

Due to this demand, the Vatican has felt it necessary to declare that “it alone has the right to ensure the respect due to the Successors of Peter, and therefore, to protect the figure and personal identity of the Pope from the unauthorized use of his name and/or the papal coat of arms for ends and activities which have little or nothing to do with the Catholic Church.”

The declaration alludes to attempts to use ecclesiastical or pontifical symbols and logos to “attribute credibility and authority to initiatives” as another reason to establish their “copyright” on the Holy Father’s name, picture and coat of arms.

“Consequently, the use of anything referring directly to the person or office of the Supreme Pontiff… and/or the use of the title ‘Pontifical,’ must receive previous and express authorization from the Holy See,” concluded the message released to the press.

Source: Catholic News Agency

The No.1 Trend Forecaster Gerald Celente: The Terror And The Crash of 2010

Listen AMERICA! Listen WORLD! Listen!!!

Stop listening to elite puppets like Obama, Bernanke and Geithner or you are doomed!!!

1 of 2:

2 of 2:

All US-bound passengers to face full body search

Security chiefs last night threw a ring of steel around every airport serving America – amid growing fears of a new al-Qaeda onslaught.

And experts warn all US-bound passengers could face full body searches in a bid to thwart future bomb outrages.

Body-searches have already been introduced at Amsterdam’s Schiphol airport following a plea from American officials.

Judith Sluiter, a spokeswoman for the Dutch National Co-ordinator for Counter-terrorism, said: “The extra measures apply on all flights to the US for an indefinite period.”

Schiphol is one of Europe’s busiest airports with a heavy load of transit passengers from Africa and Asia to North America.

It strictly enforces EU security rules that only allow small amounts of liquid in hand-luggage if it is in a clear plastic container.

Scanners Bosses at Schiphol have spent the past year testing full-body scanners that allow security staff to see the outline of a passenger’s body beneath their clothes.

Sen. Joe Lieberman: Yemen will be ‘tomorrow’s war’ if pre-emptive action not taken

Don’t you love the Bush doctrine of preemptive war?

– War President Obama Ordered U.S. Military Strike on Yemen Terrorists

Preemptive action to root out al-Qaeda? Sure!:

BBC now admits al-Qaeda never existed

– Rep. Dennis Kucinich: US War Presidents ignore Congress and Constitution

Sen. Joe Lieberman (I-Conn.) Sunday said that Yemen could be the ground of America’s next overseas war if Washington does not take preemptive action to root out al-Qaeda interests there.

Lieberman, who helms the Senate Homeland Security and Governmental Affairs Committee, said on “Fox News Sunday” that the U.S. will have to take an active approach in Yemen after multiple recent terrorist attacks on the U.S. were linked back to the Middle Eastern nation.

The Connecticut senator said that an administration official told him that “Iraq was yesterday’s war, Afghanistan is today’s war. If we don’t act preemptively, Yemen will be tomorrow’s war.”

Lieberman, who is known to be hawkish on security issues, said that Yemen needs to be a focal point because two recent attacks were linked back to a growing al-Qaeda presence there.

Maj. Nidal Malik Hasan — the Army officer who killed 13 people in a shooting rampage at Fort Hood in November — was linked to Anwar al-Awlaki, a radical Muslim cleric now based in Yemen.

The senator said that Umar Farouk Abdulmutallab, the 23-year-old Nigerian accused of attempting to set off a plastic-explosive device aboard a Northwest Airlines flight from Amsterdam to Detroit on Friday, “reached out to Yemen” but was “not sure” if he contacted al-Awlaki. Abdulmutallab reportedly told authorities he traveled to Yemen and met al-Qaida figures there.

The U.S. earlier this month launched cruise missiles at two al-Qaeda targets in Yemen. The attacks represented a major escalation of U.S. efforts against al-Qaeda in Yemen.

Sen. Arlen Specter (D-Pa.), also on Fox, agreed that preemptive strikes should be “one [option] we ought to be considering” but added that “it’s a big, complex subject.”

Read moreSen. Joe Lieberman: Yemen will be ‘tomorrow’s war’ if pre-emptive action not taken

Irish Catholic Bishops Resign Over Church Cover-Up of Child Abuse

Dublin Bishops Eamonn Walsh and Ray Field issue joint statement announcing their resignation in wake of damning investigation

Two Roman Catholic bishops in Ireland resigned on Christmas day in the wake of a damning investigation into decades of church cover-up of child abuse in the Dublin archdiocese.

Dublin Bishops Eamonn Walsh and Ray Field offered an apology to child-abuse victims as they announced their resignation during Christmas mass. Priests read the statement to worshippers throughout the archdiocese, home to a quarter of Ireland’s 4 million Catholics.

Earlier this month two other bishops, Donal Murray of Limerick and Jim Moriarty of Kildare, resigned following the publication on 26 November of a three-year investigation into why so many abusive Dublin priests escaped justice for so long.

The government-ordered investigation found that Dublin church leaders spent decades shielding more than 170 paedophile priests from the law. They began providing information to police only in 1995 – but continued to keep secret, until 2004, many files and other records of reported abuse.

In a joint statement Walsh and Field said they hoped their resignations “may help to bring the peace and reconciliation of Jesus Christ to the victims (and) survivors of child sexual abuse. We again apologise to them.”

Read moreIrish Catholic Bishops Resign Over Church Cover-Up of Child Abuse

Build-A-Bear: The Sinister Green Plot to Turn Our Kids Into Eco-Fascist Manchurian Candidates

Do Al Gore or Dr Rajendra Pachauri own shares in the international toy franchise Build-A-Bear? Here is a video – one of a series of three – that the company’s impressionable young customers are being directed to watch via its website www.buildabearville.com. (Hat tip: Plato Says)

You can watch the other two here and here.

America’s parents aren’t happy at this kind of eco-indoctrination. Here’s a taste from Big Government.

Every year we take the kids to Build-A-Bear, but we have now gone for the last time. I get enough indoctrination from the main stream media, and now I need to worry about what political messges Build-A-Bear feels a need to pass on to my grandchidren? I don’t think so. They just made sure that we will now switch to a store that sells toys that don’t come with political indoctrination. Build-A-Bear, you just lost an entire family and generation of good customers.

Leave our children alone Build a Bear. I once thought your store was cute …. the whole concept of it but not anymore. Let children be children. They should not have to deal with heavy subjects such as Global warming which is a hoax anyway. Pure disgusting on your part and I will no longer shop at your stores or online.

Wow … more like build-a-scare than a bear. This is unconscionable. My kids have a dozen of their products but we will NOT be shopping there anymore. I just can’t believe they actually did that. I shouldn’t be surprised but what a mistake.

and here is Build-A-Bear’s CEO’s not altogether convincing response.

Our goal with the online webisodes was to show children, through two animated polar bears and a penguin, how they could also make a difference in big and small ways. The animated story occurs in the North Pole where the 2 polar bear characters live and they want to help keep the ice from melting so Santa and the reindeers can take off safely in time to deliver all their gifts. Thanks to the giant ice cubes created by the bear and penguin team they replace the melting ice and all is well so Santa and the reindeers do not miss a beat.

We had no other intentions with the story whatsoever. we do hear you and will certainly take your opinion into consideration when developing future stories. It is interested customers like yourselves that help us do a better job.

Sincerely,

Maxine Clark

Maxine Clark

Founder and Chief Executive Bear

Merry Christmas, Maxine. Something tells me that your Yuletide sales figures are about to stink like Mr Hankey.

Scientists develop electronic ‘Sex chip’ to be implanted into the brain to stimulate pleasure

WTF!

The chip works by sending tiny shocks from implanted electrodes in the brain.

The technology has been used in the United States to treat Parkinson’s disease.

But in recent months scientists have been focusing on the area of the brain just behind the eyes known as the orbitofrontal cortex – this is associated with feelings of pleasure derived from eating and sex.

A research survey conducted by Morten Kringelbach, senior fellow at Oxford University’s department of psychiatry, found the orbitofrontal cortex could be a “new stimulation target” to help people suffering from anhedonia, an inability to experience pleasure from such activities. His findings are reported in the Nature Reviews Neuroscience journal.

Neurosurgery professor Tipu Aziz, said: “There is evidence that this chip will work. A few years ago a scientist implanted such a device into the brain of a woman with a low sex drive and turned her into a very sexually active woman. She didn’t like the sudden change, so the wiring in her head was removed.”

Robin Hood of Las Vegas: Taking Money From Rich Casinos Giving It To The Poor

When Kurt and Megan Kegler’s phone rang at their mobile home outside Detroit, the future looked grim.

Robin Hood 702 has given television interviews, but with his face in shadow

When the mystery gambler was $35,000 up he quit the table, and handed the proceeds to the Keglers in a giant bag of hundred dollar chips .

Their three-year-old daughter, Madison, had been diagnosed with a brain tumour and they were $35,000 (£21,000) in debt.

But when they heard what the caller had to say, they broke down in tears, hardly able to believe their ears. He was a mysterious, high-rolling Las Vegas gambler who had been choosing needy families to give them his winnings. “You have been chosen,” the voice told the Keglers. “I’m flying you to Vegas, and I’m going to win your money for you.” What followed seemed like a dream. A stretch limousine to the airport, first-class flights and a Rolls Royce to their 8,000 square-foot suite in the Palazzo hotel. There, Mr Kegler, 48, and his wife, 29, were met by their benefactor, who promptly staked huge amounts of his own money in a marathon card session.

It wasn’t plain sailing on the blackjack table, despite his confidence: the Keglers saw him go down hundreds of thousands of dollars before he managed to hit a winning streak and recover.

When he was $35,000 up he quit the table, and handed the proceeds to the Keglers in a giant bag of hundred dollar chips. “It completely changed everything,” said Mrs Kegler.

Read moreRobin Hood of Las Vegas: Taking Money From Rich Casinos Giving It To The Poor

Arrow Trucking Shuts Down, Lays Off 1,400 And Strands Drivers During Layoff

BREAKING NEWS! Arrow Trucking Abruptly Shuts Down Leaving 1,400 Unemployed and Many STRANDED!

Arrow Trucking ex-employee

Arrow Trucking Take The Money And Run Video Hash

Arrow Trucking laid off approximately 200 drivers this week and stopped payments on their gas cards, leaving some drivers stranded Tuesday around the United States. (Getty Images)

Layoffs are a fact of life in this economy, but there are humane ways to do it.

Then there’s the Arrow Trucking Arrow Trucking method.

The Tulsa, Okla., trucking company stopped payment on the gas cards of its drivers, leaving some of them stranded Tuesday around the United States, miles from home. No explanation on the website. No one at the company answering phones.

The 200 or so employees at Arrow Trucking’s headquarters were told to pack up their belongings and go home Tuesday morning, according to the Tulsa World.

The only acknowledgement was a brief recorded message on the company’s main phone number, asking drivers of its Freightliner and Kenworth trucks to turn their rigs in to the nearest dealer and to call a special hotline to arrange for a bus ticket home. Drivers of the company’s Navistar trucks were told to call back for more information.

“I wouldn’t say it’s typical, but I wouldn’t say it’s unheard of” for a trucking company to lay off workers in such a fashion, says Alan Bristol, a truck driver in Fort Collins, Colo., who was laid off earlier this year.

Read moreArrow Trucking Shuts Down, Lays Off 1,400 And Strands Drivers During Layoff

We’re Screwed! Hyperinflation like in the Weimar Republic; Great Depression worse than in the 1930s

The US is already beyond hope!

See also:

– John Williams of Shadowstats: Prepare For The Hyperinflationary Great Depression

This is the Greatest Depression.

ShadowStats.com founder John Williams explains the risk of hyperinflation. Worst-case scenario? Rioting in the streets and devolution to a bartering system.

Courtesy of John WilliamsEconomist/statistician John Williams shifts through the government’s rose-tinted data

Do you believe everything the government tells you? Economist and statistician John Williams sure doesn’t. Williams, who has consulted for individuals and Fortune 500 companies, now uncovers the truth behind the U.S. government’s economic numbers on his Web site at ShadowStats.com. Williams says, over the last several decades, the feds have been infusing their data with optimistic biases to make the economy seem far rosier than it really is. His site reruns the numbers using the original methodology. What he found was not good.

Maymin: So we are technically bankrupt?

Williams: Yes, and when countries are in that state, what they usually do is rev up the printing presses and print the money they need to meet their obligations. And that creates inflation, hyperinflation, and makes the currency worthless.

Obama says America will go bankrupt if Congress doesn’t pass the health care bill.

Well, it’s going to go bankrupt if they do pass the health care bill, too, but at least he’s thinking about it. He talks about it publicly, which is one thing prior administrations refused to do. Give him credit for that. But what he’s setting up with this health care system will just accelerate the process.

Where are we right now?

In terms of the GDP, we are about halfway to depression level. If you look at retail sales, industrial production, we are already well into depressionary. If you look at things such as the housing industry, the new orders for durable goods we are in Great Depression territory. If we have hyperinflation, which I see coming not too far down the road, that would be so disruptive to our system that it would result in the cessation of many levels of normal economic commerce, and that would throw us into a great depression, and one worse than was seen in the 1930s.

What kind of hyperinflation are we talking about?

I am talking something like you saw with the Weimar Republic of the 1930s. There the currency became worthless enough that people used it actually as toilet paper or wallpaper. You could go to a fine restaurant and have an expensive dinner and order an expensive bottle of wine. The next morning that empty bottle of wine is worth more as scrap glass than it had been the night before filled with expensive wine.

We just saw an extreme example in Zimbabwe. … Probably the most extreme hyperinflation that anyone has ever seen. At the same time, you still had a functioning, albeit troubled, Zimbabwe economy. How could that be? They had a workable backup system of a black market in U.S. dollars. We don’t have a backup system of anything. Our system, with its heavy dependence on electronic currency, in a hyperinflation would not do well. It would probably cease to function very quickly. You could have disruptions in supply chains to food stores. The economy would devolve into something like a barter system until they came up with a replacement global currency.

What can we do to avoid hyperinflation? What if we just shut down the Fed or something like that?

We can’t. The actions have already been taken to put us in it. It’s beyond control. The government does put out financial statements usually in December using generally accepted accounting principles, where unfunded liabilities like Medicare and Social Security are included in the same way as corporations account for their employee pension liabilities. And in 2008, for example, the one-year deficit was $5.1 trillion dollars. And that’s instead of the $450 billion, plus or minus, that was officially reported.

Wow.

These numbers are beyond containment. Even the 2008 numbers, you can take 100 percent of people’s income and corporate profit and you’d still be in deficit. There’s no way you can raise enough money in taxes.

What about spending?

If you eliminated all federal expenditures except for Medicare and Social Security, you’d still be in deficit. You have to slash Social Security and Medicare. But I don’t see any political will to rein in the costs the way they have to be reined in. There’s just no way it can be contained. The total federal debt and net present value of the unfunded liabilities right now totals about $75 trillion. That’s five times the level of GDP.

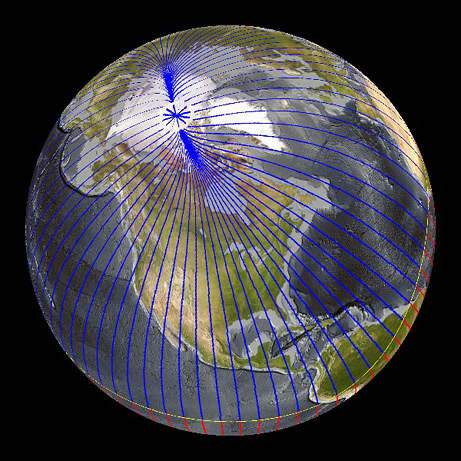

Earth’s North Magnetic Pole is Racing Toward Russia at Almost 64 Kilometers a Year Due to Core Flux

Before:

National Geographic News (December 15, 2005):

– North Magnetic Pole Is Shifting Rapidly Toward Russia:

New research shows the pole moving at rapid clip—25 miles (40 kilometers) a year.

Over the past century the pole has moved 685 miles (1,100 kilometers) from Arctic Canada toward Siberia, says Joe Stoner, a paleomagnetist at Oregon State University.

Now …

North Magnetic Pole Moving East Due to Core Flux

Earth’s north magnetic pole is racing toward Russia at almost 40 miles (64 kilometers) a year due to magnetic changes in the planet’s core, new research says.

The core is too deep for scientists to directly detect its magnetic field. But researchers can infer the field’s movements by tracking how Earth’s magnetic field has been changing at the surface and in space.

Now, newly analyzed data suggest that there’s a region of rapidly changing magnetism on the core’s surface, possibly being created by a mysterious “plume” of magnetism arising from deeper in the core.

And it’s this region that could be pulling the magnetic pole away from its long-time location in northern Canada, said Arnaud Chulliat, a geophysicist at the Institut de Physique du Globe de Paris in France.