I have found the leaked information on this closed session of Congress in March, but the source was not really reliable.

Now, since there is more than enough proof that the economy is going down the toilet (US: Total Crash of the Entire Financial System Expected, Say Experts), I have come across this information again at another website and so I have finally decided to publish it.

It would be very wise to prepare yourself, no matter weather this is true or not.

Have a look at the “World Situation” and the “Solution“. – The Infinite Unknown

A secret meeting of Congress discusses immanent martial law.

On March 13th 2008 there was a secret closed door meeting of The United States House Of Representatives in Washington. In the history of The United States this is only the fourth time a secret meeting was held by the house. Even though Representatives are sworn to secrecy by House Rules XVII, some of the members were so shocked, horrified, furious, and concerned about the future of America by what was revealed to them inside the secret meeting, that they have started to leak this secret information to independent news agencies around the world. The mass media said almost nothing about the secret meeting of the House, mentioning only one of the items being discussed. (The new surveillance techniques that are going to be used by the U.S. Government to watch all American citizens). The story was first released in a newspaper out of Brisbane, Australia revealing the contents of the secret U.S. Government meeting and plans for America including all of it’s citizens. Shortly there after, David J. Meyer from Last Trumpet Ministries found it and made it more available for the world to see.

Here is what was revealed:

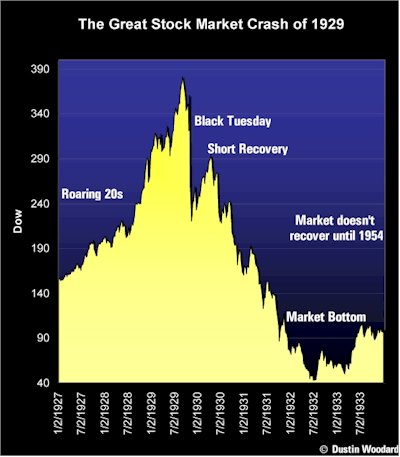

- The imminent collapse of the U.S. Economy to occur sometime in late 2008

- The imminent collapse of the U.S. Government finances sometime in mid 2009

- The possibility of Civil War inside the United States as a result of the collapse

- The advance round-ups of “insurgent U.S. Citizens” likely to move against the government

- The detention of those rounded up at The REX 84 Camps constructed throughout the United States

- The possibility of public retaliation against members of Congress for the collapses

- The location of safe facilities for members of Congress and their families to reside during massive civil unrest

- The necessary and unavoidable merger of The U.S. with Canada and Mexico establishing The North American Union

- The issuance of a new currency called the AMERO for all three nations as an economic solution.

Except for a few hundred thousand U.S. Patriots, most Americans have no clue what has really been going on within The United States over the past 100 years, and the sad thing is that most do not want to know the truth. The further you look into the rabbit hole, the deeper it gets. Go to any currency conversion site and convert U.S. dollars to Euros so you can see for yourself the massive decline of the dollar. Look at how much money is and has been spent on the Iraq War to date, ($12 billion per month). Look at our currency and when it stopped being backed by gold.

The Federal Reserve is not federal but a private bank who does not have Americans best interests at heart. We no longer have any manufacturing really based out of America and there is no way that our economy can survive this incredible strain very much longer. The IRS strong arms every American yearly with income taxes, yet there are no laws saying an income tax is to be paid.

The CIA is involved in everything from global drug trafficking and covert military missions, to assassinations around the world and including U.S. Soil. Look at JFK for instance. It did not take long after JFK announced that he was going disband the CIA that he was shot in Texas. America’s new StasiThe Department Of Homeland Security is and has been slowly eradicating our rights for a few years now. based organization called

House Bill H.R. 1955/S-1959 was read by the senate and then sent to DHS for some reason, but is now back and sure to pass. Once passed, this bill introduced by Jane Harman (D/CA), will be the proverbial last nail hammered into every American patriots coffin. H.R. 4279 or the Prioritizing Resources and Organization for Intellectual Property Act of 2008 which was recently passed by the U.S. House of Representatives, will give the government draconian powers to do just this. This legislation gives the government the power to seize property that facilitates the violation of intellectual property laws. The legislation also mandates the formation of a formal Intellectual Property Enforcement Division within the office of the Deputy Attorney General to enforce this insanity…

It has been revealed that F.E.M.A. has been building internment camps all over America granting Halliburton a massive $385 million dollar construction contract to make this happen. Most of these sites only need refurbished because they are mostly closed prisons, old WW2 internment camps still intact and other facilities taken over by the government. Some people have referred to them as F.E.M.A. Death Camps where the infamous Red list/Blue Lists will be used to decide who goes where.

Whether you believe that The NWO/Illuminati/Globalization is real or not, there is a lot of proof that exposes definite plans or plots by the rich, political and religious elite to bring on an era of the end times. It is almost like some individuals are trying to make bible prophecy come true in their own sick and twisted ways. Not to mention that the world only has about 10 to 15 years of drinking water left before the wars fought for oil today will be fought for water in the near future. It has been said that these powers want to depopulate the planet of over 30% of it’s human inhabitants in the coming years. Examine all of the executive orders that have been signed into place allowing the president to basically become dictator in control of all government from tribal to federal in the event of any national emergency.

If you did not know, In late 2006, Congress revised the Posse Comitatus Act and the Insurrection Act to make it far easier for a president to declare martial law. Those changes were repealed at the end of this January as part of Public Law 110-181 (HR 4986), the National Defense Authorization Act for Fiscal Year 2008 (signed into law by President Bush on January 28, 2008). Unfortunately it is not the great victory in which one might think because of the total militarization of all local and State police forces all across America.

Will there be martial law? Is martial law coming soon to America? When you see law enforcement being armed with automatic weapons, bullet proof vests and riot gear in small towns that have not had a murder or crime in years, then you have to ask yourself why.

The United States has more people locked up in prisons today than Russia and China combined. It comes out to one in every hundred Americans is behind bars. Our once great country that our ancestors fought and died for has become exactly the tyrants they were fighting. Fascists! When has America ever used words like Homeland? Never!

If you spend a few weeks reading all the info, watching the videos and following the links at The U.A.F.F., you will then have a better understanding of what has led to The Decline And Fall Of America. Remember that Knowledge is power! Learn, look, listen, read, share, prepare, train, stock up on food and water supply for one year.

Fill your pantry with non perishable foods, medicines, cooking oils, tinned meats and veggies. Flour, oats dried corn peas, beans and lentils.. Teach your self how to preserve food for storage. Check out your local potable/ drinking water supplies, non perfumed chlorine bleach is a good sterilizer for water, about 2 teaspoons full per 2 gallon bucket, stirred well and allowed to stand for at least 24 hours with a lid on it or until it no longer smells of bleach. Boiling water helps but it is not always enough to kill off the bacteria which can resist high temperatures.

(There are healthier ways to treat water – The Infinite Unknown)

Americans have been warned for years of the things to come, but have blindly looked away from the truth, which has been available for all to see. There are no more excuses not to prepare for the possible future. The time to act is now before it is too late.

B.A. Brooks

March 13, 2008

Source: The United American Freedom Foundation