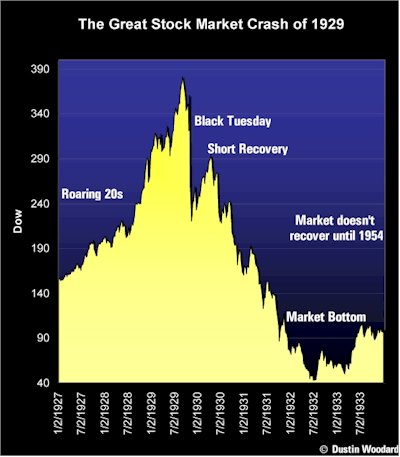

Compared to Wall Street the US government and the Fed nuked the economy, the dollar and any bright future that the people in the US might have had. The people will experience the fallout very soon.

The ‘Greatest Depression’.

Cynthia McKinney is spot-on :

(This guest post comes from Tavakoli Structured Finance)

If a high-on-crack driver crashed his speeding rental car into your house and killed your spouse, you would be outraged if law enforcers took bribes and gave the driver a pass on a blood test. If the judge then merely fined the killer and ordered you to pay it, you would appeal, wondering what happened to justice. If the government then handed the crack-driver keys to a bigger rental car and presented you with the rental bill, you would certainly protest.

How is it, then, that you have remained largely silent in the face of the same sort of behavior by Wall Street and Washington? Bonus-seeking bankers careened off the right path and ran Ponzi schemes that nearly ruined our economy. Bureaucrats and elected officials bailed them out without demanding consequences. Bankers are revving their engines again.

Bankers Get Bonuses, the USA Gets the Great Recession

Taxpayers are asked to believe that over-borrowing by U.S. consumers created a global financial crisis. This myth aids and abets Wall Street. The economy was nearly destroyed because banks borrowed massively, and they borrowed many multiples more than they could afford. Wall Street pumped the Fed’s cheap money through financial meth labs, and deceptive financial vehicles ran over securities laws at top speed.

More than 20% of mortgage loans–including originally sound loans–are underwater, meaning the borrower owes more than the home is worth. Official unemployment numbers hover at around 10%. If you include underemployment, it is around 18%. In depressed areas where the nation’s poorest–chiefly minorities–have been hurt the most, unemployment has soared past 30%. For this destitute group, unemployment combined with underemployment exceeds 50%.

As U.S. soldiers fought wars in Iraq and Afghanistan, Wall Street flattened Main Street. Our foreign wars drag on, while the U.S. battles a crippling recession at home.

Global Ponzi Scheme

Fraud by borrowers, fraud on borrowers, and speculation by people who thought home prices would rise forever have all tarnished mortgage lending. Yet this pales compared to the epidemic of predatory lending.

Predatory snipers committed financial murder as deliberately as British soldiers sold smallpox contaminated blankets to Native Americans. Honest homeowners were systematically targeted and actively misled into bad mortgage products. Loans were presented as gifts, but these Trojan horse loans hid destructive risk. “Disclosures” were acts of malice.

When Wall Street packaged these loans and sold deceptive “investments,” documents did not specifically disclose that credit ratings were misleading. If you know or should know a car’s gas tank will blow up, you cannot use a misleading third-party consumer report as an excuse. Yet bonus-seeking bankers used this sort of excuse to get through a few more highly-paid bonus cycles, before it all fell apart. Only the elite crowd of insiders prospered.*

This was the most massive Ponzi scheme in the history of the global capital markets. U.S. taxpayers became unwilling unsophisticated investors when we bailed out the financial system. We must hold Wall Street accountable for its fraud.

Read moreWall Street Is A High-On-Crack Driver That Just Smashed Into Your House

A trader reacts in front of the DAX board at the Frankfurt stock exchange.

A trader reacts in front of the DAX board at the Frankfurt stock exchange.