FYI.

– The Markets Should Celebrate Stanley Fischer As Number Two At Fed, A Perfect Ten Strike (Forbes, Dec 11, 2013):

I know and admire the wisdom of Stanley Fischer, apparently to be appointed Vice Chairman of the Federal Reserve Bank. Fischer will add a serious complement of experience to maintain stability of the nation’s monetary policy as he understands only too well the absolute requirement of avoiding another meltdown. This appointment will strengthen the positive attitude of financial markets as Fischer is a strong asset for Yellen, and influential with other local Fed presidents as well as Finance Ministers and Central Bankers around the globe. Just recently, Larry Summers and a passel of other influential economists saluted Fischer with keenly read papers at the IMF to honor his influence in economic circles. And I know that Fischer has a very high regard for the former Treasury Secretary.

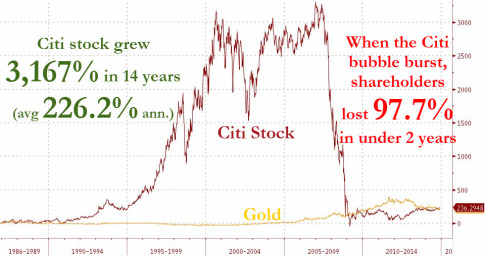

I believe his record as MIT Professor supervising Ben Bernanke’s thesis on the depression in 1979, his time at the IMF as chief economist, a few years at Citigroup and then a spectacular success steering the Israeli economy to superior economic growth at the Bank of Israel will be seen as a valuable counterpart to Janet Yellen’s huge challenge of easing us out of quantitative easing.

…

– For No. 2 at Fed, White House Favors Central Banker in the Bernanke Mold (New York Times, Dec 11, 2013):

WASHINGTON — Stanley Fischer, the former governor of the Bank of Israel and a mentor to the Federal Reserve’s chairman, Ben S. Bernanke, is the leading candidate to become vice chairman of the Fed, according to former and current administration officials.

…

– Former Bank of Israel Gov. Fischer near Fed vice chair nomination: Reports (CNBC. Dec 11, 2013):

The White House is close to nominating Stanley Fischer, the former governor of the Bank of Israel, as vice chair of the Federal Reserve, various media outlets reported on Wednesday.

Fischer, 70, headed the Israeli central bank until earlier this year. He is a former head of the economics department at MIT, former number two official at the IMF and former chief economist at the World Bank.

Among his students during his 20-plus years teaching at MIT were outgoing Fed Chairman Ben Bernanke and former presidential advisor Greg Mankiw.

Read moreWhite House Favors Former Bank Of Israel Governor Stanley Fischer To Be Fed Vice Chair