– Yellen Starts Work At Brookings Institution On Monday:

A glitch in the monetary matrix?

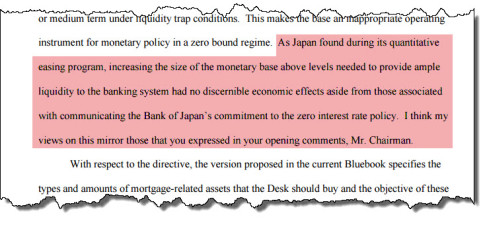

Fed watchers will recall that shortly after he departed the Fed to make way for Janet Yellen, Ben Bernanke first joined the Brookings Institution in DC (before also joining PIMCO and Citadel as an advisor), where he became blogger emeritus. Fast forward a little over three years, when deja vu has hit, and as Steve Liesman reported moments ago, Janet Yellen – who is still technically employed by the Fed until this weekend – will begin work Monday morning as a distinguished fellow at the Hutchins Center on Fiscal and Monetary Policy at the Brookings Institution in Washington, DC.

In heading to Brookings, Yellen follows in the steps of former Fed Chairman Ben Bernanke and former vice chairman Donald Kohn, along with former top Fed staffer Nellie Liang.

Yellen, 71, spent 17 years in the Federal Reserve system, including four as chair, four as vice chair, three as a Federal Reserve governor and six as San Francisco Fed president.

In addition to blogging, what will Yellen do at Brookings?

Read moreJanet Yellen Starts Work At Brookings Institution On Monday