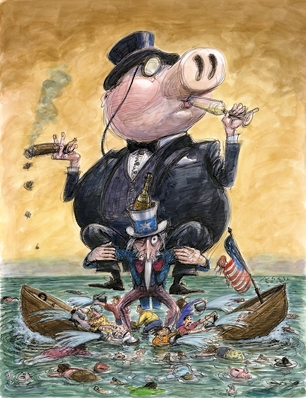

– The Truth Behind Juncker’s Lies: In The Second Largest Greek City, 1250 Companies Have Shuttered In 2012 (ZeroHedge, Aug 22, 2012):

European viceroy of various neo-colonial territories Jean-Claude Juncker, best known for being a self-professed pathological liar, just concluded a press conference in which he did what he does best: lie. Here is a sampling of the soundbites along with our commentary:

- EU’S JUNCKER SAYS TRUTH IS GREECE SUFFERS CREDIBILITY CRISIS – coming from a pathological liar, this one is our favorite

- EU’S JUNCKER SAYS CONVINCED GOVERNMENT WILL TAKE ALL MEASURES. “all measures” = “all gold”

- EU’S JUNCKER: FULLY CONFIDENT GOVERNMENT TO TAKE ALL EFFORTS “all efforts” = “all gold”

- EU’S JUNCKER SAYS GREECE MUST OPEN UP CLOSED PROFESSIONS. Chimneysweep? Bootblack? Telegraph Operator? Tax Collector? Prosecutor? Uncorrupted muppet?

- EU’S JUNCKER SAYS BALL IS IN GREEK COURT; IS LAST CHANCE. The ball will be repoed to the ECB shortly

- EU’S JUNCKER SAYS NOT SAYING THERE WON’T EVER BE A 3RD PROGRAM or 33rd program

- EU’S JUNCKER SAYS GREEK EURO EXIT WOULD BE RISK TO EURO AREA and Obama’s reelection

- EU’S JUNCKER SAYS BALL IS IN GREEK COURT; not for long: ball will soon be repoed to the ECB

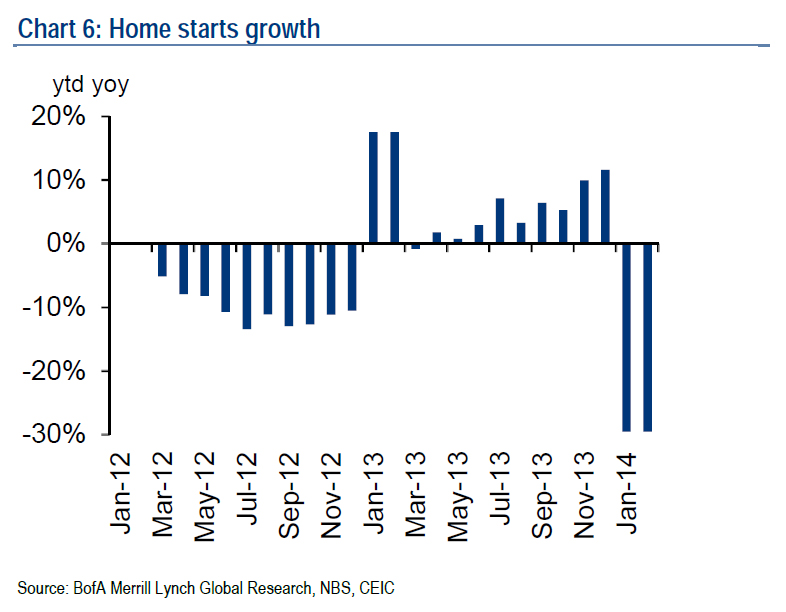

And much more propaganda. Here is the truth. According to Greek Thema, in Thessaloniki, the second-largest city in Greece, so far in 2012, an unprecedented 1,250 companies have shut down. This means no jobs, no tax revenues, no money in circulation. A complete and total economic collapse.

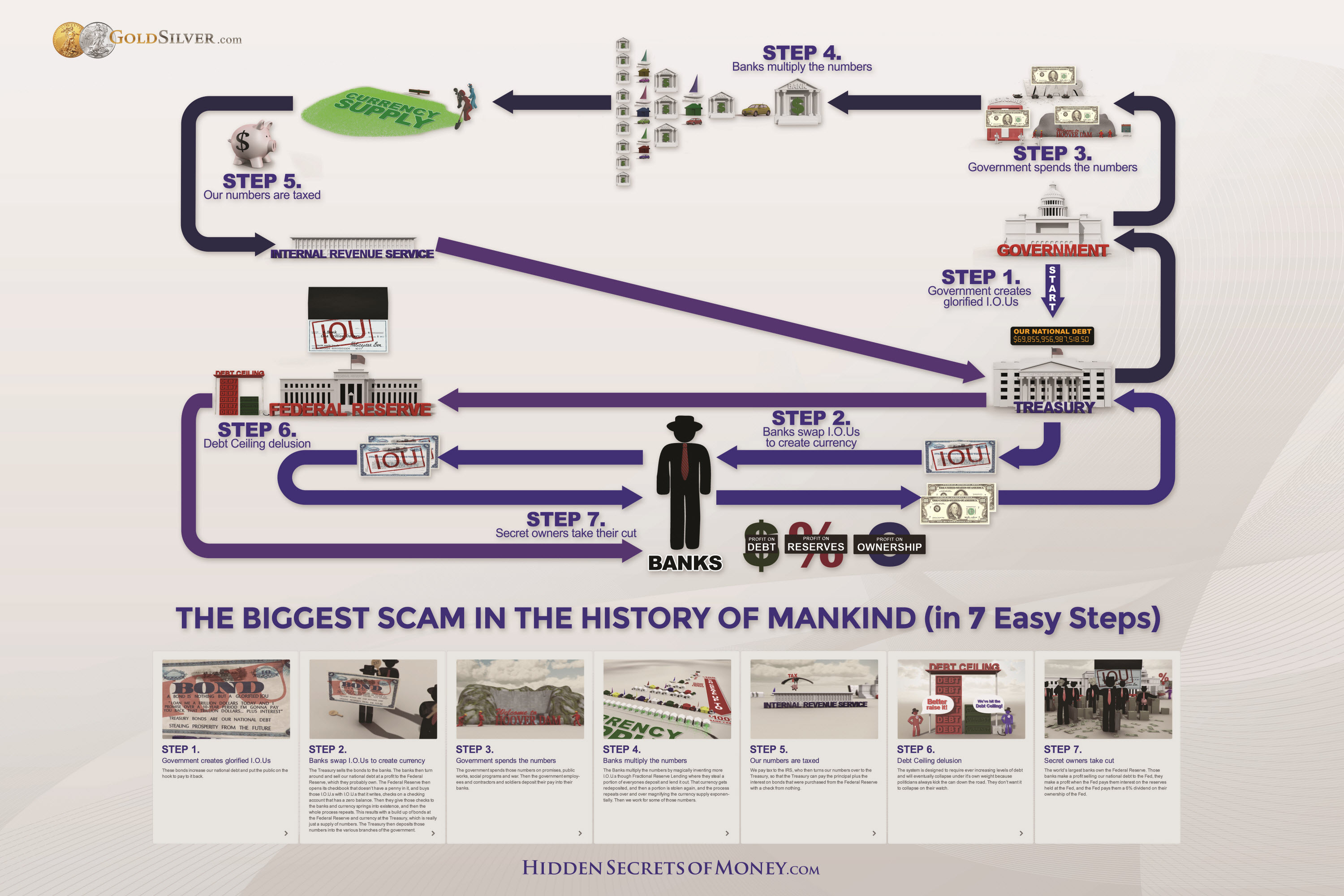

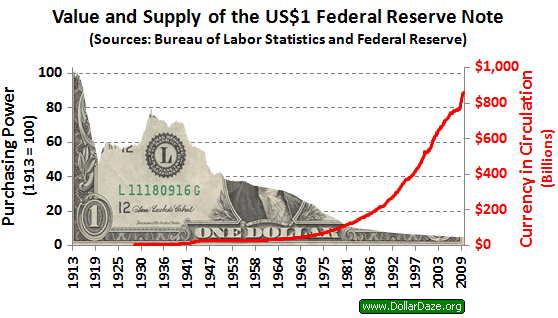

So let us explain: while Greece and Europe may engage in endless check kiting Ponzi schemes: such as the most recent one, whereby Greece promises to pay Germany by issuing bills, bought by its banks, which in turn are repoed to the ECB via the ELA, with the cash used by the country to pay Germany and the ECB, even as Germany’s contingent liabilities get more massive by funding the ECB’s capital, the reality is that unless someone does some work, and creates real wealth, real money, instead of merely shuffling electronic cash from Point A to Point B, while the only thing increasing are German contingent liabilities, aka systemic debt, absolutely nothing will change.