– China’s Housing Problem In One Chart (ZeroHedge, March 19, 2014):

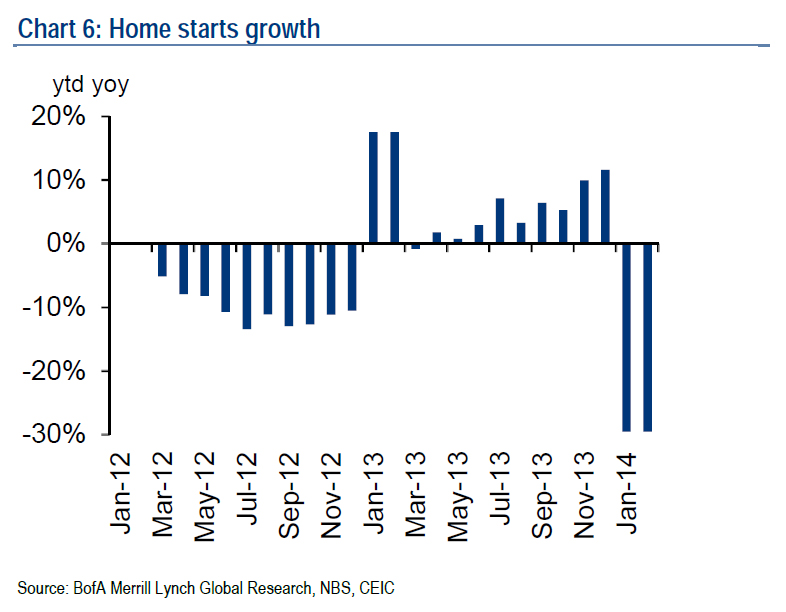

The one problem with every Ponzi scheme is that it must constantly grow, in both demand and supply terms, for the mass delusion to continue. The other problem, of course, is that every Ponzi scheme always comes to an end…. which may have just happened in China where as the chart below shows, as of this moment at least, the supply side to the Chinese housing ponzi (and recall that in China the bubble is not in the stock market like in the US, but in housing) has slammed shut.

Source: BofA

Had China done it right, they might have been the world’s economic leader, instead, they adopted all the crooked policies of the west, and now, they are in deep trouble….taking much of the world with it.

Their credibility is nearly as low as that of the US, and their real debt level (depending on what you read) is 5-12X annual GDP. If you go to USdebtclock.org, they claim 7% of debt to GDP……total liars.

I am not surprised, nor is anyone else with any sense at all. I bet this won’t make it to US media.