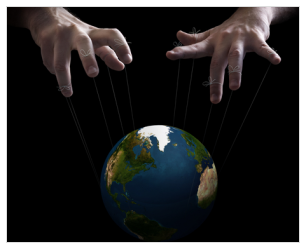

– What To Do When Every Market Is Manipulated (ZeroHedge, Aug 16, 2012):

Hint: cut the strings

If you don’t know who the sucker at the card table is, it’s you.

~ old gambler’s saying

What do the following have in common?

LIBOR, Bernie Madoff, MF Global, Peregrine Financial, zero-percent interest rates, the Social Security and Medicare entitlement funds, many state and municipal pension funds, mark-to-model asset values, quote stuffing and high frequency trading (HFT), and debt-based money?

The answer is that every single thing in that list is an example of market rigging, fraud, or both.

How are we supposed to make decisions in today’s rigged and often fraudulent market environment? Where should you put your money if you don’t know where the risks lie? How does one control risk when control fraud runs rampant?

Unfortunately, there are no perfect answers to these questions. Instead, the task is to recognize what sort of world we happen to live in today and adjust one’s actions to the realities as they happen to be. The purpose of this report is not to stir up resentment or anger — although those are perfectly valid responses to the abuses we are forced to live with — but to simply acknowledge the landscape as it is so that we can make informed decisions.

In this report I connect the dots on the fraud, noting both what we already know about and what we’d better prudently suspect is happening (but not yet revealed). In Part II, we talk about ways to operate, make decisions, and control risk given the sorry state of affairs in our financial markets.

Swimming Naked

As Warren Buffet said, “It’s only when the tide goes out that you learn who’s been swimming naked.”

What he meant was that poorly-run companies can appear healthy during boom times but are later exposed as hollow shells when the economic tide retreats. Naturally it’s a lot easier to make money when times are booming, but much more difficult when the economic pie is stagnant or shrinking. The dot-com companies of the late 1990s are the poster children for this phenomenon.

My corollary to Buffet’s naked swimming quote is this: It’s only when the pie stops expanding that you find out who’s been running a Ponzi scheme.

The global pie is no longer expanding, and the relentless parade of disquieting economic and financial news can be laid right upon that fact.

Sure, there are the prosecutable examples, such as Bernie Madoff, but state and municipal pensions and the Social Security entitlement program also fit the definition. So does the practice of expanding public debt at a faster pace than GDP, which many nations, provinces, and states have done for many years running. These are all Ponzi schemes in the sense that they require constant growth to remain ‘healthy’ (or hidden, more accurately) and are therefore mathematically certain to fail. Now that the economic pie is no longer growing like it used to and most likely will not for decades to come (if ever), all of these schemes are rapidly falling apart.

The insolvency of Greece, which is now in a full-bore depression, is simply a reflection of a multi-year Ponzi scheme that has now run its course and fallen apart. It is simply not possible to borrow forever at a faster rate than your income growth, and Greece is now a harbinger of things to come for every country in a similar position. That includes all of the PIIGS, Japan, and the US.

Now that the pie has stopped expanding, all of the countries that have been swimming naked are exposed. Timing will vary, as in this metaphor some were in shallower water (Greece) than others (the US), but timing aside, there really isn’t much of a difference between any of them.

Illegal and Condoned Fraud

Where does one even begin with a discussion of all of the rampant fraud that has been revealed of late? Should we suspect that there is suddenly a lot more fraud in the system? Or is the lack of growth simply revealing the extent to which fraud and Ponzi schemes are a significant feature of our political-financial-regulatory-banking landscape? I lean towards the latter view.

I suppose we need to begin this discussion with the fact that any exponential, debt-based monetary system is, at its very core, a Ponzi scheme. It simply has to keep expanding so that there’s enough money and credit manufactured today to meet yesterday’s principal and interest loads. Without endless growth, sooner or later the debt pile collapses, and truly extraordinary losses are taken by somebody.

If our entire money system is itself a Ponzi scheme, then it follows that much of what will be based on that monetary superstructure will, almost by definition, share that characteristic.

The garden-variety illegal schemes, such as those run by Bernie Madoff and Peregrine Financial, are easier to cover up and keep running when money and credit are readily available and expanding rapidly. Their early demise just means that they were in the weakest positions and therefore unable to survive the first rounds of crediting/money stagnation.

Next in line is the practice of borrowing at a faster rate than economic growth. That process is already well underway for Greece, Spain, Italy, and Portugal — but just barely. An enormous gap exists between any practical level of funding and the desired levels of spending, and closing that gap will be a long and painful process.

Following this will be the state-sponsored schemes. Woefully underfunded pensions and entitlement programs will take longer to unravel, but it will happen too in one form or another, most likely by cutting benefits.

The simple truth is that when credit and money expansion stops, all of the various schemes that relied upon the illusion of growth supplied by that dynamic are exposed as unworkable propositions. One summary of the current crisis is this: Credit growth stalled and there simply wasn’t enough ‘juice’ left in the system to cover the various ‘legal’ and illegal Ponzi schemes.

Socially speaking, as long as the pie is expanding, there is virtually zero public or political support to call out the schemes for what they are. If anything, the opposite is true. It is only once some limit to growth is reached — the most recent case being the bursting of a multi-decade credit bubble in 2008 — that the party ends, heads groggily lift, and the painful lack of standards and critical thinking are finally revealed.

The fraud has always been there, often in plain sight, but very few really cared as long as the status quo was being maintained. Obviously and mathematically unworkable municipal and state pension plans are a prime example of this dynamic. For as long as the fiction could be maintained, very few challenged the system, even though they were quite obviously going to be an eventual fiduciary train wreck.

The recent spate of municipal bankruptcies indicates that the ‘eventual’ train wreck has begun and the first few cars of a very long train are off the rails.

Officially Supported Fraud

As bad as the private frauds are, and as corrosive as they are to public trust, they pale in comparison to those perpetuated at the very highest levels. The fact that some frauds are supported and encouraged by the regulatory bodies and official institutions should render them no less palatable to the rational mind. In fact, the opposite should be true.

Recently it has become clear that various regulatory bodies can be counted on to look the other way when certain frauds are aligned with the aims and goals of the state while punishing other frauds selectively and grudgingly. There are many recent examples to support this view.

The LIBOR scandal is a perfect example of regulators ‘looking the other way when it suits us.’ Because a LIBOR rate that was manipulated to inappropriately low levels created the appearance of robust bank health, the Fed and other central banks and regulatory authorities were more than happy to look the other way. Not just briefly, but over many years.

That the manipulation of LIBOR also happened to pad the profits of big, well-connected banks (another prime goal of the central authorities) was just one more reason to tacitly support the manipulation. It’s important to note that LIBOR was and is the main determinant for the rate of interest paid on tens of trillions of loans and hundreds of trillions in derivatives.

If the central authorities are willing to overlook fraud on that scale, how far are they willing to go in other areas? Asked another way, just how serious is the predicament we face, and what are we not being told?

The painfully clear message from all of this is that lying, cheating, and stealing are all just fine, as long as they support the main policy aims of the times (and perhaps a few current or prospective colleagues). That is a main lesson of LIBOR-gate, and it is ugly.

Which Brings Us to Gold

One of the prime reasons that I support the notion that the price of gold is neither free nor fair is that I think there is an incentive for the US and UK central banks (and the others, too) to have no serious questions raised about fiat money. Gold is the only monetary barometer that exists outside of the world of fiat money.

If the Fed was willing to look the other way while banks colluded to keep LIBOR artificially low because that sent the ‘right’ signal about bank health and boosted profits, do you really think they would not also look the other way if banks could make money by manipulating the gold market into a more stable or even lower price band than it otherwise might occupy?

To me, it is a given that the Fed, et al., would condone literally any and all activities that would boost the apparent health of major banks (their prime clients) and the apparent health of fiat money (their only product). Said more directly, it is unthinkable that they do not have gold squarely in their sights on a daily basis.

The second point I want to make about gold is that with every revelation of fraud and/or price manipulation, I grow more convinced that gold should play an increasing role as an anchor to your portfolio. The lessons of LIBOR-gate suggest a haphazard approach to enforcing the rules and reinforce the idea that perhaps things are a bit worse off under the surface than we’ve been told.

Beyond the regulatory and process lapses (like the oil trading story below) that contribute to both illegal and sanctioned fraud, the most grotesque mispricing of everything begins with the mispricing of money itself. Thanks to three years of money priced at zero percent, the entire system is riddled with distorted prices, especially the price for risk. For example, virtually every pension fund is now essentially forced to lend money to the US government for ten years at 1.5% interest, a ridiculous rate given the risks of inflation and even default that a free market would price very differently.

A final thought here is that we simply cannot trust the prices we see around us as much as we used to. I know that one of the central axioms of traders and reasonable people everywhere is that the market is always right. If the price of gasoline is $3.50/gallon or the price of gold is $1,550/ounce, then those are the correct and right prices.

However, it now seems likely that most of the prices we see are simply reflections of something at once more mundane and sinister: central planning. First they are distorted by the pernicious effects of mispriced money, and second by selective lack of enforcement.

An Unfortunate Lack of Accountability

The many years that Bernie Madoff was able to continue his fraud despite ample and clear proof supplied to the US Securities and Exchange Commission (SEC), coupled with the complete lack of consequences for the named regulators known to have actively ignored the evidence, tell us simply that above certain levels, accountability has all but disappeared.

Can anyone provide a compelling reason why Jon Corzine is not behind bars or charged with something…anything?

Most recently, the SEC declined to press charges against Goldman Sachs for their role in misleading clients about the riskiness of the toxic mortgage products they manufactured and sold.

Goldman dodges SEC bullet over bum mortgage deal

Aug 9, 2012

(MoneyWatch) The Securities and Exchange Commission has ended an investigation intowhether Goldman Sachs misled investors in a $1.3 billion sale of residential mortgage-backed securities arranged by the investment bank in 2006, shortly before the housing crash.

The agency notified Goldman in February that it was looking into whether the company misrepresented the riskiness of a mortgage deal dubbed “Fremont Home Loan Trust 2006-E.” Goldman disclosed in a regulatory filing Thursday that the SEC does not intend to recommend any enforcement action against the company over the deal.

If ever there were a more open and shut case, I would be hard pressed to imagine what it might be. The rules over financial disclosure are quite clear, and everything I understand about Goldman’s actions in selling these securities crossed that line. Recall that in some cases Goldman was packaging these things specifically so that one client (John Paulson) could short them, while selling the other side of the deal to someone else, while failing to disclose that these particular items had been designed to fail.

Further, in 2010 Goldman paid a $550 million fine to settle federal charges that it misled investors and that a Congressional panel had concluded that Goldman had deceived investors. Yet despite all that, the SEC just can’t figure out how to find that any laws have been broken by Goldman here.

Similarly:

Standard Chartered to pay $340 million to settle with N.Y. over Iran charges

Aug 14, 2012

London-based Standard Chartered Bankagreed to pay $340million to settle New York state charges that it illegally funneled hundreds of billions of dollars to Iran, even as other probes by federal regulators are continuing.

New York’s Department of Financial Services surprised fellow regulators last week when it unveiled a blistering report accusing Standard Chartered of conspiring with Iran to launder $250billion from 2001 to 2007 to bypass U.S. economic sanctions.

Note that no criminal charges apply here, just a fine of $340 million (with an “m”) to settle up on a conspiracy where over $250 billion (with a “b”) was involved. Even the idea of ‘punitive’ seems to be beyond the grasp of current regulators and enforcers. Crime does pay and is virtually risk-free from a criminal perspective, but it has to be really big crime and it has to involve a bank.

Meanwhile, the US Commodity Futures Trading Commission (CFTC) is reportedly set to drop a four-year investigation (mainly held in private meetings) into silver manipulation, concluding — surprise! — that no such manipulation exists. Heading up the panel is … wait for it … wait for it … Gary Gensler, a former Goldman executive.

Here we might not be overly impressed with the CFTC for having already missed both the MF Global and Peregrine Financial debacles that happened right under their ineffective regulatory noses, but the real damage is the constant erosion of faith in their obviously broken and sometimes crooked model that selectively enforces rules depending on whether or not the alleged miscreant is a very large institution.

Listen, it is really simple and has always been true: If someone can scam a market and make money, they will. Here’s another potential example:

Was the petrol price rigged too?

Jul 15, 2012

Motorists may have been paying too much for their petrol because banks andother traders are likely to have tried to manipulate oil prices in the same way they rigged interest rates, an official report has warned.

Concerns are growing about the reliability of oil prices, after a report for the G20 found the market is wide open to “manipulation or distortion”.

Traders from banks, oil companies or hedge funds have an “incentive” to distort the market and are likely to try to report false prices, it said.

Petrol retailers use oil price “benchmarks” to decide how much to pay for future supplies.

The rate is calculated by data companies based on submissions from firms which trade oil on a daily basis – such as banks, hedge funds and energy companies.

However, like Libor – the interest rate measure that Barclays was earlier this month found to have rigged – the market is unregulated and relies on the honesty of the firms to submit accurate data about all their trades.

I have no idea if or to what extent the oil markets have been manipulated, but given the fact that the system apparently relies to some degree on the “honesty of the firms to submit accurate data,” I will have to reiterate that anything that can be rigged for profit will be rigged for profit.

While we might gnash our teeth, or become enraged or depressed at this state of affairs and lack of accountability, I think it’s just as healthy to observe that it is what it is and plan accordingly.

In Part II: Protecting Your Wealth, we focus on the strategies and steps we as individuals can take to decrease our vulnerability to the dysfunction, manipulation, and sleight of hand discussed above. The positive reality here is that there are alternatives to playing the game in the casino by the casino’s rules.

Click here to access Part II of this report (free executive summary; paid enrollment required for full access).