Deceiving and lying to the American people is OK:

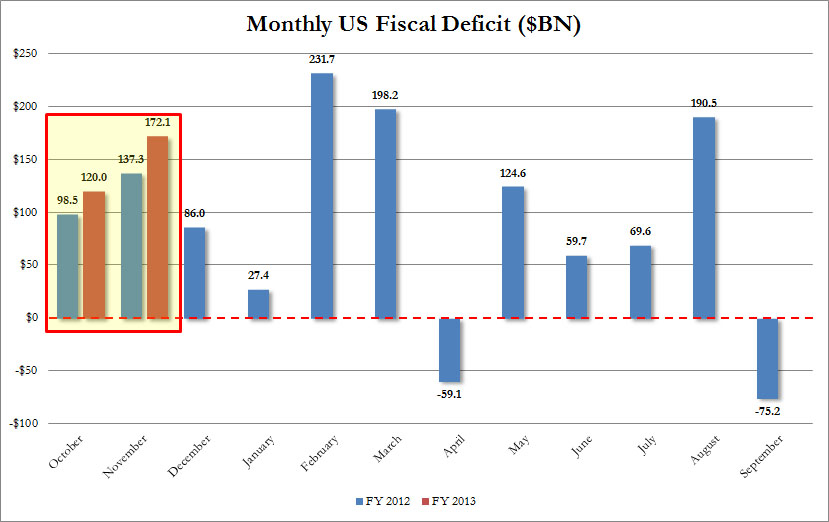

– Welcome to the Recovery (New York Times, by Timothy Geithner, August 2, 2010)

More:

– ‘Stress Test’ Reviewed: Tim Geithner Is ‘A Grifter, A Petty Con Artist’

– Timothy Geithner in January 2013: ‘Extremely Unlikely Will Take A Job In The World Of Finance’

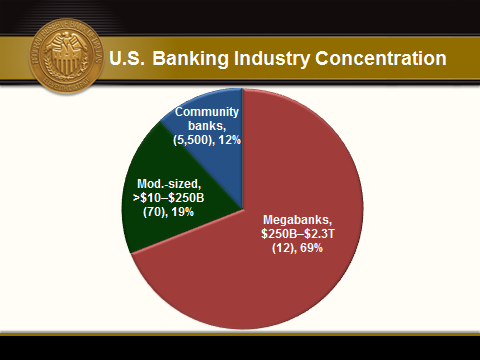

– Matt Taibbi: Geithner Is ‘The Architect Of Too Big To Fail’ (Video)

– Downgrading The US Will Cost S&P $1.5 Billion (ZeroHedge, Jan 20, 2015):

Remember when S&P forgot for a second that it lives in a world of pretend free speech, and where telling the truth would promptly result in a lawsuit by none other than the US government under false pretenses (and from which Buffett darling Moody’s was excluded) after it downgraded the US from AAA to AA+ in the summer of 2011? A downgrade which as Bloomberg previously reported led to this exchange with then Treasury Secretary Tim Geithner: “S&P’s conduct would be looked at very carefully,” Geithner told McGraw according to the filing. “Such behavior would not occur, he said, without a response from the government.”

Well, S&P will never make the same mistake again, because according to Reuters, it will cost it $1.5 billion to settle with the government and put the whole “downgrade” episode in the past.

- S&P SAID IN SETTLEMNT TALKS WITH WITH DOJ,STATES: RTRS

- S&P SAID IN SETTLEMNT TALKS FOR $1.5B: REUTERS

- SEC SAID TO BAN S&P FROM RATING PART OF CMBS MARKET FOR A YEAR

- S&P SETTLEMENT WITH SEC SAID TO INCLUDE $60 MILLION FINE

- S&P SETTLEMENT ON CMBS SAID TO BE ANNOUNCED AS SOON AS TOMORROW

And let that be a lesson to anyone else who thinks the First Amendment is anything but window dressing.