– Geithner’s Legacy: The “0.2%” Hold $7.8 Trillion, Or 69% Of All Assets; And $212 Trillion Of Derivative Liabilities (ZeroHedge, Jan 26, 2013):

As of this morning Tim Geithner is no longer Treasury Secretary. And while Tim Geithner’s reign of clueless pandering to the banks has left the US will absolutely disastrous consequences, an outcome that will become clear in time, the most ruinous of his policies is making the banks which were too big to fail to begin with, so big they can neither fail nor be sued, as the recent fiasco surrounding the exit of Assistant attorney general Lanny Breuer showed. Just how big are these banks? Dallas Fed’s Disk Fisher explains.

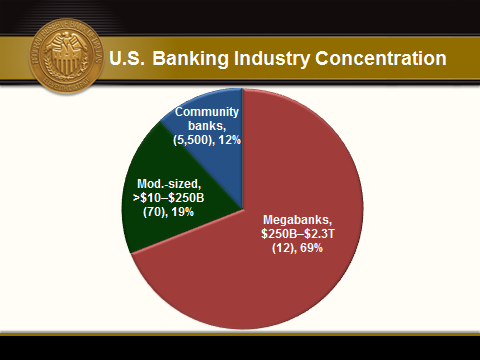

It is important to have an accurate view of the landscape of banking today in order to understand the impact of this proposal.

As of third quarter 2012, there were approximately 5,600 commercial banking organizations in the U.S. The bulk of these—roughly 5,500—were community banks with assets of less than $10 billion. These community-focused organizations accounted for 98.6 percent of all banks but only 12 percent of total industry assets. Another group numbering nearly 70 banking organizations—with assets of between $10 billion and $250 billion—accounted for 1.2 percent of banks, while controlling 19 percent of industry assets. The remaining group, the megabanks—with assets of between $250 billion and $2.3 trillion—was made up of a mere 12 institutions. These dozen behemoths accounted for roughly 0.2 percent of all banks, but they held 69 percent of industry assets.

What does this mean numerically?