– Tomgram: Nomi Prins, All in the Family Trump:

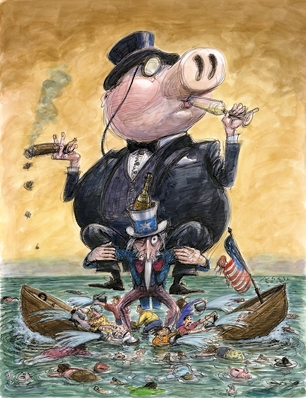

President Trump, his children and their spouses, aren’t just using the Oval Office to augment their political legacy or secure future riches. Okay, they certainly are doing that, but that’s not the most useful way to think about what’s happening at the moment. Everything will make more sense if you reimagine the White House as simply the newest branch of the Trump family business empire, its latest outpost.

It turns out that the voters who cast their ballots for Donald Trump, the patriarch, got a package deal for his whole clan. That would include, of course, first daughter Ivanka who, along with her husband, Jared Kushner, is now a key political adviser to the president of the United States. Both now have offices in the White House close to him. They have multiple security clearances, access to high-level leaders whenever they visit the Oval Office or Mar-a-Lago, and the perfect formula for the sort of brand-enhancement that now seems to come with such eminence. President Trump may have an exceedingly “flexible” attitude toward policymaking generally, but in one area count on him to be stalwart and immobile: his urge to run the White House like a business, a family business.

The ways that Jared, “senior adviser to the president,” and Ivanka, “assistant to the president,” have already benefited from their links to “Dad” in the first 100 days of his presidency stagger the imagination. Ivanka’s company, for instance, won three new trademarks for its products from China on the very day she dined with President Xi Jinping at her father’s Palm Beach club.

Read moreNomi Prins: The Empire Expands (Not The American One; Trump’s)