Flashback:

– Gold & Silver Prices Under The Weimar Republic’s Inflation

* * *

Please support I. U.

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

The man who trades freedom for security does not deserve nor will he ever receive either. – Benjamin Franklin

The World’s Most Famous Case of Hyperinflation (Part 1)

The Money Project is an ongoing collaboration between Visual Capitalist and Texas Precious Metals that seeks to use intuitive visualizations to explore the origins, nature, and use of money.

The Great War ended on the 11th hour of November 11th, 1918, when the signed armistice came into effect.

Though this peace would signal the end of the war, it would also help lead to a series of further destruction: this time the destruction of wealth and savings.

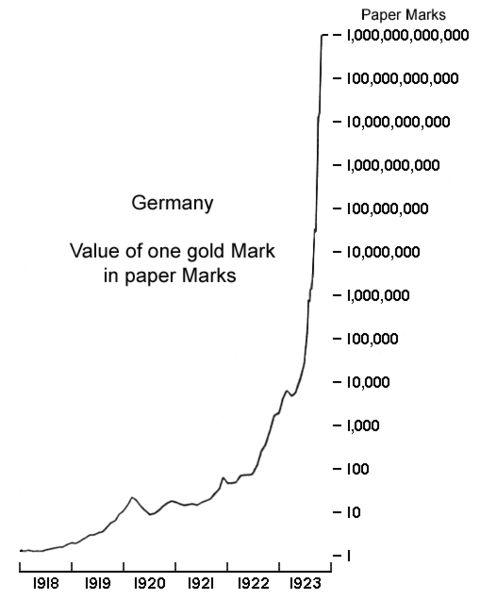

The world’s most famous hyperinflation event, which took place in Germany from 1921 and 1924, was a financial calamity that led millions of people to have their savings erased.

The Treaty of Versailles

Five years after the assassination of Archduke Franz Ferdinand, the Treaty of Versailles was signed, officially ending the state of war between Germany and the Allies.

The terms of the agreement, which were essentially forced upon Germany, made the country:

- Accept blame for the war

- Agree to pay £6.6 billion in reparations (equal to $442 billion in USD today)

- Forfeit territory in Europe as well as its colonies

- Forbid Germany to have submarines or an air force, as well as a limited army and navy

- Accept the Rhineland, a strategic area bordering France and other countries, to be fully demilitarized.

“I believe that the campaign for securing out of Germany the general costs of the war was one of the most serious acts of political unwisdom for which our statesmen have ever been responsible.”

– John Maynard Keynes, representative of the British TreasuryKeynes believed the sums being asked of Germany in reparations were many times more than it was possible for Germany to pay. He thought that this could create large amounts of instability with the global financial system.

The Catalysts

1. Germany had suspended the Mark’s convertibility into gold at the beginning of war.

This created two separate versions of the same currency:

Goldmark: The Goldmark refers to the version on the gold standard, with 2790 Mark equal to 1 kg of pure gold. This meant: 1 USD = 4 Goldmarks, £1 = 20.43 Goldmarks

Papiermark: The Papiermark refers to the version printed on paper. These were used to finance the war.

In fear that Germany would run the printing presses, the Allies specified that reparations must be paid in the Goldmarks and raw materials of equivalent value.2. Heavy Debt

Even before reparations, Germany was already in significant debt. The country had borrowed heavily during the war with expectations that it would be won, leaving the losers repay the loans.

Adding together previous debts with the reparations, debt exceeded Germany’s GDP.

3. Inability to Pay

The burden of payments was high. The country’s economy had been damaged by the war, and the loss of Germany’s richest farmland (West Prussia) and the Saar coalfields did not help either.

Foreign speculators began to lose confidence in Germany’s ability to pay, and started betting against the Mark.

Foreign banks and businesses expected increasingly large amounts of German money in exchange for their own currency. It became very expensive for Germany to buy food and raw materials from other countries.

Germany began mass printing bank notes to buy foreign currency, which was in turn used to pay reparations.

4. Invasion of The Ruhr

After multiple defaults on payments of coal and timber, the Reparation Commission voted to occupy Germany’s most important industrial lands (The Ruhr) to enforce the payment of reparations.

French and Belgian troops invaded in January 1923 and began The Occupation of The Ruhr.

German authorities promoted the spirit of passive resistance, and told workers to “do nothing” to help the invaders. In other words, The Ruhr was in a general strike, and income from one of Germany’s most important industrial areas was gone.

On top of that, more and more banknotes had to be printed to pay striking workers.

Hyperinflation

Just two calendar years after the end of the war, the Papiermark was worth 10% of its original value. By the end of 1923, it took 1 trillion Papiermarks to buy a single Goldmark.

All cash savings had lost their value, and the prudent German middleclass savers were inexplicably punished.

Learn about the effects of German hyperinflation, how it was curtailed, and about other famous hyperinflations in Part 2 (released sometime the week of Jan 18-22, 2016).

– Weimar Greece – The Effects Of A Currency Collapse:

Cash is a scarce commodity in Greece.

In June, Greek banks declared a surprise limitation on how much could be withdrawn from an account. At present, the government still limits the cash withdrawals of Greeks.

And, of course, this is just the most recent in a series of events that make up the cash squeeze. In response, Greeks have done what all people do when they cannot get enough currency – they improvise.

“And just like that Weimar 2.0 is born.“

– “The Government Is Literally Paying Itself” – Citi Calls For Money Paradrops:

Last Friday, we posted what we thought was a watershed report by Australia’s largest investment bank Macquarie, one which openly called for central bank funding of fiscal spending, aka “helicopter money”, by directly monetizing treasuries. Ironically, the bank made the call despite admitting that it would not work in the long run, leading to even more stagflation and deflation. This was the gist:

As velocity of money globally continues to fall, conventional QEs have to become exponentially larger, as marginal benefit declines. If public sector is not prepared to step aside, what other measures can be introduced to support nominal GDP and avoid deflation?

Read more“The Government Is Literally Paying Itself” – Citi Calls For Money Paradrops

In 1920 gold fell, then it soared!

– Gold/Silver Prices Under the Weimar Republic’s Inflation (Daily Paul, Dec 21, 2010):

Stole this from another article/blogger.

Quote:

“On a closing note, because I forgot last week, I would like to share with everyone just how the price of silver and gold escalated in German Mark terms, through the Weimar experience:

Hyperinflation: Wiemar, Germany January 1919 to November 1923

[Expressed in German Marks needed to by an oz. of ag. or au.]”Jan. 1919

Silver 12

Gold 170May. 1919

Silver 17

Gold 267Sept. 1919

Silver 31

Gold 499Jan. 1920

Silver 84

Gold 1,340May 1920

Silver 60

Gold 966Sept. 1921

Silver 80

Gold 2,175Jan. 1922

Silver 249

Gold 3,976May. 1922

Silver 375

Gold 6,012Sept. 1922

Silver 1899

Gold 30,381Read moreGold & Silver Prices Under The Weimar Republic’s Inflation

Added: Jun 29, 2014

Description:

Chris Martenson, who holds a PhD in pathology and an MBA, contends 2008 was just a warm up to a much bigger calamity. Martenson says, “2008 was the shot across the bow, and that’s when our credit experiment broke, and we have been doing everything possible to paper over it since. . . . When you take real stuff out of the ground, you grow food, you take oil out of the ground, you process ore into steel, and you manufacture real things–that’s real wealth. The claims (such as stocks, bonds and currencies) have to be in proportion to the real wealth, and the claims have been growing and growing and growing for so long that they are way out of balance to the real stuff, and the real stuff isn’t growing like it used to. You can see that in the GDP numbers for the U.S. or the world at large. Growth is slowing, slowing, slowing, and the claims are getting larger and larger. This represents a huge and gigantic source of potential energy. There is a gap there and it’s going to get closed. Only one of two things are going to happen: (1) real stuff starts expanding like crazy, or (2) the claims get destroyed. That’s what we are talking about when we talk about a market crash. The claims get destroyed. People get wiped out. The people who don’t get ruined are people safely over in the real wealth already. If you own an unencumbered farm, if you own a productive asset, if you own gold or silver, or if you own your house outright, you are going to be vastly safer than . . . someone who is leveraged and hinged into this other system.”

Join Greg Hunter as he goes One-on-One with Chris Martenson co-founder of PeakProsperity.com.

– Quantitative Easing Worked For The Weimar Republic For A Little While Too (Economic Collapse, Sep 22, 2013):

There is a reason why every fiat currency in the history of the world has eventually failed. At some point, those issuing fiat currencies always find themselves giving in to the temptation to wildly print more money. Sometimes, the motivation for doing this is good. When an economy is really struggling, those that have been entrusted with the management of that economy can easily fall for the lie that things would be better if people just had “more money”. Today, the Federal Reserve finds itself faced with a scenario that is very similar to what the Weimar Republic was facing nearly 100 years ago. Like the Weimar Republic, the U.S. economy is also struggling and like the Weimar Republic, the U.S. government is absolutely drowning in debt. Unfortunately, the Federal Reserve has decided to adopt the same solution that the Weimar Republic chose. The Federal Reserve is recklessly printing money out of thin air, and in the short-term some positive things have come out of it. But quantitative easing worked for the Weimar Republic for a little while too. At first, more money caused economic activity to increase and unemployment was low. But all of that money printing destroyed faith in German currency and in the German financial system and ultimately Germany experienced an economic meltdown that the world is still talking about today. This is the path that the Federal Reserve is taking America down, but most Americans have absolutely no idea what is happening.

It is really easy to start printing money, but it is incredibly hard to stop. Like any addict, the Fed is promising that they can quit at any time, but this month they refused to even start tapering their money printing a little bit. The behavior of the Fed is so shameful that even CNBC is comparing it to a drug addict at this point:

Read moreQuantitative Easing Worked For The Weimar Republic For A Little While Too

Flashback:

– Inflation, Hyperinflation and Real Estate (Price Collaps)

– Argentina’s Economic Collapse (Documentary)

Related info:

– German Weimar Republic in the early 1920s and the U.S. – Troubling similarities

– Charts: Germany, during the Weimar Republic & the hyperinflation

FYI.

– Federal Reserve Money Printing Is The Real Reason Why The Stock Market Is Soaring (Economic Collapse, Jan 28, 2013):

You can thank the reckless money printing that the Federal Reserve has been doing for the incredible bull market that we have seen in recent months. When the Federal Reserve does more “quantitative easing”, it is the financial markets that benefit the most. The Dow and the S&P 500 have both hit levels not seen since 2007 this month, and many analysts are projecting that 2013 will be a banner year for stocks. But is a rising stock market really a sign that the overall economy is rapidly improving as many are suggesting? Of course not. Just because the Federal Reserve has inflated another false stock market bubble with a bunch of funny money does not mean that the U.S. economy is in great shape. In fact, the truth is that things just keep getting worse for average Americans. The percentage of working age Americans with a job has fallen from 60.6% to 58.6% while Barack Obama has been president, 40 percent of all American workers are making $20,000 a year or less, median household income has declined for four years in a row, and poverty in the United States is absolutely exploding. So quantitative easing has definitely not made things better for the middle class. But all of the money printing that the Fed has been doing has worked out wonderfully for Wall Street. Profits are soaring at Goldman Sachs and luxury estates in the Hamptons are selling briskly. Unfortunately, this is how things work in America these days. Our “leaders” seem far more concerned with the welfare of Wall Street than they do about the welfare of the American people.

Read more‘Federal Reserve Money Printing Is The Real Reason Why The Stock Market Is Soaring’

– The Germans don’t trust Obama with their gold – and can you blame them? (Telegraph, Jan 18, 2013):

Back in the mid-1920s, the head of the German Central Bank, Herr Hjalmar Schacht, went to New York to see Germany’s gold. However the NY Fed officials were unable to find the palette of Germany’s gold bullion. The Chairman of the Federal Reserve, Benjamin Strong was mortified, but to put him at ease Herr Schacht turned to him and said ‘Never mind, I believe you when you when you say the gold is there. Even if it weren’t you are good for its replacement.’ (H/T The Real Asset Company)

But that was then and this is now. In the eyes of the Germans – and who can blame them? – America has lost its mojo to such a degree that it can no longer be trusted honour its debts, even in the unlikely event that it were financially capable of doing so. Which is why, following in the footsteps of Venezuela’s Hugo Chavez (who may be an idiot but is definitely no fool), Germany is repatriatriating its gold from the US federal reserve. It will now be stored in Frankfurt.

This is an important story. One of the most spectacular con tricks of the last twelve months, pulled off by our political class with the connivance of much of the media, is that we’ve escaped the global economic armageddon which looked till quite recently as if it was going to engulf us. The Euro didn’t collapse; Europe isn’t in flames; QE hasn’t led to Weimar-style hyperinflation; the fiscal cliff has been dodged; Britain hasn’t yet lost its triple A credit rating; the bond markets haven’t gone postal…

Well it may look calm on the surface, but this latest move by the Bundesbank gives us a pretty good indication that beneath the surface that serene-seeming swan is paddling for dear life.

If you want a full analysis I recommend this excellent summary by Jan Skoyles. The scary part is this bit:

Read moreThe Germans Don’t Trust Obama With Their Gold – And Can You Blame Them?

– Cashin Remembers Germany’s Hyperinflation Birthday (ZeroHedge, Oct 11, 2012):

Via Art Cashin of UBS,Originally, on this day in 1922, the German Central Bank and the German Treasury took an inevitable step in a process which had begun with their previous effort to “jump start” a stagnant economy. Many months earlier they had decided that what was needed was easier money. Their initial efforts brought little response. So, using the governmental “more is better” theory they simply created more and more money. But economic stagnation continued and so did the money growth. They kept making money more available. No reaction. Then, suddenly prices began to explode unbelievably (but, perversely, not business activity).

Read moreUBS’ Art Cashin Remembers Germany’s Hyperinflation Birthday

– Next Stop: Dow 100,000 (ZeroHedge, May 15, 2012):

We thought that Jeremy Siegel, Laszlo “the Ruler” Birinyi and Jim Altucher were optimistic with their stock market targets. Sadly, with their equal to or less than 20,000 Dow Jones predictions, the three merely come off as rank amateurs, especially when compared to the forecast of BNP’s head of fixed income Philippe Gijesels, who sees the stock market at 100,000 at some point over the next 25 years. However, unlike the previous trio who bases its forecasts on misguided expectations of economic growth, Gijesels may actually end up being right, because his estimate is predicated on one simple thing: hyperinflation, or specifically 12.2% inflation each year, which for a country like America is tantamount to the dreaded H-word. The other premise used by Gijesels: too much debt which has to be inflated. And actually, he is spot on. The only problem is that when the Dow hits 100,000 due to money printing, which is his underlying thesis, one will needed scientific notation to express the price of any hard asset (and most certainly gold), because if America falls in a two-decade long Weimar republic phase, the Dow may well be 100,000 or 100 googol – the truth is it won’t matter as the money this number translated to would be absolutely meaningless. Just ask the Weimar Germans, who may have had some tremendous monthly increases in their 401(k) statements, but all they really cared about is whether they had the latest and most fashionable wheelbarrow model.

– Hugh Hendry On Europe “You Can’t Make Up How Bad It Is” (ZeroHedge, May 2, 2012):

At The Milken Institute conference yesterday, Hugh Hendry delivered his usual eloquent and critical insights on the state of Europe. Beginning with the statement that “All of Europe has defaulted”, the canny-wee-fella (translation: shrewd and cautious young chap) explained that “The political economy in Europe is such that the politicians chose to default on their spending obligations to their citizens in order to honor the pact with their financial creditors and so as time goes on, the politicians are being rejected.” Between France’s election of Mr. Hollande and Luxembourg’s ‘when times get tough you have to lie’ Juncker, Hendry says the only inspiration for Europe is fiction as “you just can’t make up how bad it is” as he goes on to discuss the precedent for a way forward, the grotesque distortions of fixed exchange rate regimes, why Weimar happened, why the transfer union will never happen, Ayn Rand’s reality, and fear politicians are feeling.

“Hyperinflation accompanied by a housing collapse is simply impossible—by definition.”

– None-too-clever financial blogger.Most people in the advanced economies—including most economists—really don’t have any idea what inflation and hyperinflation is. They don’t have a clue because they haven’t lived through it, or were children when it happened in the States and in Europe during the Seventies.

Read moreInflation, Hyperinflation and Real Estate (Price Collaps)

See also:

– Federal Reserve To Spend $600 Billion More To Destroy The US Dollar And The Middle Class

As is all too well known by now, starting over the next few days, the Fed will commence purchasing $75 billion in Treasury securities monthly until the end of June, and will buy an additional $35 billion in Treasurys to make up for declining holdings of MBS (due to repurchases).

We still believe that as a result of the imminent drop in rates (especially those around the curve belly), as we have claimed for over a month, the feedback loop that will be created will result in a far greater repurchase frequency of MBS securities over the next 8 months, and we would not be surprised if at some point in Q2 2011, the Fed is buying $150 billion in Treasurys monthly.

Since nobody will believe this until it is actually confirmed by the H.4.1., we will leave this topic alone for the time being. And after all its will “only” mean a rotation of Fed holdings, a switch in duration, and an impact on the shape of curve. What is certain is that on June 30, the Fed’s balance sheet will have $2.68 trillion (or more) in holdings, of which $1.77 trillion will be in Treasurys, compared to the $840 billion today.

What is also certain is that the Fed will not be able to stop there. Which is why we have extended the projection period through January 2012. At that point the Fed will hold $2.6 trillion in US Treasuries, or roughly 25% of total US marketable debt at that point.

And for those who collect now completely irrelevant statistics, the Fed will surpass China’s $868 billion in UST holdings before the end of November. Yes, ladies and gentlemen, shit just got real.

Incidentally, nowhere do we assume that the Fed will have launched QE 3, 4, and so forth, over the next 12 months, even though we now estimate the probability of America becoming an exponentially self-monetizing, Weimar-type case study in hyperinflation at over 50%.

Submitted by Tyler Durden on 11/03/2010 22:14 -0500

Source: ZeroHedge

Highly recommended reading.

The Greatest Depression is here.

When Fed Chairman Ben Bernanke admits to seeing an “unusually uncertain” economy ahead, it’s pretty terrifying to imagine what he’s really thinking. What John Williams envisions-and he’s by no means looking to the far horizon-is a systemic collapse, a hyperinflationary great depression and the cessation of normal commerce. Despite that bleak outlook, however, when the economist and editor of ShadowStats.com sat down for this exclusive Energy Report interview, he also had some good news.

The Energy Report: A few months back, John, you said, “if you strangle liquidity you always contract an economy and deliberately or not, liquidity is being strangled, resulting in sharp declines in consumer credit, commercial and industrial loans.” Does this mean it would spur more economic growth if banks actually started lending?

John Williams: It sure wouldn’t hurt. We’re still seeing contractions in liquidity, and that’s adjusted for inflation. In real terms, M3 money supply is down almost 8% year-over-year. It’s the sharpest fall in the post -World War II era. It’s not so much the depth of the decline in the liquidity or the duration, but the fact that the liquidity turns negative year-over-year that signals the economy turning down.

We had the signal in December of 2009 indicating intensification of the downturn, in this case, within six to nine months. We’re in that timeframe now and see softening numbers. People are talking about a weaker economy. Even Mr. Bernanke has described the economy as “unusually uncertain” in terms of its outlook. Wording like that from the Fed is a pretty good indication that something’s afoot.

The US is already beyond hope!

See also:

– John Williams of Shadowstats: Prepare For The Hyperinflationary Great Depression

This is the Greatest Depression.

Courtesy of John WilliamsEconomist/statistician John Williams shifts through the government’s rose-tinted data

Do you believe everything the government tells you? Economist and statistician John Williams sure doesn’t. Williams, who has consulted for individuals and Fortune 500 companies, now uncovers the truth behind the U.S. government’s economic numbers on his Web site at ShadowStats.com. Williams says, over the last several decades, the feds have been infusing their data with optimistic biases to make the economy seem far rosier than it really is. His site reruns the numbers using the original methodology. What he found was not good.

Maymin: So we are technically bankrupt?

Williams: Yes, and when countries are in that state, what they usually do is rev up the printing presses and print the money they need to meet their obligations. And that creates inflation, hyperinflation, and makes the currency worthless.

Obama says America will go bankrupt if Congress doesn’t pass the health care bill.

Well, it’s going to go bankrupt if they do pass the health care bill, too, but at least he’s thinking about it. He talks about it publicly, which is one thing prior administrations refused to do. Give him credit for that. But what he’s setting up with this health care system will just accelerate the process.

Where are we right now?

In terms of the GDP, we are about halfway to depression level. If you look at retail sales, industrial production, we are already well into depressionary. If you look at things such as the housing industry, the new orders for durable goods we are in Great Depression territory. If we have hyperinflation, which I see coming not too far down the road, that would be so disruptive to our system that it would result in the cessation of many levels of normal economic commerce, and that would throw us into a great depression, and one worse than was seen in the 1930s.

What kind of hyperinflation are we talking about?

I am talking something like you saw with the Weimar Republic of the 1930s. There the currency became worthless enough that people used it actually as toilet paper or wallpaper. You could go to a fine restaurant and have an expensive dinner and order an expensive bottle of wine. The next morning that empty bottle of wine is worth more as scrap glass than it had been the night before filled with expensive wine.

We just saw an extreme example in Zimbabwe. … Probably the most extreme hyperinflation that anyone has ever seen. At the same time, you still had a functioning, albeit troubled, Zimbabwe economy. How could that be? They had a workable backup system of a black market in U.S. dollars. We don’t have a backup system of anything. Our system, with its heavy dependence on electronic currency, in a hyperinflation would not do well. It would probably cease to function very quickly. You could have disruptions in supply chains to food stores. The economy would devolve into something like a barter system until they came up with a replacement global currency.

What can we do to avoid hyperinflation? What if we just shut down the Fed or something like that?

We can’t. The actions have already been taken to put us in it. It’s beyond control. The government does put out financial statements usually in December using generally accepted accounting principles, where unfunded liabilities like Medicare and Social Security are included in the same way as corporations account for their employee pension liabilities. And in 2008, for example, the one-year deficit was $5.1 trillion dollars. And that’s instead of the $450 billion, plus or minus, that was officially reported.

Wow.

These numbers are beyond containment. Even the 2008 numbers, you can take 100 percent of people’s income and corporate profit and you’d still be in deficit. There’s no way you can raise enough money in taxes.

What about spending?

If you eliminated all federal expenditures except for Medicare and Social Security, you’d still be in deficit. You have to slash Social Security and Medicare. But I don’t see any political will to rein in the costs the way they have to be reined in. There’s just no way it can be contained. The total federal debt and net present value of the unfunded liabilities right now totals about $75 trillion. That’s five times the level of GDP.

John Williams, who runs the popular counter government data manipulation site Shadowstats, has thrown down the gauntlet to deflationists, and in an extensive report concludes that the probability of a hyperinflationary episode in America over the next year has reached critical levels. While the debate between deflationists and (hyper)inflationists has been a long and painful one, numerous events set off in motion by the Bernanke Fed (as a direct legacy of the Greenspan multi-decade period of cheap and boundless credit) may have well cast America as the unwilling protagonist in the sequel of the failed monetary policy economic experiment better known as Zimbabwe.

Williams does not mince his words:

The U.S. economic and systemic solvency crises of the last two years are just precursors to a Great Collapse: a hyperinflationary great depression. Such will reflect a complete collapse in the purchasing power of the U.S. dollar, a collapse in the normal stream of U.S. commercial and economic activity, a collapse in the U.S. financial system as we know it, and a likely realignment of the U.S. political environment. The current U.S. financial markets, financial system and economy remain highly unstable and vulnerable to unexpected shocks. The Federal Reserve is dedicated to preventing deflation, to debasing the U.S. dollar. The results of those efforts are being seen in tentative selling pressures against the U.S. currency and in the rallying price of gold.

And even as Bernanke continues existing in a factless vacuum where he sees no asset bubbles, Williams takes aim at the one party almost exclusively responsible for the economic carnage that will soon transpire:

The crises have been generated out of and are centered on the United States financial system, triggered by the collapse of debt excesses actively encouraged by the Greenspan Federal Reserve. Recognizing that the U.S. economy was sagging under the weight of structural changes created by government trade, regulatory and social policies — policies that limited real consumer income growth — Mr. Greenspan played along with the political and banking systems. He made policy decisions to steal economic activity from the future, fueling economic growth of the last decade largely through debt expansion.

The Greenspan Fed pushed for ever-greater systemic leverage, including the happy acceptance of new financial products, which included instruments of mis-packaged lending risks, designed for consumption by global entities that openly did not understand the nature of the risks being taken. Complicit in this broad malfeasance was the U.S. government, including both major political parties in successive Administrations and Congresses.

As with consumers, the federal government could not make ends meet while appeasing that portion of the electorate that could be kept docile by ever-expanding government programs and increasing government spending. The solution was ever-expanding federal debt and deficits.Purportedly, it was Arthur Burns, Fed Chairman under Richard Nixon, who first offered the advice that helped to guide Alan Greenspan and a number of Administrations. The gist of the wisdom imparted was that if you ran into problems, you could ignore the budget deficit and the dollar. Ignoring them did not matter, because doing so would not cost you any votes.

Back in 2005, I raised the issue of a then-inevitable U.S. hyperinflation with an advisor to both the Bush Administration and Fed Chairman Greenspan. I was told simply that “It’s too far into the future to worry about.”Indeed, pushing the big problems into the future appears to have been the working strategy for both the Fed and recent Administrations. Yet, the U.S. dollar and the budget deficit do matter, and the future is at hand. The day of ultimate financial reckoning has arrived, and it is playing out.

Looking at the events over the past year demonstrates that Williams is not just being a drama queen.

Effective financial impairments and at least partial nationalizations or orchestrated bailouts/takeovers resulted for institutions such as Bear Stearns, Citigroup, Washington Mutual, AIG, General Motors, Chrysler, Fannie Mae and Freddie Mac, along with a number of further troubled financial institutions. The Fed moved to provide whatever systemic liquidity would be needed, while the federal government moved to finance corporate bailouts and to introduce significant stimulus spending.

Curiously, though, the Fed and the Treasury let Lehman Brothers fail outright, which triggered a foreseeable run on the system and markedly intensified the systemic solvency crisis in September 2008. Whether someone was trying to play political games, with the public and Congress increasingly raising questions of moral hazard issues, or whether the U.S. financial wizards missed what would happen or simply moved to bring the crisis to a head, remains to be seen.

More on the impending timing of the complete economic collapse of the US financial system:

Read moreJohn Williams of Shadowstats: Prepare For The Hyperinflationary Great Depression

The Bank of England voted today to begin quantitative easing – printing money to you and me – in a last ditch attempt to save the UK from the twin threats of depression and deflation.

It is a decision that is fraught with risks.

The hope is that the money pumped into the economy will encourage banks to become more relaxed about lending to individuals and businesses.

Flush with extra cash we will all rush out to spend it, kickstarting the economy and dragging it out of recession. Governor of the Bank of England, Mervyn King, will get a well deserved knighthood, and the rest of us will all breathe a sigh of relief and carry on as before, a little poorer, a little wiser, but generally OK.

But, none of the above is certain.

Banks might prefer to sit on the cash resulting in continued gridlock in the borrowing market. Impact: a big fat zero.

If too much money is pumped into the economy inflation or even hyper-inflation becomes a real threat. Impact: an unwelcome return to the 1970s.

Read moreThe dangers of printing money: four lessons from history

Added: Oct. 13, 2008

Source: YouTube