In 1920 gold fell, then it soared!

– Gold/Silver Prices Under the Weimar Republic’s Inflation (Daily Paul, Dec 21, 2010):

Stole this from another article/blogger.

Quote:

“On a closing note, because I forgot last week, I would like to share with everyone just how the price of silver and gold escalated in German Mark terms, through the Weimar experience:

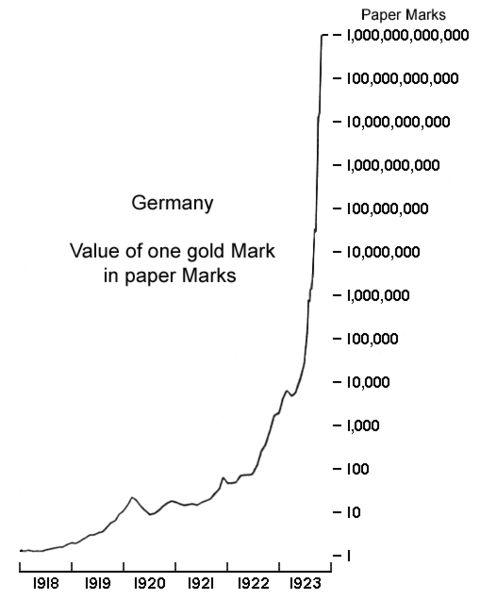

Hyperinflation: Wiemar, Germany January 1919 to November 1923

[Expressed in German Marks needed to by an oz. of ag. or au.]”Jan. 1919

Silver 12

Gold 170May. 1919

Silver 17

Gold 267Sept. 1919

Silver 31

Gold 499Jan. 1920

Silver 84

Gold 1,340May 1920

Silver 60

Gold 966Sept. 1921

Silver 80

Gold 2,175Jan. 1922

Silver 249

Gold 3,976May. 1922

Silver 375

Gold 6,012Sept. 1922

Silver 1899

Gold 30,381Jan. 1923

Silver 23,277

Gold 372,447May. 1923

Silver 44,397

Gold 710,355June 5, 1923

Silver 80,953

Gold 1,295,256July 3, 1923

Silver 207,239

Gold 3,315,831Aug. 7, 1923

Silver 4,273,874

Gold 68,382,000Sept. 4, 1923

Silver 16,839,937

Gold 269,429,000Oct. 2, 1923

Silver 414,484,000

Gold 6,631,749,000Oct. 9, 1923

Silver 1,554,309,000

Gold 24,868,950,000Oct. 16, 1923

Silver 5,319,567,000

Gold 84,969,072,000Oct. 23, 1923

Silver 7,253,460,000

Gold 1,160,552,662,000Oct. 30, 1923

Silver 8,419,200,000

Gold 1,347,070,000,000Nov. 5, 1923

Silver 54,375,000,000

Gold 8,700,000,000,000Nov. 13, 1923

Silver 108,750,000,000

Gold 17,400,000,000,000Nov. 30, 1923

Silver 543,750,000,000

Gold 87,000,000,000,000

Monopoly Money on steroids in slightly less than 5 years.

what happened after that? 1924, 1925 and so on

What history often hides in these economic destructions is what did an ounce of silver actually buy during this period? What did an ounce of gold buy?

I have heard through the grapevine that in Venezuela hyperinflation an ounce of silver fed you for a month and an average hone could be bought for a few ounces of gold. These details seemed to be lost to the world wind of history .

25 ounces of gold bought a city block of real estate. At about 160/1 ratio that same investment is 4000 ounces of silver.

I highly recommend you read the book, “When Money Dies” by the UK Author Adam Fergusson. It tells the story of how the Weimar Hyper-Inflation affected the average citizens of Germany, Austria and Hungry. In October of 1923 Germany’s Inflation Rate hit

29,000% for the month. Those who fail to see the relevance of history are condemned to relive it again. The exponent growth of US debt as an average is every 100 days the gov’t borrows another USD 1,000,000,000,000 Trillion dollars 1 Trillion seconds is appoximately 32,000 years. Interest on the US Debt of 34.3 Trillion is now $1,000,000,000,000 Trillion. What could possible go wrong?

the numbers from 0ct 23 1923 must be wrong. the gold : silver ratio goes from 1:16 to 1:160. So you must have added an zero to the gold price from oct 23 1923 forward. It doesn’t make sense.