– Bank Of Russia Calls “Emergency” Meeting To Address Ruble Rout:

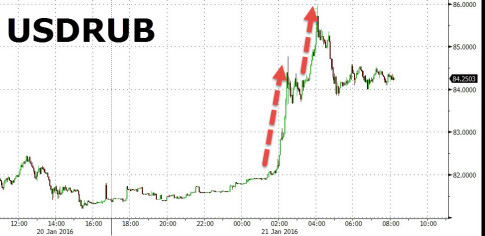

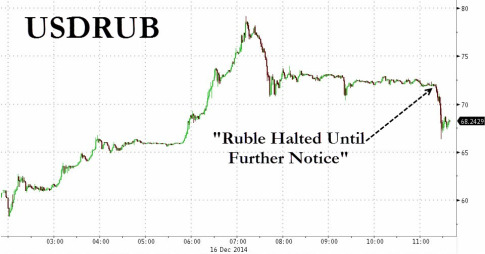

Earlier today, we highlighted a dramatic plunge in the Russian ruble which has crashed to record lows against the dollar after staging its steepest two-day decline in nine months.

The sharp (and seemingly inexorable) decline in crude prices combined with Western economic sanctions and geopolitical turmoil have weighed on the currency of late and in the midst of a new leg down in oil, investors appear to be panic selling.

“Some investors are selling at any price,” Bernd Berg, an emerging-markets strategist in London at Societe Generale told Bloomberg by e-mail.

And even as Russian central bank Deputy Chairman Vasily Pozdyshev swears “there’s no systemic risk,” the Bank of Russia has now called an emergency meeting with state-run and private lenders to discuss the FX bloodbath.

Read moreBank Of Russia Calls “Emergency” Meeting To Address Ruble Rout