Back in May we first introduced our readers to the FX manipulation practice known as “last look.” Wait, what’s that? This is what we said:

The last look practice is a legacy of over-the-phone currency trading, when traders would take a final check of the market before executing an order. It has survived even as foreign-exchange trading moved onto electronic platforms, leaving banks with the option to back out of an order after it was accepted by a client.

Forex

Swiss Shocker Triggers Gigantic Losses For Banks, Hedge Funds And Currency Traders

– Swiss Shocker Triggers Gigantic Losses For Banks, Hedge Funds And Currency Traders (Economic Collapse, Jan 19, 2015):

The absolutely stunning decision by the Swiss National Bank to decouple from the euro has triggered billions of dollars worth of losses all over the globe. Citigroup and Deutsche Bank both say that their losses were somewhere in the neighborhood of 150 million dollars, a major hedge fund that had 830 million dollars in assets at the end of December has been forced to shut down, and several major global currency trading firms have announced that they are now insolvent. And these are just the losses that we know about so far. It will be many months before the full scope of the financial devastation caused by the Swiss National Bank is fully revealed. But of course the same thing could be said about the crash in the price of oil that we have witnessed in recent weeks. These two “black swan events” have set financial dominoes in motion all over the globe. At this point we can only guess how bad the financial devastation will ultimately be.

But everyone agrees that it will be bad. For example, one financial expert at Boston University says that he believes the losses caused by the Swiss National Bank decision will be in the billions of dollars…

“The losses will be in the billions — they are still being tallied,” said Mark T. Williams, an executive-in-residence at Boston University specializing in risk management. “They will range from large banks, brokers, hedge funds, mutual funds to currency speculators. There will be ripple effects throughout the financial system.”

Read moreSwiss Shocker Triggers Gigantic Losses For Banks, Hedge Funds And Currency Traders

Knight 2.0: Jefferies Rescues FXCM With $300 Million Bailout, CNBC Reports

– Knight 2.0: Jefferies Rescues FXCM With $300 Million Bailout, CNBC Reports (ZeroHedge, Jan 16, 2015):

In an apparent replay for 2012’s Knight Trading algo-implosion $400 million cash-infusion bailout, Jefferies (owned by NY-based I-bank Leucadia) is riding its white horse to the rescue of FXCM and its $200-million-plus client losses:

- *LUK IN $300M DEAL TO LET FXCM CONTINUE NORMAL OPS: CNBC

- *LEUCADIA GIVE FXCM $300M IN FINANCING CNBC

Leucadia will get $250m in senior notes as part of the deal, CNBC says. So – in summary – a central bank blew up an FX broker and a mid-market junk-bond underwriter bailed them out… must be good for a green close for the week in stocks!

Read moreKnight 2.0: Jefferies Rescues FXCM With $300 Million Bailout, CNBC Reports

Deutsche, Interactive Brokers, Barclays Lost Hundreds Of Millions Due To Swiss Franc Volatility

– Deutsche, Interactive Brokers, Barclays Lost Hundreds Of Millions Due To Swiss Franc Volatility (ZeroHedge, Jan 16, 2015):

Yesterday, in the aftermath of the Swiss shocker, we tweeted what was quite obvious to anyone who realized that speculators were most short the CHF since the summer of 2013:

The SNB just blew up countless macro hedge funds

— zerohedge (@zerohedge) January 15, 2015

We have yet to find out just which hedge funds were blown up yesterday, but we already do know that numerous retail FX brokers did get blown up and as reported earlier, the largest retail broker FXCM is trading down 90% in the pre-market.And now, thanks to Dow Jones, we start to learn just how much pain the bank themselves suffered:

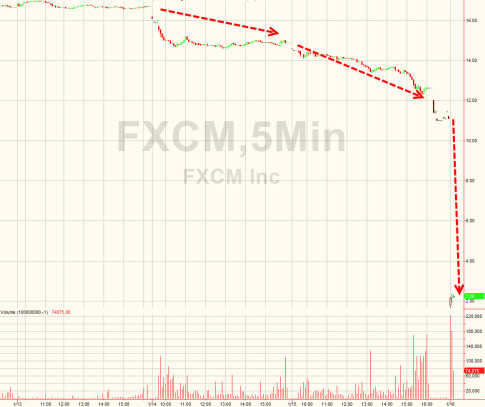

Largest Retail FX Broker Stock Crashes 90% As Swiss Contagion Spreads

– Largest Retail FX Broker Stock Crashes 90% As Swiss Contagion Spreads (ZeroHedge, Jan 16, 2015):

UPDATE: Knight Trading 2.0? Jefferies executive are reportedly on-site at FXCM discussing a $200 million bailout

As we first reported last night, FXCM was among the first of many retail FX brokers (and the largest) to see its clients suffer massive losses from yesterday’s Swiss Franc surge following the SNB decision to unleash market forces. There are now at least 4 retail FX brokers (FXCM, Excel Markets, OANDA, and Alpari) who have announced “issues” but FXCM, being among the largest and publicly traded is the most transparent example of wjust what can go wrong when average joes are allowed 100:1 leverage. FXCM is now stuck chasing clients for money they do not (and will never) have.. and its stock is down 90%, trading a $2 this morning (down from $17 on Wednesday). As Credit Suisse notes, time is running out as regulators “tend to be impatient once capital requirements are breached.”

…

The Rigging Triangle Exposed: The JPMorgan-British Petroleum-Bank Of England Cartel Full Frontal

To all those wondering if everything is rigged, we have a very simple answer: Yes.

– The Rigging Triangle Exposed: The JPMorgan-British Petroleum-Bank Of England Cartel Full Frontal (ZeroHedge, Dec 30, 2014):

The name Dick Usher is familiar to regular readers: he was the head of spot foreign exchange for JPMorgan, and the bank’s alleged chief FX market manipulator, who was promptly fired after it was revealed that JPM was the bank coordinating the biggest FX rigging scheme in history, as initially revealed in “Another JPMorganite Busted For “Bandits’ Club” Market Manipulation.” Subsequent revelations – which would have been impossible without the tremendous reporting of Bloomberg’s Liam Vaughan – showed that JPM was not alone: as recent legal actions confirmed, virtually every single bank was also a keen FX rigging participant. However, the undisputed ringleader was always America’s largest bank, which would make sense: having a virtually unlimited balance sheet, JPM could outlast practically any margin call, and make money while its far smaller peers were closed out of trades… and existence.

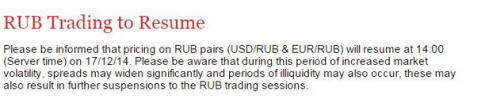

‘Ruble Trading To Resume’

– “Ruble Trading To Resume” (ZeroHedge, Dec 17, 2014):

As already noted, yesterday one after another FX broker scrambled to disconnected the Russian currency from the system due to “western banks stopping quoting pricing” and as a result of epic volatility (and as everyone knows, brokers prefer to only trade those pairs where they know with near certainty they can pick 1 pip or so from every trade which is why they prefer stability and orderly markets). However, in the aftermath of today’s announcement that the Russia finance ministry will join the central bank in selling reserves, the RUB has found a bid. And sure enough, here come the FX brokers barging back, advising that Ruble trading is set to resume this afternoon.

Big Banks Busted Massively Manipulating Foreign Exchange, Precious Metals … And Every Other Market

– Big Banks Busted Massively Manipulating Foreign Exchange, Precious Metals … And Every Other Market (Washington’s Blog, Nov 12, 2014):

Currency Markets Are Rigged

Currency markets are massively rigged. And see this and this.

Reuters notes today:

Caught Rigging FX and Gold? Your Punishment Will Be A Bonus Capped At Just 200% Of Your Base Salary

– Caught Rigging FX and Gold? Your Punishment Will Be A Bonus Capped At Just 200% Of Your Base Salary (ZeroHedge, Nov 11, 2014):

…

There are many more details and we will break them out shortly, but cutting to the chase, here is the punishment:

FINMA has also instructed UBS to limit bonuses for traders of foreign exchange and precious metals to 200 percent of their base salary for two years.

Which means that clearly nobody is going to jail, however the punishment is far more harsh: riggers will have a bonus of ONLY 200% their base salary for two years to look forward to!

The horror, the horror.

Which naturally means that base salaries across the rigging banks are about to soar to offset the tempoyrary bonus cap to the “keep the talent” happy. After all someone has to keep on rigging markets and generate bank revenue.

Bank of England Fires Chief FX Dealer Participating In Currency-Rigging Scandal

– Bank of England Fires Chief FX Dealer Participating In Currency-Rigging Scandal (ZeroHedge, Nov 11, 2014):

Early in 2014, when the FX rigging scandal was still news, one of the most disturbing developments to emerge was that none other than the venerable Bank of England itself had been engaged in collusion with various manipulating parties, explicitly those participating in “The Bandits Club”, “Cartel” and other chatrooms, as described in “Bank Of England Encouraged Currency Manipulation By Banks.”

As Bloomberg reported at the time:

Read moreBank of England Fires Chief FX Dealer Participating In Currency-Rigging Scandal

How Banks Continue FX Rigging Right Under The SEC’s Noses

– How Banks Continue FX Rigging Right Under The SEC’s Noses (ZeroHedge, Sep 16, 2014):

The good news is that the rigging of the FX markets – now conspiracy fact, not conspiracy theory – has, according to Bloomberg, forced the world’s biggest banks to overhaul how they trade currencies to regain the trust of customers and preempt regulators’ efforts to force changes on an industry tarnished by allegations of manipulation with the “modernization of processes that probably should have been brought in 15 or 20 years ago.” However, the FX market is far from ‘clean’ as Bloomberg notes, while banks can limit access to details about client orders on their computer systems, they can’t keep employees from talking to one another. Some traders also are still communicating with clients and counterparts at other firms via Snapchat, circumventing their company’s controls right under the nose of the SEC. As one trader commented, “these [reform] changes look like fig leaves.”

As Bloomberg reports, positive changes are happening (on the surface)…

Read moreHow Banks Continue FX Rigging Right Under The SEC’s Noses

Gerald Celente On The Dead Bankers (Video)

YouTube Added: Feb 25, 2014

New York Regulator Demands Documents From More Than A Dozen Banks including Barclays, Deutsche, Goldman Sachs And RBS As Forex Probe Widens

– New York regulator demands bank documents as investigation widens (Guardian, Feb 5, 2014):

Goldman Sachs and Barclays among banks investigated after reports some traders shared information about currency positions

New York state’s top financial regulator has demanded documents from more than a dozen banks including Barclays, Deutsche, Goldman Sachs and RBS as a probe widened into trading practices in the $5.3tn-a-day global foreign exchange markets.

Benjamin Lawsky, New York’s financial services superintendent, made the move following the banks’ decision to fire or suspend at least 20 traders following reports that employees at some firms had shared information about their currency positions with counterparts at other companies.

Meet The “Bandits’ Club” – The TBTF Wall Street Cartel Rigging The FX Market

– Meet the “Bandits’ Club” – The TBTF Wall Street Cartel Rigging the FX Market (Liberty Blitzkrieg, Dec 20, 2013):

Another day, another tale of how the “Too Big to Jail” Wall Street cartel manipulates a major global market with no repercussions whatsoever. Must be nice having essentially every Congressperson and regulator in your back pocket. Get caught? Pay a little fine and get on with it. Everyone wins!

Actually, everyone loses. Except for the handful of FX manipulators, rigging global currency markets from their Essex villages outside of London. These traders for major TBTF banks refer to themselves by various names in their now silenced Bloomberg chat rooms, from The Cartel,” “The Bandits’ Club,” “One Team, One Dream” and “The Mafia.” Very classy guys. Glad we bailed your asses out…

More from Bloomberg:

Read moreMeet The “Bandits’ Club” – The TBTF Wall Street Cartel Rigging The FX Market

Energy Prices: Manipulated – LIBOR: Manipulated – FX: Manipulated – Now Brent Crude: Manipulated – But Suggest Gold Is And You’re Branded A Whacko!

Energy Prices: Manipulated LIBOR: Manipulated FX: Manipulated Now Brent Crude: Manipulated But suggest gold is and you're branded a whacko!

— Grant Williams (@ttmygh) November 6, 2013

Thing about #gold, when most are ready to buy there won't be any. "No one told you when to run / You missed the starting gun." #PinkFloyd

— Jim Rickards (@JamesGRickards) November 4, 2013

Want To Trade FX On Inside Information? Here Is How To Do It, Straight From Kashya Hildebrand (Video)

– Want To Trade FX On Inside Information? Here Is How To Do It, Straight From Kashya Hildebrand (ZeroHedge, Jan. 12, 2012):

Wondering how wives of (ex) central bankers would engage in insider trading if that was their intent (forgetting for a second that if one is the wife of a central banker one probably should not be engaging in any FX transaction to begin with)? Now we know, courtesy of this first interview with the wife of the former SNB head following his departure in which she tell us how a former Moore Capital currency trader would engage in FX insider trading “if one wanted to…”

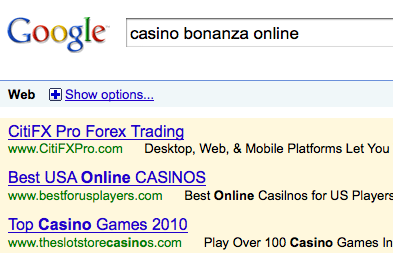

BUSTED: Citigroup Caught BLATANTLY Marketing Itself As Casino

In the course of getting to know the online forex landscape, we came across the following.

That’s right. When you do a search for “Casino Bonanza Online” you get two ads for online casino-based sites, but the very first is an add for CitiFXPro.com, which is, yes, a retail Forex trading site run by Citi.

Now, it’s not really shocking that a multi-headed behemoth as big as Citigroup (C) has a retail Forex site, but here they’re specifically advertising against gambling-related terms, and showing up right next to Best USA Online CASINOS.

Major Wall Street firms are frequently likened to casinos, but they’re usually not this blatant about it, and usually their services are geared towards sophisticated, institutional investors. But CitiFXPro.com is pure retail, requiring only $10,000 to open an account. That’s not non-trivial, but it’s way less than the threshold for anything that would be regarded as institutional.

And if all this alone weren’t enough to make Paul Volcker lose his lunch, check out what Citi lists as its advantages. Check out the fourth one, specifically:

Read moreBUSTED: Citigroup Caught BLATANTLY Marketing Itself As Casino