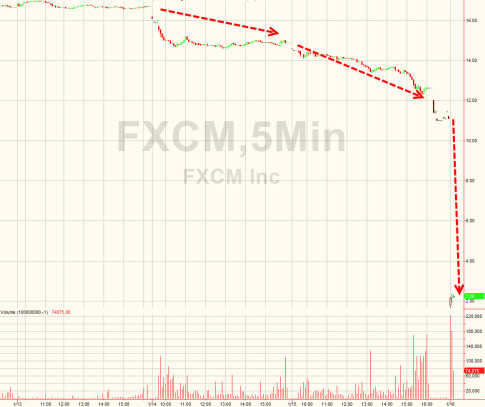

– Largest Retail FX Broker Stock Crashes 90% As Swiss Contagion Spreads (ZeroHedge, Jan 16, 2015):

UPDATE: Knight Trading 2.0? Jefferies executive are reportedly on-site at FXCM discussing a $200 million bailout

As we first reported last night, FXCM was among the first of many retail FX brokers (and the largest) to see its clients suffer massive losses from yesterday’s Swiss Franc surge following the SNB decision to unleash market forces. There are now at least 4 retail FX brokers (FXCM, Excel Markets, OANDA, and Alpari) who have announced “issues” but FXCM, being among the largest and publicly traded is the most transparent example of wjust what can go wrong when average joes are allowed 100:1 leverage. FXCM is now stuck chasing clients for money they do not (and will never) have.. and its stock is down 90%, trading a $2 this morning (down from $17 on Wednesday). As Credit Suisse notes, time is running out as regulators “tend to be impatient once capital requirements are breached.”

…