***

Related info:

* * *

Please support I. U.

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

The man who trades freedom for security does not deserve nor will he ever receive either. – Benjamin Franklin

***

Related info:

* * *

Please support I. U.

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

– The Perfect Storm Protocol ()

TREATMENT RATING: This is rated one of the top cancer treatments on the planet earth, including natural medicine cancer clinics. In fact, this protocol is far better than most natural medicine cancer clinics. It is designed to revert cancer cells into normal cells by using high doses of DMSO and chlorine dioxide.

Warning for those on blood thinners (or those who have bleeding problems)

Cancer patients who are on blood thinners cannot use this protocol because of the high doses of DMSO and other anti-oxidants which are an integral part of this protocol.

The Perfect Storm Protocol

This protocol is the result of a phone conversation I had with a cancer patient. Remembering what I said to her, I thought I might as well put what we talked about into a cancer treatment so everyone has access to it.

This protocol can be very inexpensive (less than $100) or it can be moderately expensive (about $4,600).

– Dirt Cheap Protocol (Updated December 22, 2016):

When dealing with cancer, someone in the family should be designated as the “cancer guru” in the family. This person should become an expert in the main protocol. For example, they should study this article and the articles it links to several times to make sure they understand this protocol.

For example, I have been contacted by many cancer patients who described the cancer protocol they were using. In some cases, they were using the Dirt Cheap Protocol, but they were only using three or four of these items. Someone didn’t do their homework. I can’t tell you how many times I have seen this. A patient should use 14 or more of the items in this protocol, not three or four. Fighting cancer is like fighting a fire, you need enough fire trucks.

(Screenshot – Click on image to enlarge.)

Here is the censored article:

– Accusations Of Treason In The Greek Parliament Against Bilderberg PM Papandreou

In my commentary to the above article I wrote:

Flashback:

– Greek Central Bank Accused of Encouraging Naked Short Selling of Greek Bonds (Financial Times)

And remember that the biggest Greek CDS speculator has been the state-controlled Hellenic Post Bank with help from (Yes, you’ve guessed it!) Goldman Sachs:– State-controlled Hellenic Post Bank (TT) bet against Greece (Kathimerini)

– Fragwürdige Finanzgeschäfte Griechen wetten auf eigene Pleite (Sueddeutsche Zeitung)

The state-controlled Hellenic Post Bank was betting on Greece going bankrupt!

What will happen if Greece defaults:

– Here Is What Happens After Greece Defaults

Solution:

So who could possibly ‘dislike’ such an article?

On a side note:

Alexa Rank:

Infinite Unknown had a global Alexa Rank of just above 100,000 (for a while) and even below that (quite a while ago).

A webmaster told me (when it became apparent that the numbers were dropping fast) that Alexa had changed its rating methods, which in his opinion clearly disfavors websites like I.U.

You can look up I.U.’s global ranking here:

http://www.alexa.com/siteinfo/infiniteunknown.net

The only way we can make up for all this censorship coming our way is if readers would start hitting that social media buttons like crazy.

Maybe that would also bring more attention to the website, which could possibly result in more financial support for my work, which is much, much needed.

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

– Wall Street’s Latest Retail Fleecing Product Exposed – Structured CDs:

Ms. Bailey, the Citizens Bank customer in Massachusetts, had sold a condo in Maine in 2013, a year after the death of her husband, who she says had handled their finances. She went to a Citizens branch in Arlington, a suburb of Boston, to deposit the money. She says bank employees pressured her not to just park the money in a savings account.

She says she was directed to Citizens broker Andrew Jurkunas, who steered her to a CD called the GS Momentum Builder Multi-Asset 5 ER Index-Linked Certificate of Deposit Due 2021. It is one of a series of CDs based on a Goldman Sachs-designed index that tracks the performance of up to 14 exchange-traded funds and a cash-like holding. The index aggregates the performance of different combinations of some or all of the underlying funds, relying on a complex formula designed to smooth volatility.

When Ms. Bailey received her first statement showing that the value of her CD had dropped by more than $4,000, she complained to Massachusetts state securities regulators. This January, the office filed civil charges against the bank alleging that Mr. Jurkunas, who wasn’t named or accused of wrongdoing, didn’t adequately disclose the risks of the market-linked CD.

– From yesterday’s excellent Wall Street Journal article: Wall Street Re-Engineers the CD—and Returns Suffer

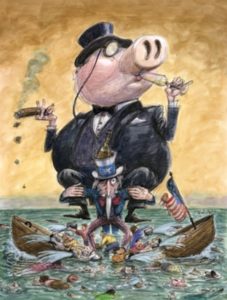

Wall Street is an industry that should have been allowed to go down in flames back in 2008. Bailing out these career criminals and sociopaths was one of the gravest errors in American history. An error that we as a nation continue to suffer from to this day.

Read moreWall Street’s Latest Retail Fleecing Product Exposed – Structured CDs

Continue to prepare for collapse. (And maybe support this website if you can.)

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

– Venezuela Sells Billions In Gold To Repay Its Debt:

Just under a year ago in the aftermath of the “OPEC Thanksgiving Massacre” of 2014 which sent oil crashing when Saudi Arabia effectively ended the oil cartel, we predicted that Venezuela (with its CDS trading at 2300 bps back then) would become the first casualty of the “crude carnage.” Since then not only has Venezuela, which relies on crude oil for 95% of its export revenue, suffered a dramatic episode of hyperinflation (which is only accelerating) coupled with total economic collapse, but its CDS has, as expected, blown out to reflect a default of probability at 96% over the next five years as shown below.

Yet while everyone promptly jumped on the “Venezuela will default bandwagon” it has so far avoided bankruptcy.

How can this country with a massive debt load and a paralyzed economy have avoided default so far?

– Wall Street Banks Admit They Rigged CDS Prices Too:

As Bloomberg reports, “JPMorgan Chase & Co. is set to pay almost a third of a $1.86 billion settlement to resolve accusations that a dozen big banks conspired to limit competition in the credit-default swaps market, according to people briefed on terms of the deal.”

– Glencore Implodes: Stock Plunges Most Ever, CDS Blow Out To Record Up On Equity Wipeout Fears:

Update: And there it is: GLENCORE DEBT INSURANCE COSTS SURGE TO RECORD HIGH; 5-YR CREDIT DEFAULT SWAPS RISE 207BASIS POINTS FROM FRIDAY’S CLOSE TO 757 BASIS POINTS

Those who listened to our reco to buy Glencore CDS at 170 bps in March 2014 can take the rest of the year off. As of this moment, GLEN Credit Default Swap were pushing on 600 bps, 4 times wider, and on pace to take out the 2011 liquidity crunch highs. After that, it’s smooth sailing to all time wides and the start of a self-fulfilling prophecy which leads to the Companys’s IG downgrade and the collapse of trillions in derivative notionals as what may be the trading desk of the biggest commodity counterparty quietly goes out of business.

…

– Glencore Default Risk Surges Above 50%:

Glencore is in total free-fall across all markets today. Most worrying for systemic risk concerns is the rush into credit protection that has occurred, as counterparties attempt to hedge their exposures. Forthe first time since 2009, Glencore CDS are being quoted with upfront pricing (something that happens as firms become seriously distressed). Based on the latest data, it costs 875bps per year (or 14% upfront) to buy protection against a Glencore default (which implies – given standard recoveries – a 54% chance of default).

…

– Greek Credit Risk Spikes, Default Probability Tops 70% (Zerohedge, Jan 28, 2015):

Greek default risk has surged in recent days and today as it becomes clear what Syriza expects from Europe, short-term CDS are at post-crisis highs with 5Y CDS implying a 76% probability of default (based on standard recovery assumptions – which may be a little high in this case). Given the domestic bank dominance in the buying of domestic government debt, Greek banks are getting hammered as everyone’s favorite hedge fund trade is an utter bloodbath. Greek stocks overall are down and GGBs are tumbling once again – back at 16 month lows (given back all the ECBQE hope bounce). Perhaps not surprising moves, given new Greek Finance Minister Yanis Varoufakis reality-exposing comments yesterday, “the problem with the bailout is that it wasn’t really a bailout… it was an extend and pretend, it was a vicious cycle, a debt-deflationary trap, which destroyed our social economy.”

…

FYI.

– Outspooking The Lehman Apocalypse: Could A Russian Default Be In The Cards? (ZeroHedge, Dec 16, 2014):

Via Mint – Blain’s Extra Porridge,

“Nazhmite Lyubuyu Stavku…“

Extra Comment – this might be getting serious.

Russia’s markets have been spanked hard despite last night’s hike. 19% currency crash and 13% down stocks in a session. Ouch! Cumulatively, over the past few weeks stocks, oil and the Ruble are off 50% plus, and bonds off 40%. This morning felt like free-fall. Expect more action from the Russians to stave off economic catastrophe… imminent capital controls are rumoured, but markets are demonstrating a massive loss of confidence.

Lots of old market hands are talking about how its similar to the Russia default and crash of ‘98 all over again.. Actually.. its worse.

Much worse.

Read moreOutspooking The Lehman Apocalypse: Could A Russian Default Be In The Cards?

– Venezuelan Bonds Crash To Lowest Price Since 1998 (ZeroHedge, Dec 9, 2014):

Bond prices in Venezuela have totally collapsed this morning – at 45c on the dollar, they are the lowest since 1998 – as the realization of the “abyss” they are staring into sparks an exodus from all credit positions in the country. VENZ 5Y CDS rallied 130bps which signals hedgers unwinding and the simultaneous sale of the underlying bonds implies broad-based capital flight (and profit taking) as 1Y CDS surges to record highs at 4830bps.

VENZ Bond prices collapse to 1998 lows…

- VENEZUELA 2027 DOLLAR BONDS FALL TO LOWEST SINCE 1998

Venezuela’s 1Y CDS has smashed to record highs implying imminent devaluation or default…

If you didn’t think this was serious, think again. (as Bloomberg reports)

The scores of money managers and analysts who crowded into Cleary Gottlieb Steen & Hamilton LLP’s panel discussion on Venezuela last week are a testament to the deepening concern over whether President Nicolas Maduro can make good on the nation’s debt obligations.

– With 1 Week Left Until Argentina’s ‘D’efault-Day, Judge Blasts “Judgments Are Judgments” (ZeroHedge, July 22, 2014):

Day after day, headlines from Argentina implore Judge Griesa to do the “fair, responsible” thing and lift his judgment that holdouts get paid before current bondholders receive their payments… and day after day Argentina’s demands are met with silence or denials. Today, though, with 1 week left until Argentina must put up or shut up, Judge Griesa has come out swinging…

- *U.S. JUDGE SAYS OF ARGENTINA RULINGS: ‘JUDGMENTS ARE JUDGMENTS‘

- *ARGENTINA’S ‘INCENDIARY` RHETORIC `UNFORTUNATE,’ JUDGE SAYS

- *U.S. JUDGE URGES ‘SENSIBLE STEPS’ TO AVOID ARGENTINA DEFAULT

While CDS spreads have surged once again, bonds trade with default probabilities around only 50% which, according to Jefferies “are expensive on underestimating the risk of default.”

– Russian Bank Halts All Cash Withdrawals (ZeroHedge, Jan 28, 2014):

It would appear the fears of a global bank run are spreading. From HSBC’s limiting large cash withdrawals (for your own good) to Lloyds ATMs going down, Bloomberg reports that ‘My Bank’ – one of Russia’s top 200 lenders by assets – has introduced a complete ban on cash withdrawals until next week. While the Ruble has been losing ground rapidly recently, we suspect few have been expecting bank runs in Russia. Russia sovereign CDS had recently weakned to 4-month wides at 192bps.

Via Bloomberg,

The Forbes article has been removed. (Google screenshot)

– No, There Is No Stoppage Of Cash Transfers In China (ZeroHedge, Jan 26, 2014):

Earlier today, Forbes managed to spook readers with a bombastic report that China’s commercial banks had been instructed by the PBOC to halt cash transfers – something which would have dire implications on China’s banking system ahead of its new year holiday, and send the banking system into a tailspin just as China is desperate to avoid all turbulence ahead of a potential shadow banking default.

Leaving aside the fact that one should typically rely on official PBOC advisories, posted quite clearly on its website (where one finds no mention of this notice), one could simply keep track of interbank liquidity indicators such as repo and SHIBOR, both of which dropped, indicating that liquidity actually improved.

Anyway, here is what really happened, as reported by China Compass. “Forbes columnist Gordon Chang claimed in a much-quoted item today that the Peoples Bank of China had instructed commercial banks to halt cash transfers. Chang’s column, entitled “China Halts Bank Transfers,” specifically refers to Citibank’s Chinese branches. The report is entirely misleading.” Our advice – focus on the real “weakest links” in China’s banking system, of which there are many and are backed by facts, not the least of which is the potential upcoming shadow banking default. Ignore groundless rumors and speculation.

Read moreNO, … There Is No Stoppage Of Cash Transfers In China

– Bank Of America Caught Frontrunning Clients (ZeroHedge, Jan 25, 2014):

Every time a TBTF bank releases its 10-Q, we head straight for the section, usually well over 100 pages in, that discloses the bank’s total profitable trading days.

This is what the most recent Bank of America 10-Q said on this topic:

The histogram below is a graphic depiction of trading volatility and illustrates the daily level of trading-related revenue for the three months ended September 30, 2013 compared to the three months ended June 30, 2013 and March 31, 2013. During the three months ended September 30, 2013, positive trading-related revenue was recorded for 97 percent, or 62 trading days, of which 69 percent (44 days) were daily trading gains of over $25 million and the largest loss was $21 million. These results can be compared to the three months ended June 30, 2013, where positive trading-related revenue was recorded for 89 percent, or 57 trading days, of which 67 percent (43 days) were daily trading gains of over $25 million and the largest loss was $54 million. During the three months ended March 31, 2013, positive trading-related revenue was recorded for 100 percent, or 60 trading days, of which 97 percent (58 days) were daily trading gains over $25 million.

– $600 Billion In Trades In Four Years: How Apple Puts Even The Most Aggressive Hedge Funds To Shame (ZeroHedge, Jan 27, 2013):

Everyone knows that for the better part of the past year Apple, Inc. (“AAPL”, or “The Company”) was the world’s biggest company by market cap, with Exxon finally regaining that title on Friday, following AAPL’s latest price drop in the aftermath of its disappointing earnings. Most know that AAPL aggressively uses all legal tax loopholes to pay as little State and Federal tax as possible, despite being one of the world’s most profitable companies.Many also know, courtesy of our exclusive from September, that Apple also is the holding company for Braeburn Capital: a firm which with a few exceptions (Bridgewater; JPM’s CIO prop trading desk) also happens to be one of the world’s largest hedge funds, whose function is to manage Apple’s massive cash hoard, with virtually zero requirements, and whose obligation is to make sure that AAPL’s cash gets laundered legally and efficiently in a way that complies with prerogative #1: avoid paying taxes.

What few if any know, is that as part of its cash management obligations, Braeburn, and AAPL by extension, has conducted a mindboggling $600 billion worth of gross notional trades in just the past four years, consisting of buying and selling assorted unknown securities, or some $250 billion in 2012 alone: a grand total which represents some $1 billion per working day on average, and which puts the net turnover of some 99% of all hedge funds to shame!

Finally, what nobody knows, except for the recipients of course, is just how much in trade commissions AAPL has paid over the past four years on these hundreds of billions in trades to the brokering banks, many (or maybe all) of which may have found this commission revenue facilitating AAPL having a “Buy” recommendation: a rating shared by 52, or 83% of the raters, despite the company’s wiping out of one year in capital gains in a few short months.

The Perfectly Legal Tax Evasion Scheme

– Egyptian Stocks Plunge 9.6% As ‘Islamofascism’ Rises; Clashes Escalate (ZeroHedge, Nov 25, 2012):

Egyptian stocks cliff-dived by their most since the Arab Spring in January 2011 as Morsi’sreach-for-omnipotence sends concerned ripples through the nation that they have replaced ‘military fascism’ with so-called ‘islamofascism’. Tensions are rising once again in Tahrir Square, but as Russia Today notes in this clip, the new regime is somewhat more heavy-handed than the previous one in its control of protesters. Critically, the Musilm Brotherhood’s opposition forces, who have been quite divided recently, are joining to fight the common enemy as clashes between pro-Morsi and anti-Morsi forces are erupting. Perhaps just as worrisome as the social unrest is the fact that Egypt’s Stock Exchange Director Said Hisham Tawfiq fears “Egypt announces bankruptcy within 3 months in the case of the continuation of the current situation,” though we note Egypt CDS are near 16-month lows.

The EGX50 dropped a massive 9.5% today as markets are stunned my Morsi’s move…

and from Russia Today:

– US infrastructure on brink of thermodynamic breakdown (PressTV, Sep 14, 2012):

Federal Reserve Chairman Ben Bernanke has warned that the country’s unemployment situation “remains a grave concern” as the hiring process in the job market stays sluggish.

“Fewer than half of the eight million jobs lost in the recession have been restored and at 8.1 percent, the unemployment rate is nearly unchanged since the beginning of the year and is well above normal levels,” Bernanke told reporters on Thursday, AFP reported.

Bernanke also pointed out that the Federal Reserve does not have the means to offset the economic shock from the public spending cuts and tax hikes, scheduled for the end of 2012.

Press TV has conducted an interview with Webster Griffin Tarpley, author and historian from Washington, to further talk over the issue. the following is an approximate transcript of the interview.

Press TV: The Fed has announced that it will resume its policy of pumping more money into the economy. Will that be enough to stave off the unemployment?

Tarpley: No, it cannot. Right now we have an economic depression in the United States and around the world and the real unemployment in this country is much higher than the Federal Reserve seems to want to admit. It is about 30 million people minimum that are out of work which is significantly more than the government estimates.

The problem with the Federal Reserve is that they see their task as saving failed banks; we have to call them ‘zombie banks’ because they are bankrupt entities that sit there; they absorb government and Federal Reserve resources; they do not provide investment; they do not create jobs; there is no plan and equipment or capital goods investment going on.

Read moreWebster Tarpley: US Infrastructure On Brink Of Thermodynamic Breakdown

– Buffett Joins Team Whitney; Sees Muni Pain Ahead As He Unwinds Half Of His Bullish CDS Exposure Prematurely (ZeroHedge, Aug 20, 2012):

Just under two years ago, Meredith Whitney made a much maligned, if very vocal call, that hundreds of US municipalities will file for bankruptcy. She also put a timestamp on the call, which in retrospect was her downfall, because while she will ultimately proven 100% correct about the actual event, the fact that she was off temporally (making it seem like a trading call instead of a fundamental observation) merely had a dilutive impact of the statement. As a result she was initially taken seriously, causing a big hit to the muni market, only to be largely ignored subsequently even following several prominent California bankruptcies. This is all about to change as none other than Warren Buffett has slashed half of his entire municipal exposure, in what the WSJ has dubbed a “red flag” for the municipal-bond market. Perhaps another way of calling it is the second coming of Meredith Whitney’s muni call, this time however from an institutionalized permabull.

YouTube Added: 01.08.2012

– All The Olympic Charts That’s Fit To Print, And More (ZeroHedge; July 27, 2012)