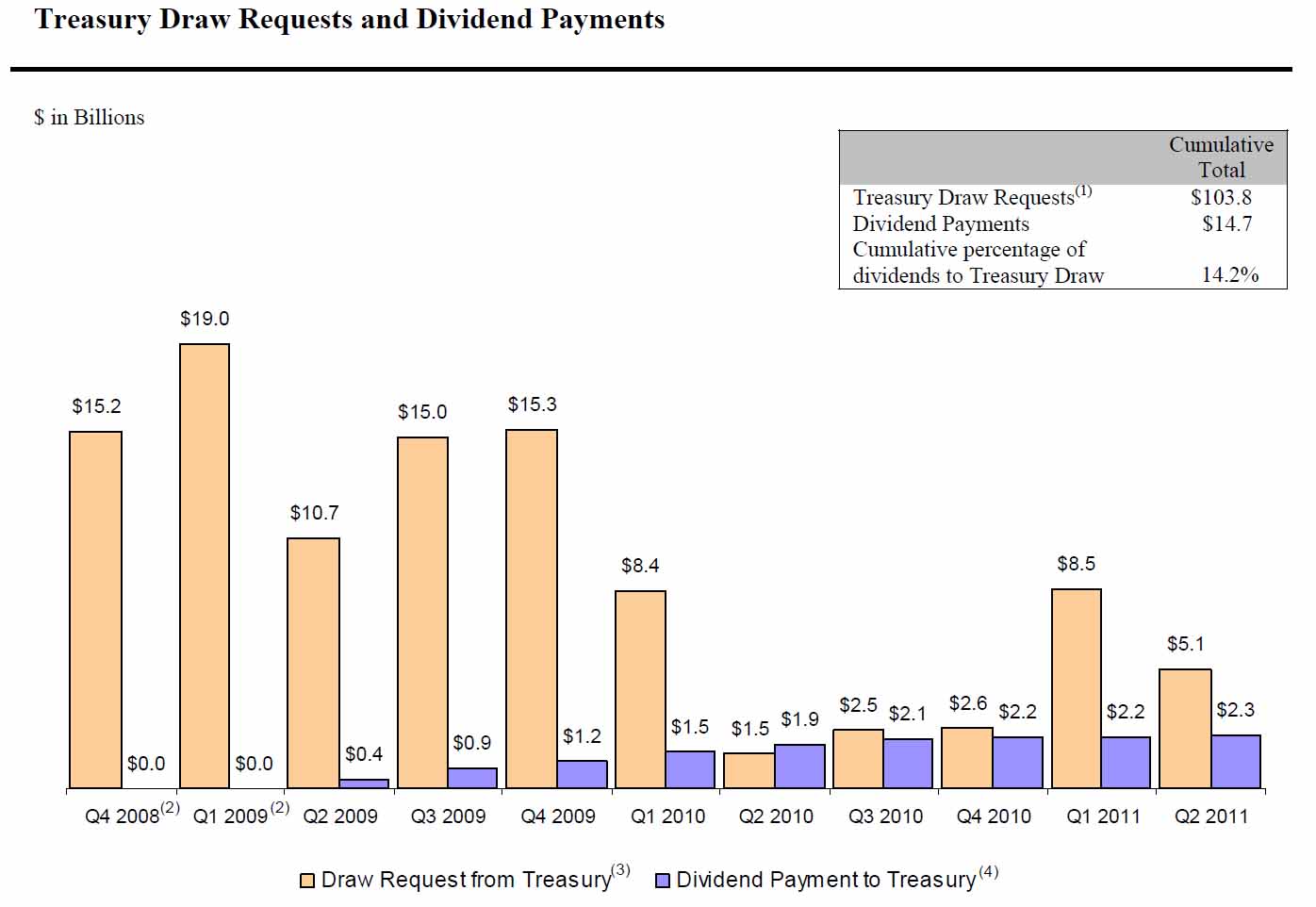

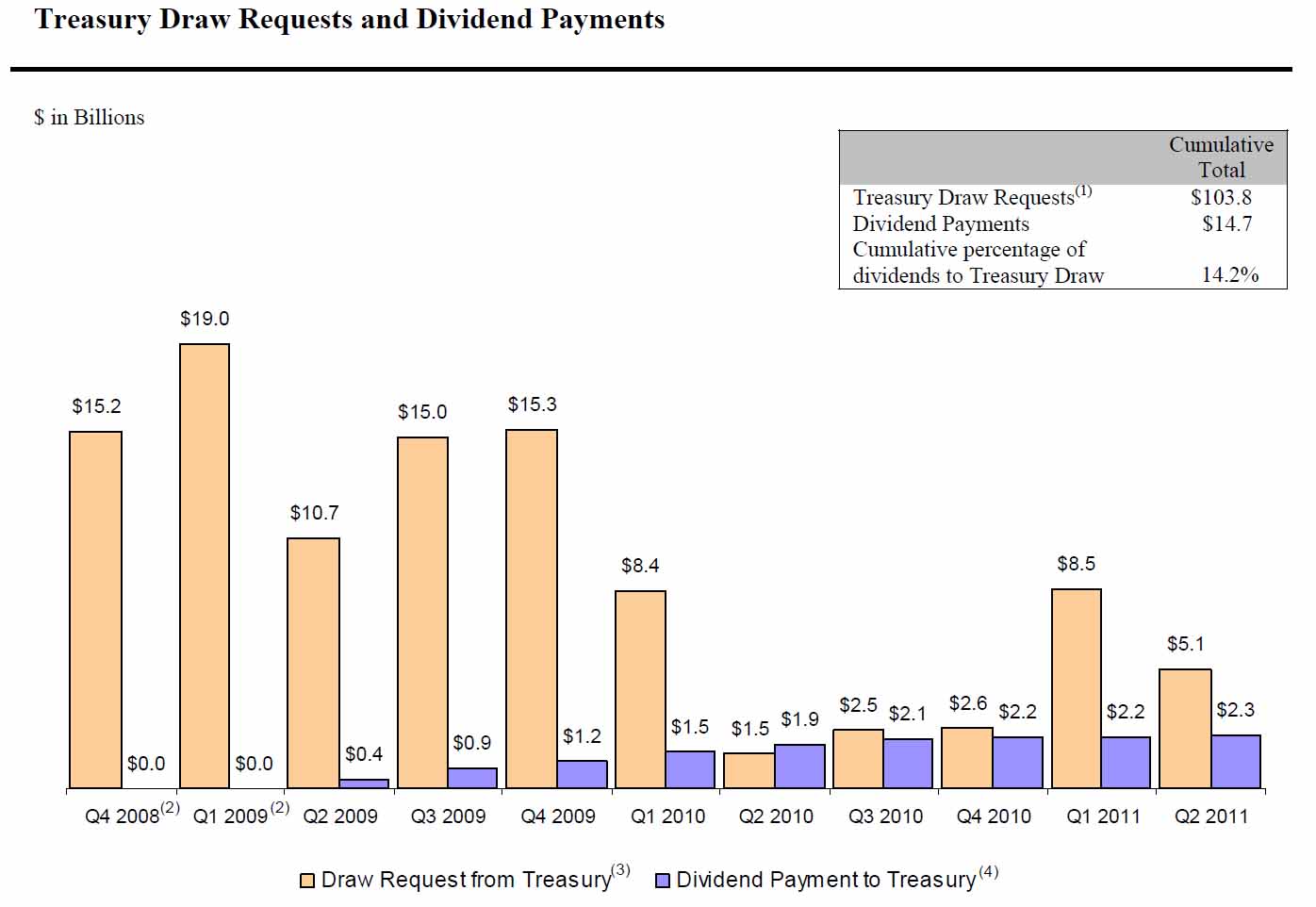

– Fannie Demands Another $5.1 Billion In Aid From Treasury In Q2, $103.8 Billion Total Since Conservatorship (ZeroHedge, Aug 5, 2011):

There is just one number that is important in the just released Fannie Mae Q2 earnings release, in which the firm reported a loss of “just” $2.9 billion, which includes $6.1 billion in credit related expenses all of which was blamed on Bush (no, really “substantially all of which were related to the company’s legacy (pre-2009) book of business“). The number that matters is that for the 11th consecutive quarter a bankrupt Fannie Mae came running to the Treasury, this time requesting $5.1 billion from Tim Geithner, the second highest number in the past year. This brings the total cumulative bailout since Fannie’s conservatorship to a stunning $103.8 billion. And wasn’t it pathological liar Tim Geithner who himself said a month ago that the GSEs are no longer a burden on the Treasury? Perhaps he can explain the chart below taken from the company’s announcement.

As for the reasons for the ongoing losses, it has everything to do with the abysmal ongoing situation in housing.

The loss in the second

quarter of 2011 reflects the continued weakness in the housing and mortgage markets, which remain under pressure from high levels of unemployment, underemployment, and the prolonged decline in home prices since their peak in the third quarter of 2006. Pursuing loan modifications, key aspect of the company’s strategy to reduce defaults, also contributed to its loss in the quarter. Fannie Mae expects its credit-related expenses to remain elevated in 2011 due to these factors.

“We remain the largest source of liquidity for the U.S. mortgage market, and we are committed to creating long-term value by helping to build a stable, sustainable housing market for the future,” said Michael J. Williams, president and chief executive officer. “We are focused on reducing taxpayer exposure by limiting our credit losses and building a strong new book of business. Our new book of business is now nearly half of our overall single-family book and we expect these new loans will be profitable over their lifetime.”

Fannie Mae’s net loss attributable to common stockholders in the second quarter of 2011 was $5.2 billion, or $(0.90) per diluted share, including $2.3 billion in dividend payments to the U.S. Treasury. The company’s net worth deficit of $5.1 billion as of June 30, 2011 reflects the recognition of its total comprehensive loss of $2.9 billion and its payment to Treasury of $2.3 billion in senior preferred stock dividends during the second quarter of 2011. The Acting Director of the Federal Housing Finance Agency (“FHFA”) will submit a request to Treasury on Fannie Mae’s behalf for $5.1 billion to eliminate the company’s net worth deficit. Upon receipt of those funds, the company’s total obligation to Treasury for its senior preferred stock will be $104.8 billion.

On the other hand, should American homeowners, aka squatters, actually start paying their mortgages, Fannie may be amazed at how quickly it will be able to turn that frown (and quarterly bailout request) upside down. Alas, that would mean fewer iPads sales and the Borg collective can not have that. After all what better reason to justify an imminent TARP 2 than an infinity +1 number of purchases of Angry Birds.