Earlier this morning, NASA’s Solar Dynamics Observatory (SDO) witnessed a complex magnetic eruption on the sun. The joint NASA/ESA Solar and Heliospheric Observatory (SOHO) — a mission sitting at the L1 point between the Earth and the sun — also spotted a large coronal mass ejection (CME) blasting in the direction of Earth.

It is thought that the SDO and SOHO observations are connected, making this a global magnetic disturbance affecting the whole of the Earth-facing side of the sun.

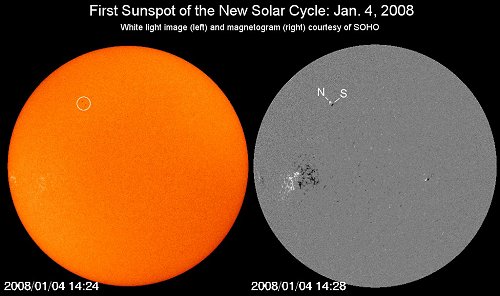

The eruption happened at around 0855 UT (3:55 am EST), when the SDO detected a C3-class solar flare originating from a cluster of sunspots (called sunspot 1092). This isn’t a large flare, but right at the same time, a filament located about 100,000 kilometers from the flare also erupted.

A “filament” is a long magnetic structure rising high above the surface of the sun filled with cool plasma. Because it is cooler than the sun’s chromosphere, when in the direct line of sight between the Earth and sun, it appears as a dark ribbon snaking across the sun’s disk. If a filament is spotted on the limb of the sun (i.e. on the side), it appears as a bright prominence arcing high into the sun’s atmosphere.

Judging by the timing, the flare and the filament erupted at the same time, suggesting they are connected via long-range magnetic field lines. The resulting shockwave emanating away from the flare site may have had a role to play in accelerating the filament when it hit the filament’s eruption zone.

Watch the video of the eruption as seen by the SDO:

This sequence of events led to a huge magnetic bubble of plasma being blasted into space. As the eruption was on the Earth-facing side of the sun, the CME is heading right for us — see the SOHO video of the CME. We can expect its arrival on Aug. 3.

Skywatchers will be on high alert that day as when that CME intermingles with the Earth’s magnetosphere, we can expect some intense aurorae around polar regions.

Far from being a frightening event, this morning’s complex solar eruption — including a flare, shockwave, filament eruption and CME — is a testament to the technological ingenuity of the solar scientists and engineers who have designed the powerful solar missions that continually monitor our tumultuous star. Now we know a CME is coming, we can prepare for its arrival.

Read moreThe Sun Unleashes Coronal Mass Ejection (CME) At Earth