– Russia-China real gold standard means end of US dollar dominance:

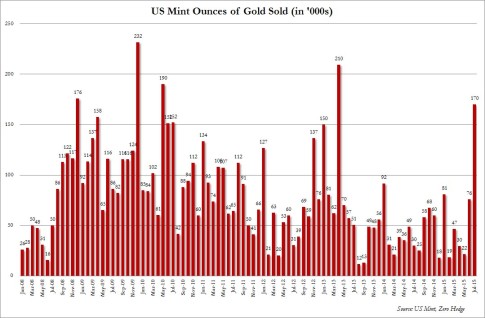

In 2016, 24,338 tons of physical gold were traded, which was 43 percent more than in 2015, according to Claudio Grass, of Precious Metal Advisory Switzerland.

Gold moving from the West to the East

“We have to put the BRICS initiative into a broader context. It is just part of a geopolitical tectonic shift which started decades ago. We have seen a constant outflow of physical gold from the West to the East. At the same time, the West has lost the economic war, and as a consequence, the focus now turns to the financial system. China dominates the world economy and has displaced the US as the world’s most formidable economic powerhouse,” he told RT.

The creation of a new gold standard by BRICS is also a step to end the US dollar’s domination of the global economy

Read moreRussia-China Real Gold Standard Means End Of US Dollar Dominance