Don’t miss:

– Silver Bullion Backwardation Suggests Supply Stress:

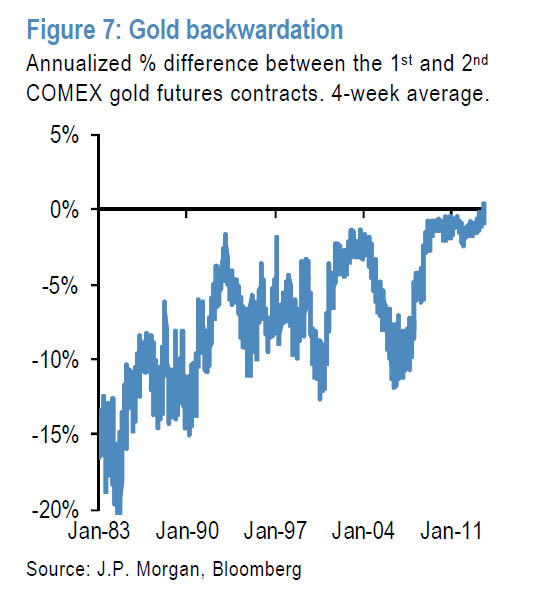

Backwardation rarely happens in the gold and silver bullion markets. Since gold futures first started to be traded in 1972 (on the Winnipeg Commodity Exchange), there have only been momentary backwardations of a few short hours.

– Silver Lease Rates Rise Sharply – Bond Yields in Portugal Rise to Record

– Silver Is Already In Extreme Backwardation! If The Same Happens With Gold, Then The End Game For The US Dollar With Hyperinflation Is Near

* COMEX silver stocks falls to four-year low

* First silver futures backwardation since ’97-98

* Strong industrial, coins demand, producer hedging cited

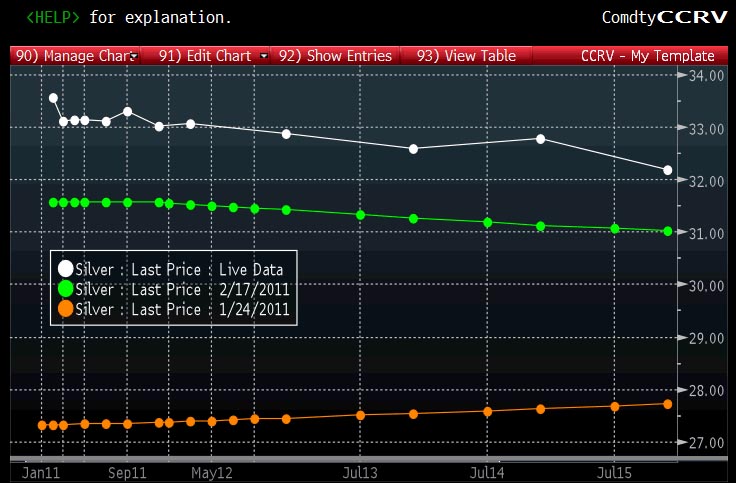

NEW YORK, Feb 11 (Reuters) – The tightest physical silver supplies in four years have tipped the U.S. silver futures market into backwardation this week, making near-term prices more expensive than more distant months.

Market watchers said that it has been more than 10 years since silver futures were last in backwardation, an unusual term structure, associated with shortage of physical supply. Warehouse stocks of the white metal have dropped to a four-year low on surging demand, while miners have hedged their future production.

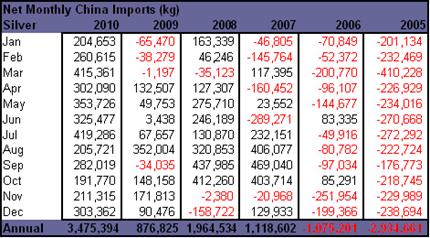

Booming industrial demand for silver and record U.S. coin sales, combined with a surge in demand from mining companies to borrow the metal for their hedge programs have led to a squeeze in the physical silver market.

“The problem is that there is great industrial demand for a specific grade of silver, and there is not enough coming fresh from the mines,” said Miguel Perez-Santalla, vice president of Heraeus Precious Metals Management.

“The stocks are being pulled for all the high grade and better materials, and that essentially put a squeeze on the physical market,” he said.

Perez-Santalla said that silver futures have not been in backwardation since billionaire Warren Buffett bought 130 million ounces of silver between 1997 and 1998.

Backwardation is a condition where cash or nearby delivery prices are higher than the price for delivery dates further in the future. Usually, forward prices are higher than cash prices to reflect the costs of storage and insurance for stocks deliverable at a later date.

“The extent of the backwardation in silver is unprecedented. It suggests that retail investment and industrial demand internationally is very robust and the small silver bullion market cannot cater to the level of demand for refined coin and bar product,” bullion dealer GoldCore said in a note on Friday.

Read more‘US Silver Term Structure Inverts As Supply Tightens’ – Reuters Article On Silver Backwardation