– Rising Inflation and the problems for the Pound vs the Euro (Tom Holian)

H/t reader squodgy.

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

The man who trades freedom for security does not deserve nor will he ever receive either. – Benjamin Franklin

– The Fed Is Losing The “Race To Debase” (ZeroHedge, Mar 25, 2012):

As we pointed out about a month ago, in “While You Were Sleeping, Central Banks Flooded The World In Liquidity” as the world was focused on headlines whether or not the Fed would step up as it always does when the market is sliding, and unleash the monetary floodgates, it was not Ben Bernanke, but eveyrone else that hit CTRL+P and took the place of the Fed, of note the primary central banking peers among the Final Four – the ECB, the BOE and the BOJ. And why not: after all the hope was that since electronic money is electronic money, and can be moved from point A to point B at the push of a button, it would be used primarily to reflate stocks around the world, but mostly where the path has least resistance – the US. What was not accounted for was that money would also be used to inflate commodities such as oil – a key factor when delaying further US-based easing in an election year. However, more than even record for this time of year gas prices, there was one even more important outcome from this chain of events. As the following chart from Willem Buiter shows, in its fake attempt to show monetary restraint, the Fed has gone straight into last place in the “race to debase.” Needless to say, in a world with $25+trillion in “excess” debt (debt which would need to be eliminated simply to reduce global debt/GDP to a “sustainable” 180% per BCG), last is a very bad place to be…

Of course, our frequent readers will note that this is the same chart that we have presented, however in the form of the main correlation chart for 2012 as we have dubbed it – i.e, the ratio between the size of the ECB and the FED vs the EURUSD. What is probably also quite disturbing is that the Fed is “losing” even after expanding by a massive 232% in the past 5 years, a number that is only topped by the Bank of England. To quantify, the Fed is now responsible for “only” 20% or so of US GDP, compared to 30% for the ECB and BOJ. To further quantify, to get back to first place in the race to debase, the Fed will have to do at least another $1.5 trillion in QE.

Also, having become a buyer of last reserve for credit money, it is easy to see why one should be outright skeptical of US GDP “numbers” – from 6% of US GDP, the Fed now accounts for a whopping 19% – this is “growth” that would not have happened unless the Fed, via debt monetization would have allowed it. Said otherwise, net of Fed deleveraging (if it ever unwinds its balance sheet of course), US GDP would be a 13% lower!

Not only that but as the chart above shows, global GDP has about $6 trillion in “one-time, non-recurring” growth factored in.

James Turk’s presentation on the gold price and the US dollar

Added: 05.06.2011

James Turk of the GoldMoney Foundation speaks about currency devaluation and the rising gold price. How the gold price is rising against all major currencies and monetary policy is political, having abandoned all pretence of seeking monetary stability. He warns of the dangers of a hyperinflationary crisis. James also explains why gold should be considered money and not an investment.

He also talks of the coming dollar collapse and the waterfall decline in the dollar, especially since Ben Bernanke’s words on QE. He talks of different examples of hyperinflation from paper money hyperinflation in Weimar Germany to deposit currency hyperinflation in Argentina. The presentation was held on 29 April 2011 in Munich, Germany.

Gold and silver are higher against all currencies (except the Canadian dollar) in the wake of the worse than expected trade deficit number ($40.6 billion). Sterling and euro are particularly weak against gold and the US dollar today.

Silver backwardation continues and while spot silver is at $30.09/oz, the March 2011 contract is at $30.07/oz and April at $30.01/oz. Incredibly, the July 2012 contract is trading at $29.93/oz and the December 2013 contract at $29.91/oz.

Backwardation is when the market quotes a lower price for spot delivery or a more nearby delivery date, and a higher price for a distant delivery date in the futures market. It indicates that buyers are concerned about securing supply in the future and are willing to pay a premium for spot delivery. It suggests that silver bullion in volume is difficult to buy and that the physical market is stressed and becoming less liquid.

Backwardation starts when the difference between the forward price in the futures market and the spot price for physical delivery is less than the cost of carry, or when there can be no delivery arbitrage. This is generally because the asset is not currently available for purchase or is increasingly illiquid.

It can end in default, failure to make delivery, and in sharply higher prices.

Backwardation rarely happens in the gold and silver bullion markets. Since gold futures first started to be traded in 1972 (on the Winnipeg Commodity Exchange), there have only been momentary backwardations of a few short hours.

The extent of the backwardation in silver is unprecedented. It suggests that retail investment and industrial demand internationally is very robust and the small silver bullion market cannot cater to the level of demand for refined coin and bar product.

This is not surprising considering the massive increase in demand, especially from Asia and China in recent months. In China alone, demand increased a huge four fold in just the last year to 3,500 tonnes.

net monthly Chinese silver imports Mitsui GoldCore

Read moreSilver Bullion Backwardation Suggests Supply Stress

Mervyn King ‘nuked’ the UK with quantitative easing, using what economists call the ‘nuclear option’:

– Quantitative Easing Explained

Just exchange the Fed with the BoE and ‘THE BEN BERNANK’ with ‘THE MERVY KING’.

Quantitative easing = printing money = creating money out of thin air = increasing the money supply = inflation = hidden tax on monetary assets = theft!

– Bank of England extends quantitative easing to £200 billion (Guardian)

And now Mervyn King warns of the fallout of quantitative easing, which is inflation!

Wake up Britain!

Mervyn King is a criminal and an elite puppet.

Mervyn King said the idea that the Bank of England could have preserved living standards by preventing a rise in inflation was ‘wishful thinking’ Photo: REUTERS

Mr King warned that inflation was likely to rise to between 4pc and 5pc over the next few months, before falling back next year. He said that inflation has climbed to its current level of 3.7pc because of rising import and energy prices and taxes, and that these factors had squeezed real take-home pay by around 12pc.

In a speech in Newcastle that included references to both Ken Dodd and Leo Tolstoy, Mr King said the shock 0.5pc fall in GDP over the fourth quarter of 2010 served as a reminder of his comment last year that the recovery would be “choppy”. But he added: “Of more immediate concern to the MPC is that we are experiencing uncomfortably high inflation.”

Read moreBank of England’s Mervyn King Warns Inflation Could Reach 5 Percent Within Months

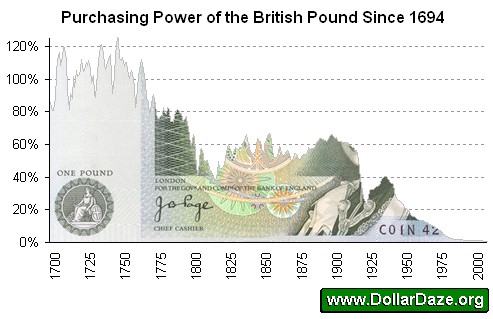

… and a short history of fiat currencies:

And soon one dollar will be completely worthless.

Franklin Roosevelt, pictured with Winston Churchill and Josef Stalin, suspended US dollar convertibility to gold in 1933

3600 BC – First smelting of gold

Egyptian goldsmiths carry out the first melting or fusing of ores in order to separate the metals inside. They use blowpipes made from fire-resistant clay to heat the smelting furnace.

2600 BC – Early gold jewellery

Goldsmiths of ancient Mesopotamia (modern-day Iraq) craft one of the earliest pieces of gold jewellery, a burial headdress of lapis and carnelian beads with willow leaf-shaped gold pendants.

1223 BC – Creation of Tutankhamun’s funeral mask

Instantly recognised the world over, the funeral mask of Tutankhamun is a triumph of gold craftsmanship from the ancient world.

– Gold hits 2010 high as Greece fear boosts buying (Reuters):

(Reuters) – Gold prices rose to their highest level this year on Friday, above $1,160 an ounce, as a downgrade of Greece’s debt renewed fears over the euro zone’s financial stability, prompting a flight to safer investments.

The metal ended the week about 3 percent higher, which marked the biggest gain since the week of January 10.

Got gold?

British gold investors have made a profit of 34pc since August last year (AFP)

In dollar terms the gold price is about 5pc below its record, but the weakness of the pound and the euro against the American currency means that for investors in Britain and the eurozone the precious metal has never been so valuable.

The price of an ounce of gold has reached record levels of £754 and €865 in recent trading, and the dollar price has reached a three-month high of $1,157.

In August last year the gold price in sterling terms was £562, so British gold investors have made a profit of 34pc, compared with a rise in the dollar price of 23pc over the same period.

– Bank of England warns families to expect fall in living standards (Telegraph):

Families have been warned by the Bank of England to expect an effective pay cut in the coming months because of the economic climate.

And the Bank of England banksters should know what they are talking about, because with their quantitative easing (= creating money out of thin air = printing money = increasing the money supply = creating inflation.) policy they are destroying the pound!

Inflation is a hidden tax on monetary assets.

“By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.”

– John Maynard Keynes

See also:

– Europe’s Top Banks Brace For UK Debt Crisis And Sterling Debacle

Almost 4million Brits living abroad are planning a mass return to home shores after seeing their savings and income stripped by the plunging values of the pound and their property.

The dramatic slump has slashed their income by a third and has turned Brits into the paupers of Europe.

Fears over job security and falling property prices are also giving expats second thoughts, according to research from foreign exchange specialist Moneycorp.

Some 845,000 Brits living in Spain and France have suffered an 8 per cent drop in house prices in the year to August 2009 alone. This wiped €30,000 off the average property on the Costa del Sol.

Sterling has slumped from over €1.50 to £1 in January 2007 to close to parity, taking a terrible toll on the estimated 5.5million British expats, and particularly the 1.1million pensioners living abroad. Moneycorp research shows that 70 per cent of all expats are now considering returning to the UK.

I have told you many times before that Gordon Brown, ‘THE SAVIOR’, is really just another elite puppet prime minister, that is destroying any future that the people of the UK might have had, hand in hand with the Bank of England, that is printing money like mad to destroy the pound.

The BoE calls it ‘Quantitative Easing’, which is creating money out of thin air = pure inflation, which is nothing more than a hidden tax.

Those criminals are looting the taxpayer until there is nothing left.

The same is happening in the US, with their elite puppet President Obama and the Fed.

No turning back: Sterling is going to fall further over coming months, warns Unicredit

The Italian-German group, Europe’s second largest bank, said Britain’s tax structure will make it hard to raise fresh revenue quickly enough to restore confidence in UK public finances.

“I am becoming convinced that Great Britain is the next country that is going to be pummelled by investors,” said Kornelius Purps, Unicredit ‘s fixed income director and a leading analyst in Germany.

Mr Purps said the UK had been cushioned at first by low debt levels but the pace of deterioration has been so extreme that the country can no longer count on market tolerance.

“Britain’s AAA-rating is highly at risk. The budget deficit is huge at 13pc of GDP and investors are not happy. The outgoing government is inactive due to the election. There will have to be absolute cuts in public salaries or pay, but nobody is talking about that,” he told The Daily Telegraph.

“Sterling is going to fall further over coming months. I am not expecting a crash of the gilts market but we may see a further rise in spreads of 30 to 50 basis points.”

Read moreEurope’s Top Banks Brace For UK Debt Crisis And Sterling Debacle

See also: – Financier Jim Rogers denies saying pound will collapse (Market Watch):

“I did not know about this press release. I didn’t say those things,” Rogers told MarketWatch.com in a phone interview from Singapore Friday.

“I am on record as saying the U.K. has serious problems over the next few years and the pound sterling has serious problems over the next few years as well,” Rogers said in the interview. “I would say the same about a lot of currencies. All paper money is suspect these days.”

Rogers said he has no position in the pound, long or short, and that he holds no U.K. assets.

He said he is long the euro, however.

“I think the euro probably will survive this bout with the Greeks,” Rogers said.

Actually, Jim Rogers didn’t say that the pound will collapse in the very near future…

It was all made up by Vince Stanzione whose company put out the following press release as what appears to have been a publicity stunt:

Pound Could Collapse Within Weeks, Predicts Billionaire Financier Jim Rogers

February 25, 2010 – Press Dispensary – The UK Pound is on the brink of a collapse which will herald a downturn worse than 2008/9, it could well happen within weeks and the British government is powerless to prevent it. And this in turn will foreshadow a global economic winter that could come before the end of 2010 and make the last two years seem like a mild spring day.

Rogers found the claim ‘outrageous’ and rushed to correct misunderstandings with the media. Meanwhile, the culprit, Vince Stanzione, says it was a mix up and that his company’s press release wasn’t meant to be sent out.

Regardless, it was great exposure for his ‘Trading Day Seminar’ either way… and a ray of attention for this self-described renaissance man:

. . . a self-made multi-millionaire based in Europe. Beginning aged 16 at NatWest Foreign Exchange in London, he quickly made his mark and then left to form his own company, since when he has been involved in mobile communications, premium rate telephony, interactive gaming, publishing and television and financial trading. He currently lives most of the year between Spain and Monaco and trades his own funds, mainly in currencies and commodities. He also teaches a small number of students and produced the best-selling course on Financial Spread Betting. Vince Stanzione is the author of ‘How to Stop Existing & Start Living’ and ‘Making Money From Financial Spread Trading’, is the Spread Betting Expert for Growth Company Investor and writes monthly columns for The City Magazine, Canary Wharf and Vicinitee Magazine.

Jason Bourne lives.

Vincent Fernando | Feb. 26, 2010, 9:01 AM

Source: The Business Insider