Now the ECB wants to resort to the ‘nuclear option’ like the Federal Reserve banksters and only Germany objects to the QE (quantitative easing) madness?

The fallout from the ‘nuclear option’ is called inflation!

All those bankster bailouts and deficit spending have bankrupted Greece, Ireland, Portugal, Spain, Italy etc.

On deficit spending and the ‘nuclear option’ (= QE = printing money = creating money out of thin air = increasing the money supply = inflation = hidden tax on monetary assets = theft):

“By a continuing process of inflation , governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.”

– John Maynard Keynes

“In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. … This is the shabby secret of the welfare statists’ tirades against gold. Deficit spending is simply a scheme for the confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists’ antagonism toward the gold standard.”

– Alan Greenspan

“When a country embarks on deficit financing and inflationism you wipe out the middle class and wealth is transferred from the middle class and the poor to the rich.”

– Ron Paul

The real intend behind those policies is to destroy the middle class and the poor, making the rich even richer.

Germany just doesn’t want to burn in the hell of Weimar again.

See also:

– Angela Merkel: ‘If this is the sort of club the euro is becoming, perhaps Germany should leave’

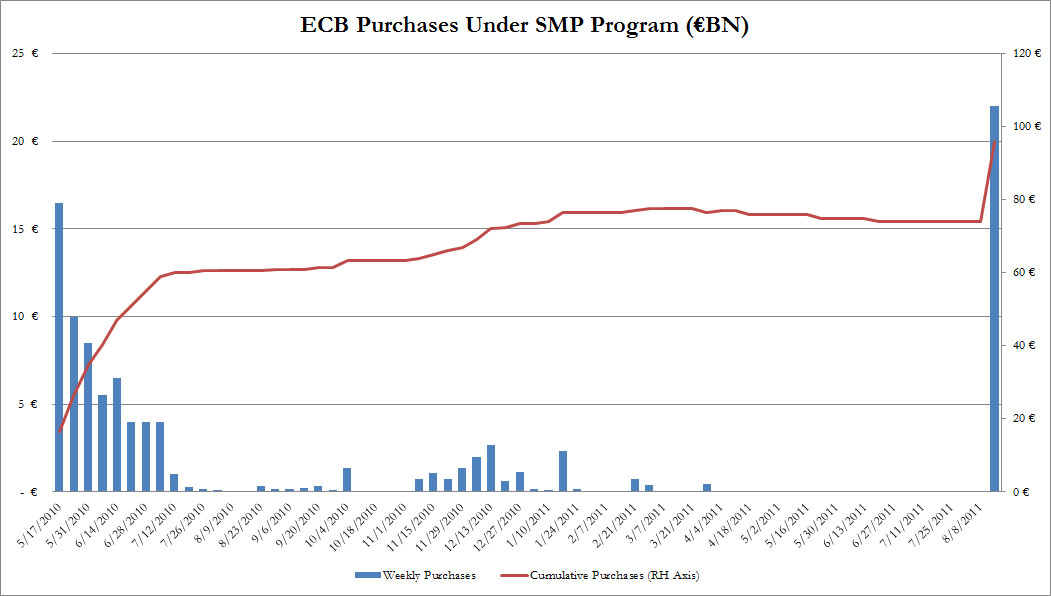

The European Central Bank has rebuffed calls for mass purchases of southern European bonds, despite growing pressure from Spain and Italy for dramatic action to buttress monetary union.

Jean-Claude Trichet, the ECB’s president, said emergency lending support for eurozone banks would be extended until at least April next year

Jean-Claude Trichet, the ECB’s president, said emergency lending support for eurozone banks would be extended until at least April next year, citing “acute tensions” in the market.

The delay removes the risk that Frankurt might soon pull away the prop holding up the Irish and Greek banking systems, as well as the Spanish cajas – or savings banks – and the sovereign states behind them. Traders say the ECB intervened directly in the weakest bond markets on Thursday to drive down yields and calm nerves.

However, Mr Trichet said there had been no decision to step up purchases of peripheral bonds to a whole new level – the so-called “nuclear option” – despite the potentially dangerous rise in Spanish, Italian, Belgian and even French yields over the past three weeks.

Some credit market analysts had speculated that the ECB might launch a blitz of €1 trillion to €2 trillion of debt purchases, but this was never likely at this stage. Such action is anathema to Germany.

Rainer Bruderle, the German economy minister, spelled out Berlin’s objections on Thursday just hours before the ECB meeting, insisting that “the permanent printing of money is not a solution”.

A chorus of influential voices in Germany has warned that any attempt by the ECB to prop up Club Med with loose money would be a grave error, undermining German political support for monetary union.

“It would be fatal if the ECB was to squander its credibility,” said Klaus Zimmerman, head of the DIW German Economic Research Institute. He said the bank is the last bastion of credibility after the serial breach of EU fiscal and debt rules.

“Broader purchases of the distressed eurozone debt would calm speculation for a short time, but would just invite risk-taking by investors in general,” he said.

Read moreECB Bows To German Veto On Mass Bond Purchases