Other Bilderberg members are Helmut Schmidt, Gerhard Schröder, Angela Merkel and Peer Steinbrück.

Get the picture Germany?

Your leaders are selected, not elected.

Just like in the US.

– George Carlin: The American Dream:

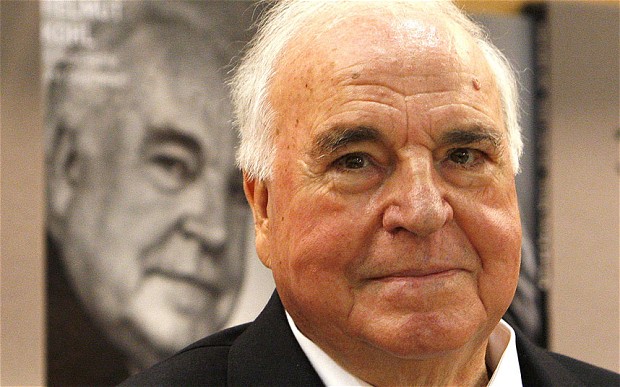

Helmut Kohl, Germany’s former chancellor, has admitted that he acted like a “dictator” to bring in the single currency to the country, otherwise he “would have lost” had he held a referendum.

“We would have lost a referendum on the introduction of the euro,” said former German Chancellor Helmut Kohl

– Helmut Kohl: I acted like a dictator to bring in the euro (Telegraph, April 9, 2013):

In an interview conducted for a journalist’s PhD thesis, Germany’s longest-serving postwar chancellor said that he would have lost any popular vote on the euro by an overwhelming majority.

“I knew that I could never win a referendum in Germany,” he said. “We would have lost a referendum on the introduction of the euro. That’s quite clear. I would have lost and by seven to three.”

The interview was conducted by Jens Peter Paul, a German journalist in 2002, the year when the Deutsche Mark was replaced by euro notes and coins, but has only been published now.

In it, Mr Kohl describes adopting the euro as an emblem of the European project, which he said had prevented war on the continent. Born in 1930, Mr Kohl’s politics were shaped by his country’s history in the 1930s and 1940s; his final years in power were focused on promoting European unity.

In the interview, he said: “If a Chancellor is trying to push something through, he must be a man of power. And if he’s smart, he knows when the time is ripe. In one case – the euro – I was like a dictator … The euro is a synonym for Europe. Europe, for the first time, has no more war.”

Mr Kohl justified overcoming the German public’s reluctance to relinquish the Deutsche Mark by saying that democratic politics had to be based on convictions rather than the ebb and flow of elections.