Chinese Kids Driving Supercars: Inside the Secret Southern California Meet-up

Nov 18, 2014

Description:

China’s ultra-rich are growing in number and in wealth – and are sending billions of dollars out of the country. Much of it is landing up in the U.S. where many children of the wealthy elite are sent to get an American college education — and they’re living large. Vocativ found a sub-culture of these Chinese students in California. They drive luxury cars like Maseratis and Ferraris and flaunt their wealth at discreet private parties and in online groups, like “Super Cars in America”.

– ‘Diabolical & absurd’: Outrage as Save the Children gives Tony Blair Global Legacy Award:

A decision by UK charity Save the Children to give Tony Blair its annual Global Legacy Award has unleashed a torrent of criticism highlighting the former PM’s role in Britain’s 2003 Iraq war and his controversial business dealings in the Middle East.

The former Labour leader, who is currently a key focus of a public inquiry into Britain’s invasion of Iraq, received the honor on Wednesday night at a star-studded gala hosted by the charity in New York.

Save the Children’s decision to offer Blair the award has provoked outrage across the UK, with critics insisting the move utterly discredits the charity.

…

Flashback:

– DEPLETED URANIUM: ‘THE GREATEST CRIME OF HISTORIC TIME’

– Dramatic Drone’s-Eye View Of The Record Upstate New York Snowfall:

With half the nation covered in snow, according to ABC, nowhere appears to have had it worse (or more suddenly) than upstate New York. As images pour in from lake-effect snow, to The Buffalo Bills stadium, and from scenes caught in a snow storm to pandas playing, we thought the following stunning drone’s-eye-view over Erie County was both incredible in its beauty and cruel in its GDP-destroying reality.

A Drone’s eye view of the beauty (and GDP cruelty) of a snow-buried upstate New York

– 141-year-old cold record shattered in Jacksonville:

For the second morning in a row, Jacksonville, Florida, dropped to a new record low.

…

– Climatologist: 30-Year Cold Spell Strikes Earth:

With nasty cold fronts thrusting an icy and early winter across the continental U.S. — along with last winter described by USA Today as “one of the snowiest, coldest, most miserable on record” — climatologist John L. Casey thinks the weather pattern is here to stay for decades to come.

In fact, Casey, a former space shuttle engineer and NASA consultant, is out with the provocative book “Dark Winter: How the Sun Is Causing a 30-Year Cold Spell,” which warns that a radical shift in global climate is underway, and that Al Gore and other environmentalists have it completely wrong.

The earth, he says, is cooling, and cooling fast.

…

And yes, you read that one right:

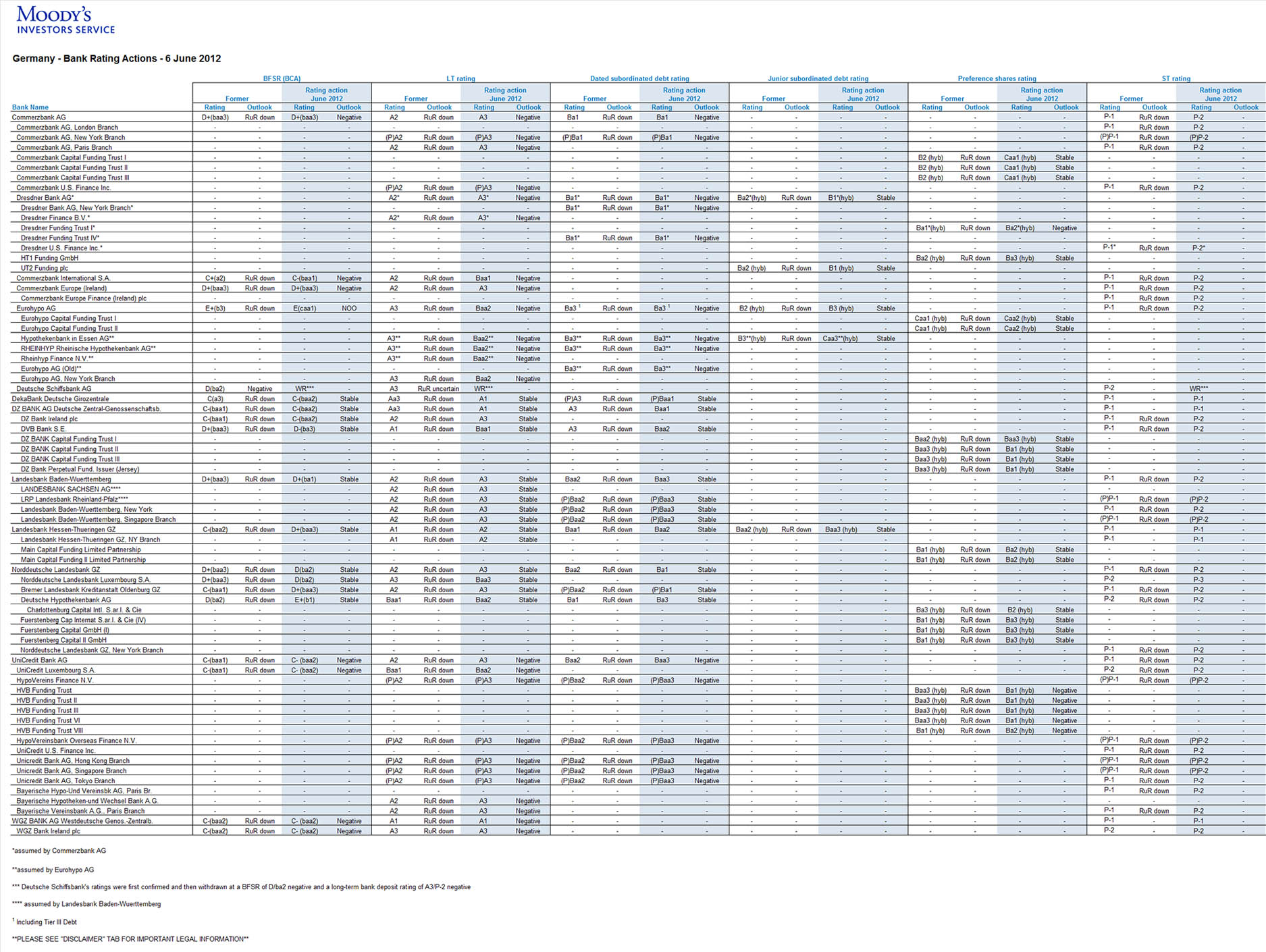

– The Wrath of Draghi: Biggest German Banks Impose “Negative Interest Rates”:

Commerzbank, Germany’s second-largest bank, a toppling marvel of ingenuity during the Financial Crisis that was bailed out by ever dutiful if unenthusiastic taxpayers, will now reward these very folks with what Germans have come to look forward to: the Wrath of Draghi.

It started with Deutsche Skatbank, a division of VR-Bank Altenburger Land. The small bank was the trial balloon in imposing the Wrath of Draghi on savers and businesses. Effective November 1, those with over €500,000 on deposit earn a “negative interest rate” of 0.25%. In less euphemistic terms, they get to pay 0.25% per year on those deposits for the privilege of giving their money to the bank.

“Punishment interest” is what Germans call this with Teutonic precision.

…

– Amazon robots prepare for Christmas:

The squat, wheeled machines move stocked shelves to workers

In its latest bid to boost productivity and speed delivery, Amazon.com Inc. is deploying a robot army.

The Seattle online retailer has outfitted several U.S. warehouses with squat, orange, wheeled robots that move stocked shelves to workers, instead of having employees seek items amid long aisles of merchandise, according to people familiar with the matter. At a 1.2-million-square-foot warehouse in Tracy, Calif., about 60 miles east of San Francisco, Amazon this summer replaced four floors of fixed shelving with the robots, the people said.

Now, “pickers” at the facility stand in one place and wait for robots to bring four-foot-by-six-foot shelving units to them, sparing them what amounted to as much as 20 miles a day of walking through the warehouse. Employees at some robot-equipped warehouses are expected to pick and scan at least 300 items an hour, compared with 100 under the old system, current and former workers said.

The robots are the fruits of Amazon’s 2012 purchase of Kiva Systems Inc. for $775 million. In May, Amazon Chief Executive Jeff Bezos told investors at Amazon’s annual meeting that he planned to deploy 10,000 Kiva robots by year-end, up from 1,400 at the time.

…

– A Quick Look At Goldman’s Takeover Of The US Judicial System: NY Fed Edition:

One really just can’t make this up. Perhaps the Fed inspector general, when he is done “fixing” the corruption at the NY Fed will be so kind to take a look at the Goldman takeover of the US judicial system next.

…

And the saddest thing: it cost the banks (and their lawyer lackeys) under a million to buy America’s judicial system off: American justice is not only for sale, it goes at firesale prices!

…

– The NY Fed’s Attempt To Explain That It Is Not A Subsidiary Of Goldman Sachs:

The most shocking, if already completely buried, news of the day was that – in yet another confirmation that Goldman Sachs is in charge of the New York Fed – a NY Fed staffer was colluding and leaking confidential, material information to a 29-year-old Goldman vice president, himself a former Federal Reserve employee. This only happened because on the day Carmen Segarra disclosed her 47 hours of “secret Goldman tapes” on This American Life, Goldman executives asked the former Fed staffer where he had gotten what appeared to be confidential information from. To nobody’s surprise the answer was: The New York Fed. So as the latter, also known as the biggest hedge fund of the western world with $2.7 trillion in AUM, is scrambling to once again prove it is shocked, shocked, that it has become merely the latest subsidiary of Goldman Sachs, Inc., it released the following statement explaining what “really” happened.

…

– “Some Folks Lied” – How The Administration Fabricated Obamacare Enrollment Numbers:

Two months ago, to much fanfare by the progressive community, HHS, if not Dr. Jonathan Gruber, were delighted to report that as of August 15, Obamacare enrollment had hit 7.3 million sign ups, well above the 7.0 million goal. Then a week ago we learned that “projection mistakes were made” after the “Obama administration revised its estimate for Obamacare enrollment, now saying – with the bruising midterms safely in the rearview mirror – that it expects some 9.9 million people to have coverage through the Affordable Care Act’s insurance exchanges in 2015, millions fewer than outside experts predicted.” Fast forward to today when moments ago Bloomberg reported, that “the Obama administration included as many as 400,000 dental plans in a number it reported for enrollments under the Affordable Care Act, an unpublicized detail that helped surpass a goal for 7 million sign-ups.“

…

– Dutch government refuses to reveal ‘secret deal’ into MH17 crash probe:

The Dutch government has refused to reveal details of a secret pact between members of the Joint Investigation Team examining the downed Flight MH17. If the participants, including Ukraine, don’t want information to be released, it will be kept secret.

…

– Neo-Feudalism Has Officially Arrived – Congressman Suggests Building A Moat Around White House:

“While the general population is aware something is seriously wrong, people remain extremely confused about the root of the problem. This is because what’s happening all around us isn’t socialism and it isn’t free market capitalism. It is actually a return to something much more ancient and much more oppressive. It is a return to serfdom, neo-fedualism and oligarchy.”

…

– Giant sinkhole swallows up old mine in Russia’s Urals (PHOTOS):

A sinkhole 20 by 30 meters (65 by 98 feet) in size has been found near a Uralkali mine in Russia’s Perm region. While the company says the development is of no further threat, locals fear the whole nearby town could go underground.

…

…

– As The “Sanctions War” Heats Up, Will Putin Play His ‘Gold Card’?:

The topic of ‘currency war’ has been bantered about in financial circles since at least the term was first used by Brazilian Finance Minister Guido Mantega in September 2010. Recently, the currency war has escalated, and a ‘sanctions war’ against Russia has broken out. History suggests that financial assets are highly unlikely to preserve investors’ real purchasing power in this inhospitable international environment, due in part to the associated currency crises, which will catalyse at least a partial international remonetisation of gold. Vladimir Putin, under pressure from economic sanctions, may calculate that now is the time to play his ‘gold card’.

…

A BRIEF HISTORY OF THE CURRENCY WAR

…

RUSSIA, NATO AND THE ‘SANCTIONS WAR’

…

SO, WILL PUTIN PLAY THE ‘GOLD CARD’?

…

– Missing Gold – Precious Metals in WTC 4 Vault: Only a Fraction Recovered?:

…

Why is there this huge discrepancy between the value of gold and silver reported recovered, and the value reported to have been stored in the vaults? There are a number of possible explanations, from outright theft using the attack as cover, to insurance fraud. Until there is a genuine investigation that probes all the relevant facts and circumstances surrounding the attack, we can only speculate.

– Retail Rapture: UK Grocery Sales Drop 1st Time In 20 Years, Dollar General To Shut 4000 Stores:

For the first time since it began collecting data in 1994, Kantar Worldpanel, the market researcher, reported a decline in UK grocery sales by value, as The FT reports the biggest UK grocers were “losing market share hand over fist,” as analysts warn “there are phoney price wars, and there are real price wars. This is a real price war.” This comes on the heels of Goldman report claiming 20% of British grocers are surplus to requirements. But it’s not just Britain… in the the cleanest dirty shirt world-economic-growth supporting decoupled economy of the USA, Reuters reports Dollar General may need to divest more than 4,000 stores to win approval from the U.S. Federal Trade Commission for its acquisition of Family Dollar.

…

– 5-foot-tall ‘Robocops’ start patrolling Silicon Valley:

Autonomous “Robocop”-style robots, equipped with microphones, speakers, cameras, laser scanners and sensors, have started to guard Silicon Valley.

The security robots, called Knightscope K5 Autonomous Data Machines, were designed by a robotics company, Knightscope, located in Mountain View, California.

The robots are programmed to notice unusual behavior and alert controllers. It also has odor and heat detectors, and can monitor pollution in carpets as well. Last but not least: with cameras, the Robocops can remember up to 300 number plates a minute, monitoring traffic.

…

– The New World Order: Does It All Just Boil Down To A Battle For Your Soul?:

…

This problem extends into the oligarchy of globalists, who adore the theories expressed in Plato’s “The Republic,” in which an elite cadre of “philosopher kings,” men who have achieved a heightened level of academic knowledge, are exalted as the most qualified leaders. However, leadership requires more than knowledge, even if that knowledge is profound. Leadership also requires compassion and informed consent, two things for which the elites have no regard.

…

– American-born London mayor refuses to pay US taxes, threatens to renounce citizenship:

The Internal Revenue Service reportedly wants London Mayor Boris Johnson to write a check for taxes he owes to the United States government, but the UK politician says he isn’t paying.

…

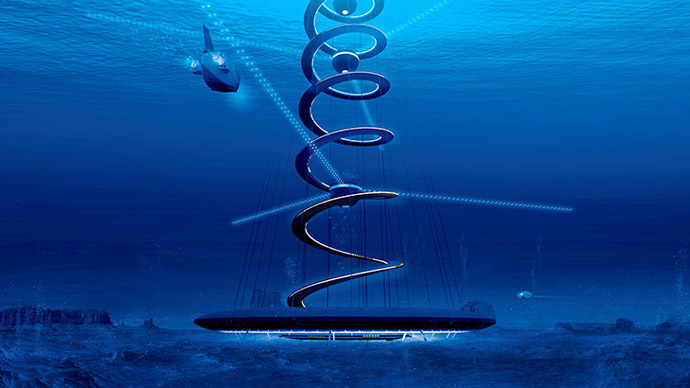

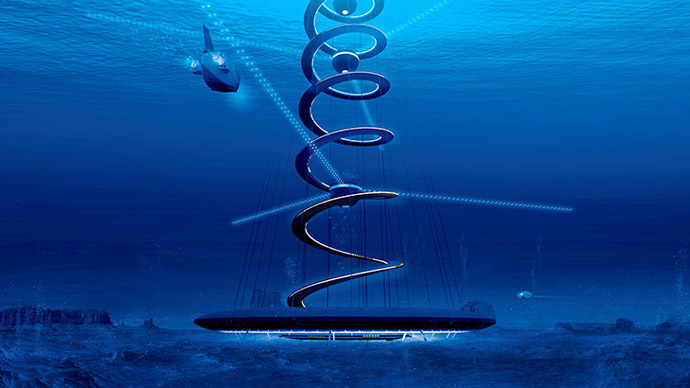

Those ‘brilliant’ Japanese ‘visionaries’ never heard of Fukushima:

– Living under the sea: Japanese visionaries unveil underwater city plan:

Will people ever live in underwater cities? Japanese construction firm says it is possible by 2030. The visionaries revealed a $25 billion deep-sea eco-city plan called Ocean Spiral for 5,000 people that will produce energy from sea resources.

Many have pondered the idea of living under the sea while sci-fi film directors such as George Lucas tempted our imagination with stunning images of underwater cities. Such was the Gungan city consisting of a mass of hydrostatic bubbles shown in the first part of the “Star wars” epic space film series.

Now a Japanese construction firm Shimizu Corp. says that building an underwater residential area is not a fantasy and aims to build one by 2030 – in just 15 years.

…

– China and others can cripple US power grid, NSA admits for the first time:

The head of the National Security Agency warned Congress on Thursday that China and “one or two” other nations currently possess the capability of crippling the American power grid through cyberattacks.

…

– 6 Months Before The Fed Is Said To Hike Rates, It Still Has No Idea How It Will Do That:

It has become quite clear that the Fed neither has the intention, nor the market mechanism to do any of that, and certainly not in a 3-6 month timeframe. Which may explain the Fed’s hawkish words on any potential surge in market vol. After all, if the nearly $3 trillion in excess reserves remain on bank balance sheets for another year, then the only reason why vol could surge is if the Fed lose the faith of the markets terminally. At that point the last worry anyone will have is whether and how the Fed will tighten monetary policy.

…

– Initial Jobless Claims Hit 2-Month Highs, Continuing Claims Tumble To 14-Year Lows:

It is still far too early to call a turn in the long-term trend of initial jobless claims but this is the 5th week that new lows have not been made, 4th miss in a row, and (despite last week’s upward revision) claims sit at 2-month highs. Initial claims printed 291k (against 284k expectations) down very slightly from an upwardly revised 293k last week. However, continuing claims continue to tumble to fresh cycle lows at 2.33 million (below expectations and well down from last week’s jump).

…

– Another Triple-Fat-Finger VIX Day Saves Stocks:

Ugly data in Asia, Europe, and US PMI meant US equities opened gap-down… that was unacceptable to ‘someone’ and so the “most shorted” names were squeezed. However, after 10 minutes the ramp started to fade… and so the big boys ‘fat-fingered’ VIX and that rescued the dip. That would be fine… but it happened again at 958ET when stocks started to fade again and suddenly VIX was lit up and zoom… stock momentum was ignited and all was well in the world… Broken record? Yes! But clearly someone has to take note of this rigging…

…

– Ice on the Mississippi River in Iowa:

“I’ve seen ice like this or even worse, but it’s usually not until the middle of December,” says lockmaster.

…

Game 9 – 2014 World Chess Championship – Magnus Carlsen vs Viswanathan Anand

WTF: A Night With Japan’s Highest Paid Male Gigolo

A trader reacts in front of the DAX board at the Frankfurt stock exchange.

A trader reacts in front of the DAX board at the Frankfurt stock exchange.