Panic:

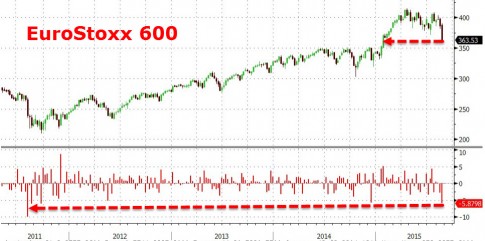

DAX -5,68%

DOW JONES -4,21%

S&P 500 -4,36%

NASDAQ COMPOSITE -4,68%

NASDAQ 100 -4,70%

– Global Stocks Plunge as 10-Year Treasury Yield Falls to Record; Gold Rises (Bloomberg, August 18, 2011):

Stocks sank while Treasuries rallied, pushing 10-year yields to a record low, amid growing concern the economy is slowing and speculation that European banks lack sufficient capital. Gold climbed to a record, while oil led commodities lower.

The MSCI All-Country World Index of stocks lost 4.2 percent at 10:22 a.m. in New York as the Standard & Poor’s 500 Index tumbled 4.3 percent and Germany’s DAX Index plunged as much as 7 percent, the most on a closing basis since 2008. Ten-year Treasury note yields slid as much as 19 basis points to 1.97 percent as rates on similar-maturity Canadian and British debt also reached all-time lows. The dollar appreciated versus 14 of 16 major peers, climbing 1 percent to $1.4286 per euro. Gold futures rallied as much as 2 percent to $1,829.70 an ounce, while oil slid 5.2 percent.

– U.S. Stocks Drop Sharply, Following Europe (New York Times, August 18, 2011):

Stocks on Wall Street fell sharply on Thursday, following the trend set in Asia and Europe as more disappointing economic data emerged and concerns again focused on the financial sector.

The Standard & Poor’s 500-stock index was down more than 4 percent. The Dow Jones industrial average was down about 450 points, or 4 percent, and the Nasdaq was down nearly 5 percent. Major indexes in Europe were down 3 to 5 percent.

The yield on the Treasury’s 10-year note fell to a record low as investors turned to the safety of fixed-income securities.