– Lloyds to shed further 3,000 jobs, double branch closures

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

The man who trades freedom for security does not deserve nor will he ever receive either. – Benjamin Franklin

– S&P Downgrades Numerous European Banks, Warns Deutsche Bank May Be Next (ZeroHedge, Feb 3, 2015):

Just hours after apparently settling its suit with the USA (not at all retaliation for downgrading them), S&P has taken the big red marker out on a slew of European banks:

- Downgrades: Credit Suisse, Barclays, Lloyds, Bank of Scotland, RBS, HSBC, and Ulster Bank

- On Watch Negative: Raiffeisen Zentralbank, MBank, Unicredit, Commerzbank, and Deutsche Bank

The driver of the shift in perspective is the apparent removal of the ‘bailout put’, as the prospect of “extraordinary government support” appeared less likely under recently passed bail-in legislation.

…

– Lloyds caught in new PPI storm: Taxpayer-backed bank saved tens of millions of pounds by wrongly cutting compensation to it’s customers (Independent; March 24, 2014):

One of Britain’s biggest banks has cost victims of the payment protection insurance (PPI) scandal tens of millions of pounds by wrongly cutting their compensation awards, a new investigation claims.

Lloyds Banking Group, which is 33 per cent owned by the taxpayer after a £20bn bailout, has been unilaterally reducing payouts to people who were mis-sold the notorious policies. The bank’s behaviour has been described by one expert as “a scandal coming out of a scandal”.

– Chinese insurer buys landmark Lloyds of London skyscraper (Reuters, July 8, 2013):

Chinese insurer Ping An has bought the landmark London home of insurance market Lloyds of London for 260 million pounds, the first in a predicted wave of property deals by Chinese companies in London.

A German fund managed by Commerz Real (part of Commerzbank) sold the building to the Chinese company in a deal that represents a rental yield of 6.1 percent, broker Savills said in a statement on Monday.

Read moreChinese Insurer Buys Landmark Lloyds Of London Skyscraper For 260 Million Pounds

– Mark-To-Market Manipulation Hides $90 Billion Losses For UK Banks (ZeroHedge, March 12, 2013):

Some have attributed the resurrection of the financial markets (or more appropriately the banks) from the March 2009 lows to the IASB/FASB changes to factual to fantasy accounting. The Telegraph reports today that from PIRC’s and the Bank of England’s Financial Policy Committee that while banker bonuses continue to rise (for now), ‘hidden’ losses among UK banks could total GBP60 Billion (USD 90 Billion). HSBC topped the list with GBP10.4 Billion in bad debts that have yet to be written off and while the ‘accounting’ bodies are suggesting they will address criticism of this farce, as one analyst notes, they “can still make unprofitable lending appear profitable.” Regulators expect to hear plans from lenders on how they intend to fill these holes before the end of the month to coincide either with the FPC’s meeting on March 19 or a statement scheduled for March 27. While outright recaps are unlikely, banks are expected to

restructure and set out plans to raise their capital levels over the next

couple of years. More fantasy…PIRC has calculated the amount of bad debts the banks may have to write off in coming years but have yet to subtract from profits, together with other items such as deferred bonuses not booked.

HSBC, which is the biggest bank by assets, was shown to have £10.4bn of hidden losses, the Royal Bank of Scotland has £9.4bn, and Barclays has £7.3bn. Lloyds Banking Group has £2.5bn and Standard Chartered £2.2bn. Together the undeclared losses total £31.8bn.

Read moreMark-To-Market Manipulation Hides $90 BILLION Losses For UK Banks

– Lloyds online fraud chief admits £2.4m fraud (Guardian, Aug 7, 2012):

A former Lloyds bank boss in charge of online security has admitted a £2.4m fraud.

Jessica Harper took the money over a four-year period while working as head of fraud and security for digital banking at Lloyds Banking Group.

Harper stood in the dock at Southwark crown court, in London, and admitted a single charge of fraud by abuse of position by submitting false invoices to claim payments totalling £2,463,750.

She also admitted a single charge of transferring criminal property, the money, which she had defrauded from her employers.

Read moreAnd Now: Lloyds Online Fraud Chief Admits £2.4 Million Fraud

See also:

Richard Ward said Lloyd’s of London could have to take writedowns on its £58.9bn investment portfolio if the eurozone collapses

– Lloyd’s of London preparing for euro collapse (Telegraph, May 27, 2012):

Richard Ward said the London market had put in place a contingency plan to switch euro underwriting to multi-currency settlement if Greece abandoned the euro.

In an interview with The Sunday Telegraph he also revealed that Lloyd’s could have to take writedowns on its £58.9bn investment portfolio if the eurozone collapses.

Europe accounts for 18pc of Lloyd’s £23.5bn of gross written premiums, mostly in France, Germany, Spain and Italy. The market also has a fledgling operation in Poland.

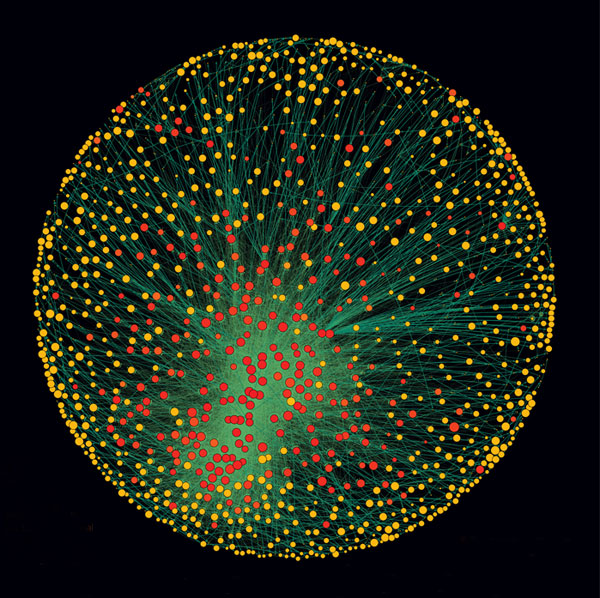

The 1318 transnational corporations that form the core of the economy. Superconnected companies are red, very connected companies are yellow. The size of the dot represents revenue (Image: PLoS One)

– Revealed – the capitalist network that runs the world (New Scientist, Oct. 19, 2011):

AS PROTESTS against financial power sweep the world this week, science may have confirmed the protesters’ worst fears. An analysis of the relationships between 43,000 transnational corporations has identified a relatively small group of companies, mainly banks, with disproportionate power over the global economy.

The study’s assumptions have attracted some criticism, but complex systems analysts contacted by New Scientist say it is a unique effort to untangle control in the global economy. Pushing the analysis further, they say, could help to identify ways of making global capitalism more stable.

The idea that a few bankers control a large chunk of the global economy might not seem like news to New York’s Occupy Wall Street movement and protesters elsewhere (see photo). But the study, by a trio of complex systems theorists at the Swiss Federal Institute of Technology in Zurich, is the first to go beyond ideology to empirically identify such a network of power. It combines the mathematics long used to model natural systems with comprehensive corporate data to map ownership among the world’s transnational corporations (TNCs).

“Reality is so complex, we must move away from dogma, whether it’s conspiracy theories or free-market,” says James Glattfelder. “Our analysis is reality-based.”

– Europe’s ‘Lehman Moment’ Looms as Greek Debt Unravels Markets: Euro Credit (Bloomberg, Jun 16, 2011):

The European Union’s failure to contain the Greek debt crisis is sending fresh shockwaves through currencies, money markets, equities and derivatives.

The euro lost more than 2 percent against the dollar in the past two days and the cost of protecting corporate bonds soared to the highest level since January, with credit-default swaps anticipating about a 78 percent chance that Greece won’t pay its debts. Equities declined around the world, while a measure of fear in fixed-income markets jumped the most since November.

Maybe the headline should read:

‘Tories plan to bribe voters, by selling bank shares to the taxpayers, that they already own’

The government bought the shares with taxpayers money and now the Tories plan to sell those bank shares back to the taxpayers, who already own them?!

Brilliant! Absolutely brilliant!

What is the alternative?:

– Gordon Brown Praises New World Order (19 Feb 2010)

Doomed!

(The Sunday Times) — THE Tories are planning a bank shares bonanza for millions of families as they fight to save their lead in the polls, which has slumped to just 6%.

Cheap shares would be offered to small investors when the government’s £70 billion stake in Royal Bank of Scotland and Lloyds Banking Group is sold, George Osborne, the shadow chancellor, said last night.

The “people’s bonus” plan comes as a Sunday Times/YouGov survey today reveals that the Tories’ lead over Labour has slipped to the narrowest gap in more than a year.

The poll, the first in a series of weekly surveys which will be conducted between now and the general election, puts the Conservatives on 39%, down one point on January’s figure, and Labour on 33%, up two. The Liberal Democrats drop one point to 17%.

Read moreUK: Tories offer bank shares bonanza for all as poll lead dives

The Government is injecting a further £30bn into Lloyds and RBS.

The Chancellor confirmed that the Government would pump an extra £25.5 billion into Royal Bank of Scotland, and declared that it was the only way to keep the business alive.

Taxpayers have poured a total of £53.5 billion into RBS, including the £20 billion part-nationalisation last year and another £8 billion that was set aside as insurance against further trouble in the future.

In total, the Government has put £74 billion of taxpayers’ money into the banks, including RBS, Lloyds and HBOS, since the start of the financial crisis last year.

The Conservatives claimed the latest bail-out equated to an extra tax liability of £2,000 for every one of the 17 million families in the country. This comes on top of the £2,350 to which every household is already exposed as a result of previous attempts to prop up the financial system.

Read moreThe government spent £4,350 per family to bailout Britain’s banksters

Traders have borrowed an estimated £1.5bn of shares, amounting to 50pc of the stock available to borrow, according to figures from Data Explorers. Dealers say some of the stock on loan has already been used to place “short positions”, while other borrowed shares are being held in preparation to short the stock as soon as Lloyds announces its rights issue.

Shares in Lloyds have dropped 10pc this week following the decision by the European Commission to break up ING, the Dutch financial services giant. In order to gain approval from European competition authorities for the state-backed bail-out it received during the financial crisis, ING is selling its insurance business, which is thought to be worth up to £14bn. Shares in ING fell nearly 20pc on the news of the sale.

Read moreHedge Funds get ready to short Lloyds, have already borrowed an estimated £1.5bn of shares

Stock-lending, a key indicator of short-selling, doubled to 3.5pc of Lloyds’ total share capital in just four days last week, according to Data Explorers, as concern mounts about the bank’s ability to raise £25bn through a combination of debt for equity swaps, assets sales and a rights issue of up to £11bn.

The Financial Services Authority (FSA) and the Government are understood to have expressed grave concern that Lloyds may not be able to raise enough cash to extradite itself from the scheme.

The Treasury and the FSA were last night holding emergency talks about an escape plan, which has yet to be given the green light by either body.

Read moreLloyds short-selling doubled last week as traders predict share collapse

LLOYDS Banking Group staff are intimidating victims of the recession who have fallen behind on loan payments, an investigation by The Sunday Times has found.

Workers at Lloyds debt recovery department were secretly tape-recorded saying they would “put the frighteners on” and “f***” customers who owed the bank money.

The bank staff are incentivised by bonuses and some claimed to be representing a solicitors’ firm, while others pressured customers with repeated calls that left them in tears. Customers were told they would not even be able to obtain a Blockbuster video shop card if they failed to pay back their debt.

The employees would appear to be in breach of the Banking Code, which pledges to customers that banks “will be sympathetic and positive” when dealing with people in financial difficulties.

The tactics were witnessed by an undercover reporter who worked at the bank’s debt recovery office in Hove, East Sussex, for more than three weeks.

Andrew Mackinlay, the Labour MP, said he would be raising this newspaper’s findings in the Commons next week when he is due to speak in a adjournment debate on debt collection. “The current rules on the collection of debt are inadequate and need to be reviewed because they are not being enforced properly,” he said. “There need to be severe financial penalties if companies are found to be harassing customers and treating them badly.”

Read moreLloyds banksters are harassing customers with talk of home repossessions and blacklists

March 11 (Bloomberg) — Paulson & Co., the hedge fund run by billionaire John Paulson, may have made 311 million pounds ($428 million) since September by short selling Lloyds Banking Group Plc and HBOS Plc.

The firm took short positions in London-based Lloyds and HBOS that were valued at 367 million pounds in September, based on the holdings and share prices on the dates they were reported. The stake fell below the reporting threshold on March 9, regulatory filings show.

Paulson, which made $3 billion anticipating the U.S. housing market would collapse, gained as Lloyds, HBOS and Royal Bank of Scotland Group Plc sought bailouts from British taxpayers. Lloyds surrendered control to the government on March 7 in exchange for asset guarantees. Paulson made least 295 million pounds shorting RBS, bringing its profit from betting U.K. banking stocks would drop to 606 million pounds, according to earlier disclosures.

Lord Mandelson, asked Sir Fred Goodwin (pictured), to give back some of his pension

As scapegoats go, Sir Fred Goodwin is straight out of Central Casting. He’s a banker; he’s mucked up big time, cost the taxpayer sums still too large to calculate properly, and he’s walked away from the mess with riches beyond the avarice of a Premiership footballer. All he lacks, as a media villain, is a pair of staring eyes and record of cruelty to animals.

If Alastair Campbell were still around, Sir Fred might have been saddled with even that. But this week, as loomed the handing to banks of further barrels of public cash on what the furniture stores used to call easy terms, the Government had no need for nudge-nudge rumours of scuttlebutt to create a diversion. It had information even more incriminating and instantly unpopular: the size of Sir Fred’s pension pot.

It was huge; it was blood-pressure raisingly indefensible; and, above all, it seemed politically useful. Ministers had known the scale of it for months; something pretty close to its size had been reported on City pages as far back as 14 October last year. But it had never become An Issue. Now the time for it to do so had arrived. And so, on Wednesday evening, the exact magnitude of it was leaked to Robert Peston of the BBC. He went on air and could barely get the numbers out for hyperventilating: Sir Fred’s pot of gold was worth £16.9m; the man – so the story went – whose megalomaniac regime of compulsive acquisitions had brought down the Royal Bank of Scotland was now retired, at the age of 50, with a pension worth £13,000 a week for the rest of his life.

The ploy worked. By the following day, Fred’s Pension was dominating the news and provoking all the anti-banker indignation that a government spin-doctor hoped it might: “These fat cats must have their fortunes neutered” (Daily Mail), “Obscene: I won’t give up a penny” (Daily Express), and “No shred of shame; RBS boss Fred” (Daily Mirror). Yet all the while, behind this smokescreen, hundreds of billions of taxpayers’ cash was being committed to the banks on terms that seemed bewildering. This – the biggest leap in the dark in British economic history – is what the row over Fred’s pension concealed. It is a story that should now be told.

For a long time, it has been known that the big scheduled domestic event of last week would be RBS’s results. Their gargantuan size was widely expected, and the final figures didn’t disappoint: £24.1bn in the red – bigger than any American bank could manage, vastly outscoring some of the week’s other losses (such as housebuilder Barratt’s £592m), and relegating to barely visible footnotes the other depressing statistics of the week, such as household spending declining at its fastest rate since 1991; house prices down 15 per cent in a year; and service sector job losses at a 10-year high.

RBS’s losses, and those of Lloyds HBOS the following day, meant a further extension to the Government’s bailout, and taxpayers’ exposure. The size of the potential commitment to the banks is estimated at £1.3 trillion, equivalent to the value of the British economy for a whole year, and a burden equal to possibly as much as £36,000 for every man, woman and child in the country. And there could yet be more unpleasant discoveries. Looming rather less large in the public consciousness than Sir Fred’s pot was the appearance before the Treasury Select Committee of Mervyn King, Governor of the Bank of England. Fully five months after the present crisis began with the collapse of Lehman Brothers in September, he told MPs that it is still not known just how big the liabilities of British banks are. In his evidence to the Treasury Select Committee last week, he said it would take “many months” to establish the scale of toxic assets held by banks, requiring a detailed assessment contract by contract.

Also overshadowed by Sir Fred’s pot was the size of the latest government support for the banks. For a fee of £6.5bn, RBS will place £325bn worth of toxic assets in the Government’s newly created Asset Protection Scheme. The bank will then be liable for only the first £19.5bn of these dodgy assets, with the taxpayer accepting the risk of the rest. The shadow chancellor, George Osborne, said: “The British taxpayer is insuring the car after it has crashed.” Lloyds Banking Group’s participation is not yet finalised, but is expected to involve about £250bn worth of toxic assets.

The U.K. is in ‘unbelievable’ bad shape:

– Britain’s AAA credit rating threatened by scale of bank bail-out

– Bank of England wants to print more money

– Britain faces £100bn cut in spending according to ‘Bankrupt Britain’ report

– Alistair Darling on BBC’s Newsnight:

“The problem was that last October the banking system was facing imminent collapse,” he said. “We had no alternative but to intervene quickly.We had a matter of days and then hours to stop the entire banking system collapsing. Since then many other countries have done the same thing. The alternative was to let HBOS go down and last October [at such a critical point] the damage would not have stopped there.”

– ‘This is the worst recession for over 100 years’:

‘Surpassing even the Great Depression of the 1930s’

Ed Balls, the PM’s closest ally, warns that downturn is ferocious and says impact will last 15 years

– Jim Rogers: ‘Sell any sterling you might have; It’s finished’

– Jim Rogers: Now it’s time to emigrate, says investment guru

Prepare yourself! Do not rely on your government and the Bank of England.

Royal Bank of Scotland and Lloyds TSB, the two banks bailed out by the Government, are to add between £1 trillion and £1.5 trillion to the public debt, the equivalent of between 70 and 100 per cent of GDP, the Office for National Statistics indicated this morning.

Britain’s public sector net debt is already a record high, hitting 47.8 per cent of GDP in January, official figures show. This is the highest level of debt recorded since the ONS started recording data in 1993.

Read moreBailed-out banks to add £1.5 trillion to public debt

Resigned: Sir James Crosby quit as deputy chairman of the FSA after claims that he sacked a whistleblower who warned the bank was expanding too fast.

The senior banker blamed for the crisis at HBOS came under fresh attack today as it emerged that he is in line for a ‘scandalous’ pension of more than half a million pounds a year.

Sir James Crosby, who was forced to quit as a City regulator last week, is due to get an annual income of £572,000 after building up a pension pot of £10.4m. The Liberal Democrats today urged Sir James to forgo the payout, given the crisis the bank now faces.

The proposed pay-out will cause further embarrassment to the newly created Lloyds Banking Group, which took over HBOS this year.

Taxpayers currently own 43% of Lloyds and HBOS and Chancellor Alistair Darling is expected by many to further nationalise the bank amid plunging share prices. The bumper pension, the details of which are buried in HBOS’s annual report published last week, heaps further pressure on to Sir James.

Last night on BBC’s Newsnight Alistair Darling, the Chancellor, defended both the Government’s role in pushing through the Lloyds takeover of HBOS last October without due diligence and the subsequent £17 billion taxpayer-funded bailout of the merged entity.

“The problem was that last October the banking system was facing imminent collapse,” he said. “We had no alternative but to intervene quickly.We had a matter of days and then hours to stop the entire banking system collapsing. Since then many other countries have done the same thing. The alternative was to let HBOS go down and last October [at such a critical point] the damage would not have stopped there.”

Peter Cummings, left, at a dinner with the Top Shop owner Sir Philip Green in 2007. Mr Cummings was the head of corporate lending at HBOS and the bank’s highest-paid director (Jeremy Young)

HBOS’s aggressive corporate banking division was revealed to have been at the heart of the £10 billion shock loss announced by Lloyds Banking Group yesterday.

Lloyds Banking Group issued a warning that HBOS, the ailing bank it has taken over, made a whopping £7 billion of corporate losses last year after making bad bets on business lending.

Lloyds admitted that HBOS’s corporate division, which was run by Peter Cummings – the highest-paid executive at the bank – has had to write off £7 billion of bad loans, far more than HBOS’s management ever admitted. Mr Cummings is understood to have left in early January with a payoff thought to be about £660,000 and £6 million of pension entitlements.

The announcement leaves taxpayers facing billions of pounds of extra losses on their rescue of Lloyds and HBOS, while politicians are now warning that it is inevitable that the Lloyds Banking Group will need more government money to keep it afloat.

Read morePeter Cummings, the man who broke HBOS with a £7bn loss

Feb. 13 (Bloomberg) — Paulson & Co., the hedge fund run by billionaire John Paulson, may have made as much as $67 million in 25 minutes today as Lloyds Banking Group Plc lost about 5.9 billion pounds ($8.5 billion) in market value.

Related article: Lloyds hit by £10bn HBOS losses (Financial Times)

Lloyds fell the most in 20 years after saying HBOS Plc, the U.K. lender it took over last month, would report a 10 billion- pound pretax loss. The shares plunged as much as 43 percent in less than 25 minutes of London trading.

Paulson, who made billions from betting against the subprime mortgage market, held a Lloyds short position representing 0.79 percent of the bank, or 129.3 million shares, as of Jan. 20, according to a regulatory filing. DataExplorers.com, which tracks share borrowing from London, said 1.1 percent of the stock was on loan as of Feb. 11, the most recent data available. That’s down from as much as 8 percent six months ago and suggests Paulson held the bulk of the remaining short position.

Submissions from banks including RBS suggest the total value of assets that will be included in the toxic loans scheme will be well over £200bn Photo: Getty

Although the details of the scheme announced last month are still being finalised, submissions from Royal Bank of Scotland and discussions with Lloyds Banking Group suggest that the total value of assets that will ultimately be included in the scheme will be significantly larger than the original estimate of £200bn.

Read moreTaxpayer to insure Treasury’s £400bn toxic loan scheme

Britain’s three top lenders need another £80bn of capital to end concerns about their solvency once and for all, stabilising the financial system, according to analysts at investment bank Nomura.

The warning will fuel fears that Royal Bank of Scotland, Lloyds Banking Group and Barclays may be fully nationalised, coming after a week in which share prices in all three banks have more than halved. Nomura added that the latest Government bail-out measures “do not change the key issue of the unknown and potentially unlimited losses of the banking system, and therefore whether it will ultimately require further capital injections”.

Investors in banks have been spooked by worse-than-expected losses at HBOS and RBS. Comparing the current recession with the 1990s, Nomura estimates that over four years Barclays will record credit losses of £33bn, Lloyds £56bn and RBS £61bn.

Read moreBarclays, RBS and Lloyds need £80bn more in capital, analyst warns

Bank shares plunged and Government bonds tumbled after Gordon Brown announced plans to insure lenders for losses on bad loans which could amount to billions of pounds.

The Prime Minister announced a scheme to allow banks to exchange cash or shares for a Government guarantee on their “toxic” debts, transferring any losses they suffer from the banks to the taxpayer.

But the Government has conceded that it can’t estimate how much taxpayers’ money will be on the line in the latest bank assistance package.

UK bond prices fell sharply as the financial markets digested the prospect of further Government borrowing. Bank stocks also tumbled with shares of Royal Bank of Scotland losing more than half their value. Lloyds, Barclays and HSBC also fell.

Ministers say the new package, which comes only three months after another £500 billion bailout, is vital to restore bank lending and help companies get credit and stay in business.

Read moreBanks bailout: Bonds tumble as Government admits no cap on taxpayer risk

Rising unemployment may prompt new capital raisings

The worsening economic slowdown is increasing fears that Britain’s banks will have to raise still more capital next year in a market starved of investors.

Investment bankers are preparing for a second round of capital raising by UK lenders on top of the £65bn already declared. Having rebuilt their balance sheets after toxic debt writedowns, the banks face an increasingly dire economic outlook that threatens to take ordinary loan impairments from individuals and businesses to levels not seen since the early 1990s.

Under those worst-case conditions, impairment charges at the domestic banks – Barclays, Royal Bank of Scotland and the combined Lloyds Banking Group – could hit £60bn next year, according to Credit Suisse analysts.

“There could be a second credit crunch for banks, with a whole new round of writedowns late in 2009 as the economy filters back to banks,” a senior investment banker said. “They have so far only provisioned for the credit crunch – so they will need to undertake a whole new round of capital raising.”

A trading update earlier this year from HBOS, which will be bought by Lloyds next month, made grim reading for the sector. Impairments from commercial and residential property shot up, and the bank warned of more bad news to come as unemployment, the biggest driver of bad debts, continues to rise.

Read moreBritish banks may face second credit crunch in the New Year